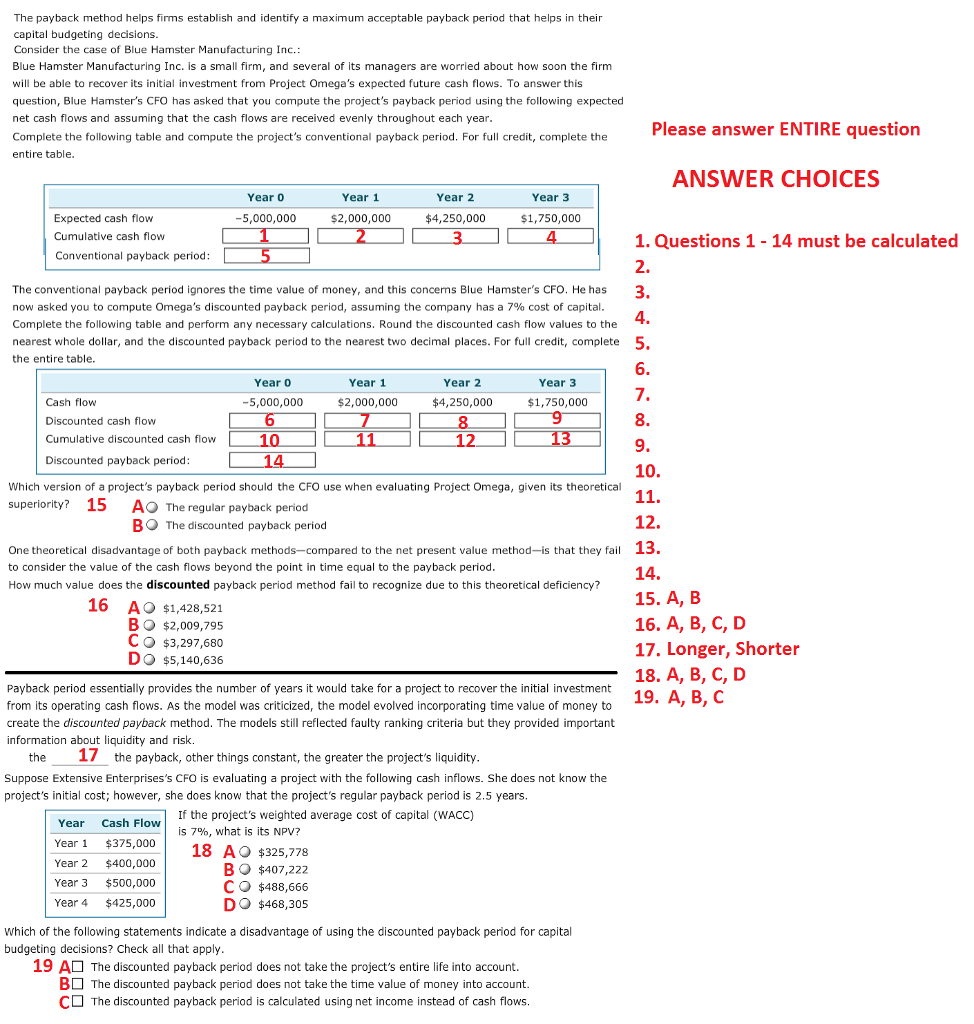

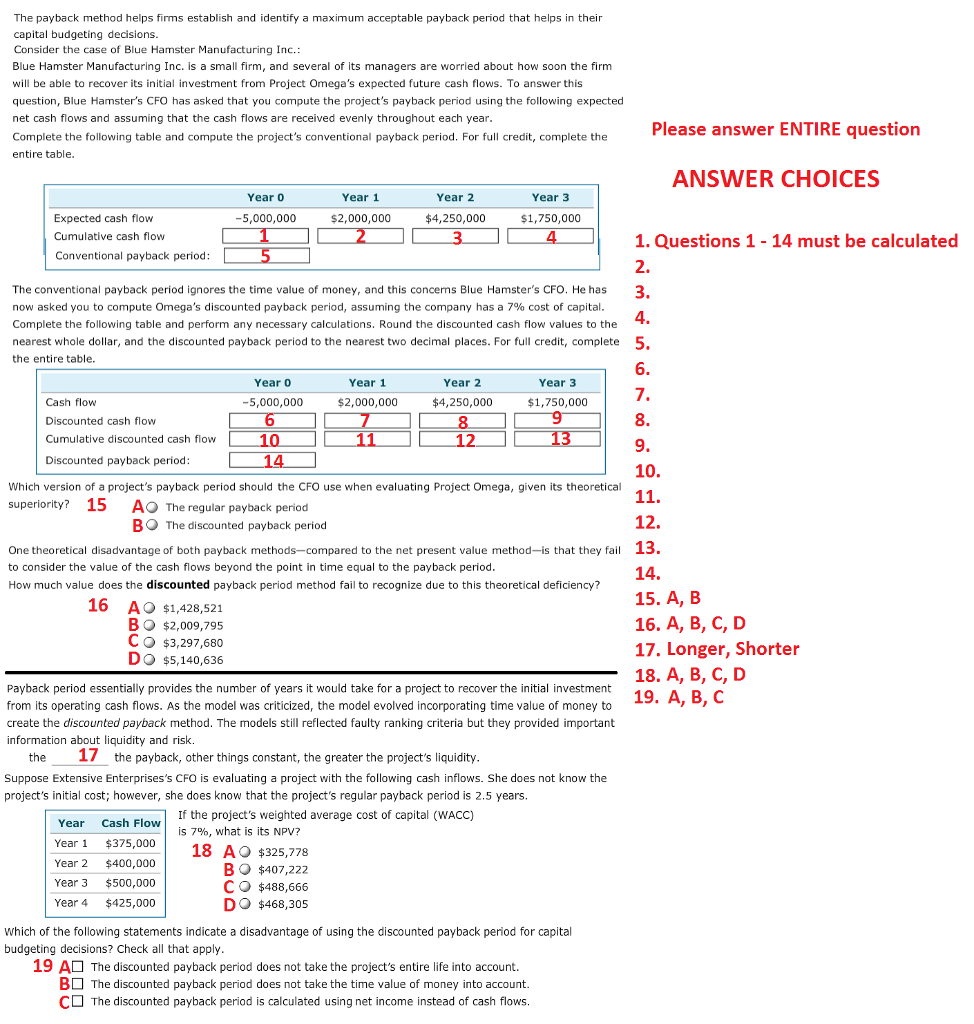

The payback method helps firms estsh and identify a maximum acceptable payback period that helps in their capital budgeting decisions Consider the case of Blue Hamster Manufacturing Inc. Blue Hamster Manufacturing Inc. is a small firm, and several of its managers are worried about how soon the firm will be able to recover its initial investment from Project Omega's expected future cash flows. To answer this question, Blue Hamster's CFO has asked that you compute the project's payback period using the following expected net cash flows and assuming that the cash flows are received evenly throughout each year Complete the following table and compute the project's conventional payback period. For full credit, complete the entire table Please answer ENTIRE question ANSWER CHOICES Year 0 Year 1 Year 2 Year 3 Expected cash flow Cumulative cash flow Conventional payback perioc -5,000,000 $2,000,000 $4,250,000 $1,750,000 1.Questions 1 - 14 must be calculated 2. 3. 4. 5, 6. 7. 8. 9. 10. The conventional payback period ignores the time value of money, and this concems Blue Hamster's CFO. He has now asked you to compute Omega's discounted payback period, assuming the company has a 7% cost of capital Complete the following table and perform any necessary calculations. Round the discounted cash flow values to the nearest whole dollar, and the discounted payback period to the nearest two decimal places. For full credit, complete the entire table. Year 0 Year 1 Year 2 Year 3 Cash flow -5,000,000 $2,000,000 $4,250,000 $1,750,000 Discounted cash flow Cumulative discounted cash flow 10- TI- 12 13 Discounted payback period Which version of a project's payback period should the CFO use when evaluating Project Omega, given its theoretical superiority? 15 AO The regular payback period BO The discounted payback period 12. One theoretical disadvantage of both payback methods-compared to the net present value method-is that they f to consider the value of the cash flows beyond the point in time equal to the payback period How much value does the discounted payback period method fail to recognize due to this theoretical deficiency? 13. 14. 15. A, B 16. A, B, C, D 17. Longer, Shorter 18. A, B, C, D 19. A, B, C 16 AO $1,428,521 BO $2.009,795 CO $3,297,680 DO $5,140,636 Payback period essentially provides the number of years it would take for a project to recover the initial investment from its operating cash flows. As the model was criticized, the model evolved incorporating time value of money to create the discounted payback method. The models still reflected faulty ranking criteria but they provided important information about liquidity and risk. the17 the payback, other things constant, the greater the project's liquidity Suppose Extensive Enterprises's CFO is evaluating a project with the following cash inflows. She does not know the project's initial cost; however, she does know that the project's regular payback period is 2.5 years. If the project's weighted average cost of capital (WACC) is 796, what is its NPV? Year Cash Flow Year 1 $375,000 Year 2 $400,000 Year 3 $500,000 ear4 $425,000 18 AO $325,778 BO $407,222 C$488,666 DO $468,305 Which of the following statements indicate a disadvantage of using the discounted payback period for capital budgeting decisions? Check all that apply 19 A B C The discounted payback period does not take the project's entire life into account. The discounted payback period does not take the time value of money into account. The discounted payback period is calculated using net income instead of cash flows