Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The party signing a promissory note is called the a. promissee. b. payor. c. payee. d. assignee. What is the total amount of interest on

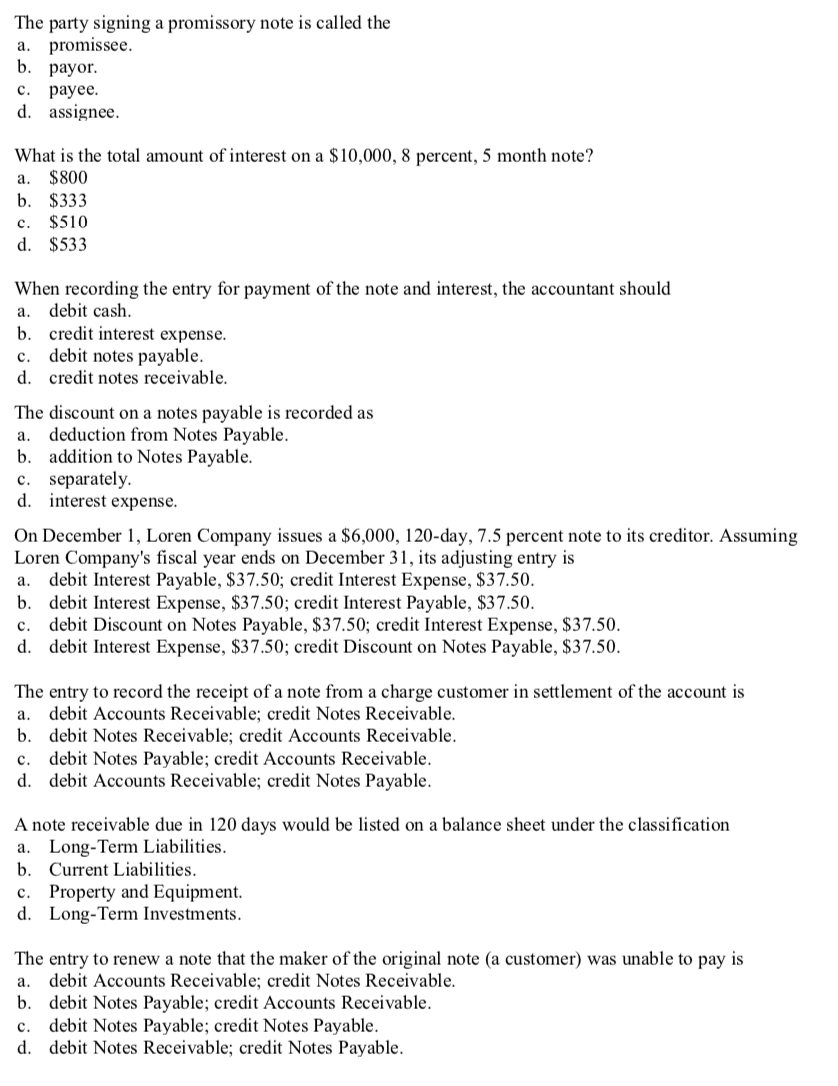

The party signing a promissory note is called the a. promissee. b. payor. c. payee. d. assignee. What is the total amount of interest on a $10,000,8 percent, 5 month note? a. $800 b. $333 c. $510 d. $533 When recording the entry for payment of the note and interest, the accountant should a. debit cash. b. credit interest expense. c. debit notes payable. d. credit notes receivable. The discount on a notes payable is recorded as a. deduction from Notes Payable. b. addition to Notes Payable. c. separately. d. interest expense. On December 1, Loren Company issues a $6,000,120-day, 7.5 percent note to its creditor. Assuming Loren Company's fiscal year ends on December 31 , its adjusting entry is a. debit Interest Payable, $37.50; credit Interest Expense, $37.50. b. debit Interest Expense, $37.50; credit Interest Payable, $37.50. c. debit Discount on Notes Payable, $37.50; credit Interest Expense, $37.50. d. debit Interest Expense, $37.50; credit Discount on Notes Payable, $37.50. The entry to record the receipt of a note from a charge customer in settlement of the account is a. debit Accounts Receivable; credit Notes Receivable. b. debit Notes Receivable; credit Accounts Receivable. c. debit Notes Payable; credit Accounts Receivable. d. debit Accounts Receivable; credit Notes Payable. A note receivable due in 120 days would be listed on a balance sheet under the classification a. Long-Term Liabilities. b. Current Liabilities. c. Property and Equipment. d. Long-Term Investments. The entry to renew a note that the maker of the original note (a customer) was unable to pay is a. debit Accounts Receivable; credit Notes Receivable. b. debit Notes Payable; credit Accounts Receivable. c. debit Notes Payable; credit Notes Payable. d. debit Notes Receivable; credit Notes Payable. The party signing a promissory note is called the a. promissee. b. payor. c. payee. d. assignee. What is the total amount of interest on a $10,000,8 percent, 5 month note? a. $800 b. $333 c. $510 d. $533 When recording the entry for payment of the note and interest, the accountant should a. debit cash. b. credit interest expense. c. debit notes payable. d. credit notes receivable. The discount on a notes payable is recorded as a. deduction from Notes Payable. b. addition to Notes Payable. c. separately. d. interest expense. On December 1, Loren Company issues a $6,000,120-day, 7.5 percent note to its creditor. Assuming Loren Company's fiscal year ends on December 31 , its adjusting entry is a. debit Interest Payable, $37.50; credit Interest Expense, $37.50. b. debit Interest Expense, $37.50; credit Interest Payable, $37.50. c. debit Discount on Notes Payable, $37.50; credit Interest Expense, $37.50. d. debit Interest Expense, $37.50; credit Discount on Notes Payable, $37.50. The entry to record the receipt of a note from a charge customer in settlement of the account is a. debit Accounts Receivable; credit Notes Receivable. b. debit Notes Receivable; credit Accounts Receivable. c. debit Notes Payable; credit Accounts Receivable. d. debit Accounts Receivable; credit Notes Payable. A note receivable due in 120 days would be listed on a balance sheet under the classification a. Long-Term Liabilities. b. Current Liabilities. c. Property and Equipment. d. Long-Term Investments. The entry to renew a note that the maker of the original note (a customer) was unable to pay is a. debit Accounts Receivable; credit Notes Receivable. b. debit Notes Payable; credit Accounts Receivable. c. debit Notes Payable; credit Notes Payable. d. debit Notes Receivable; credit Notes Payable

The party signing a promissory note is called the a. promissee. b. payor. c. payee. d. assignee. What is the total amount of interest on a $10,000,8 percent, 5 month note? a. $800 b. $333 c. $510 d. $533 When recording the entry for payment of the note and interest, the accountant should a. debit cash. b. credit interest expense. c. debit notes payable. d. credit notes receivable. The discount on a notes payable is recorded as a. deduction from Notes Payable. b. addition to Notes Payable. c. separately. d. interest expense. On December 1, Loren Company issues a $6,000,120-day, 7.5 percent note to its creditor. Assuming Loren Company's fiscal year ends on December 31 , its adjusting entry is a. debit Interest Payable, $37.50; credit Interest Expense, $37.50. b. debit Interest Expense, $37.50; credit Interest Payable, $37.50. c. debit Discount on Notes Payable, $37.50; credit Interest Expense, $37.50. d. debit Interest Expense, $37.50; credit Discount on Notes Payable, $37.50. The entry to record the receipt of a note from a charge customer in settlement of the account is a. debit Accounts Receivable; credit Notes Receivable. b. debit Notes Receivable; credit Accounts Receivable. c. debit Notes Payable; credit Accounts Receivable. d. debit Accounts Receivable; credit Notes Payable. A note receivable due in 120 days would be listed on a balance sheet under the classification a. Long-Term Liabilities. b. Current Liabilities. c. Property and Equipment. d. Long-Term Investments. The entry to renew a note that the maker of the original note (a customer) was unable to pay is a. debit Accounts Receivable; credit Notes Receivable. b. debit Notes Payable; credit Accounts Receivable. c. debit Notes Payable; credit Notes Payable. d. debit Notes Receivable; credit Notes Payable. The party signing a promissory note is called the a. promissee. b. payor. c. payee. d. assignee. What is the total amount of interest on a $10,000,8 percent, 5 month note? a. $800 b. $333 c. $510 d. $533 When recording the entry for payment of the note and interest, the accountant should a. debit cash. b. credit interest expense. c. debit notes payable. d. credit notes receivable. The discount on a notes payable is recorded as a. deduction from Notes Payable. b. addition to Notes Payable. c. separately. d. interest expense. On December 1, Loren Company issues a $6,000,120-day, 7.5 percent note to its creditor. Assuming Loren Company's fiscal year ends on December 31 , its adjusting entry is a. debit Interest Payable, $37.50; credit Interest Expense, $37.50. b. debit Interest Expense, $37.50; credit Interest Payable, $37.50. c. debit Discount on Notes Payable, $37.50; credit Interest Expense, $37.50. d. debit Interest Expense, $37.50; credit Discount on Notes Payable, $37.50. The entry to record the receipt of a note from a charge customer in settlement of the account is a. debit Accounts Receivable; credit Notes Receivable. b. debit Notes Receivable; credit Accounts Receivable. c. debit Notes Payable; credit Accounts Receivable. d. debit Accounts Receivable; credit Notes Payable. A note receivable due in 120 days would be listed on a balance sheet under the classification a. Long-Term Liabilities. b. Current Liabilities. c. Property and Equipment. d. Long-Term Investments. The entry to renew a note that the maker of the original note (a customer) was unable to pay is a. debit Accounts Receivable; credit Notes Receivable. b. debit Notes Payable; credit Accounts Receivable. c. debit Notes Payable; credit Notes Payable. d. debit Notes Receivable; credit Notes Payable Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started