Question

The payroll account for Presto Manufacturing Cupcakery has been assigned to you, and you are to complete the payroll for Sam, one of their employees.

The payroll account for Presto Manufacturing Cupcakery has been assigned to you, and you are to complete the payroll for Sam, one of their employees. Sam is married, claims 2 withholding allowances, and earns $1,650 semimonthly. In addition to Federal Income taxes, Social Security, and Medicare, he pays 5.7% in NYS income tax (based on gross income), $157.50 for a family health plan per paycheck, $13.50 for life insurance, contributes 8% of his earnings to a 401K, and has his car payment of $110 auto deducted.

Presto Manufacturing pays unemployment at a rate of 3.4%, Federal Unemployment at a rate of 0.8%, and matches their employee's Social Security and Medicare taxes.

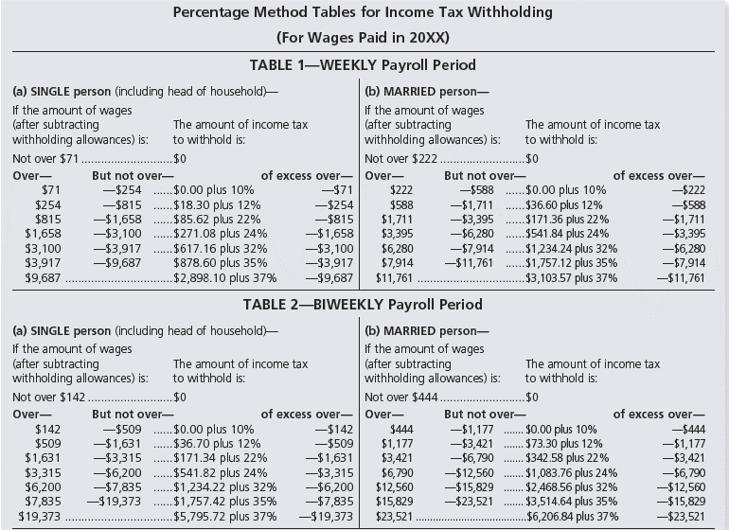

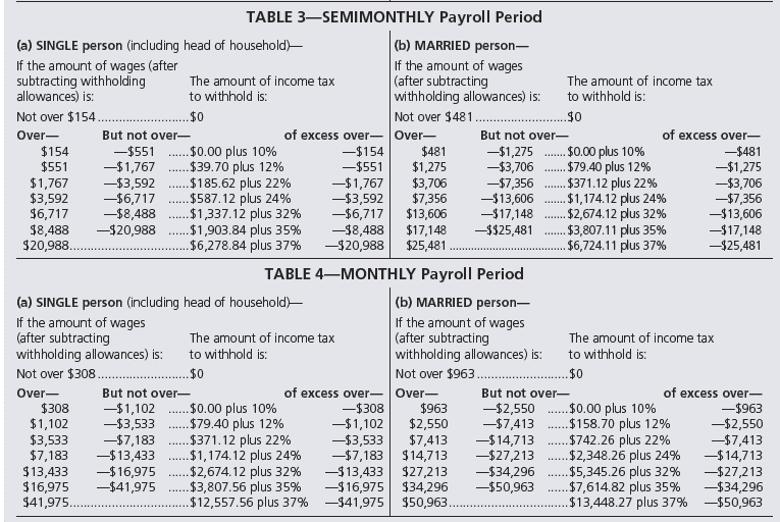

- Using your notes and the tax tables (EX 9-1 and 9-2) in the PowerPoint and eBook, calculate Sam’s take-home pay. Show and label your calculations for each deduction in the table below.

- Using the given case information, calculate the amount that Presto Manufacturing must pay for the payroll taxes for Sam in the table on page

| ||

Tax or Deduction | Calculation | Tax or Deduction Amount |

Federal Income Tax | ||

Social Security Tax (6.2%) | ||

Medicare Tax (1.45%) | ||

NYS Income Tax | ||

Health Plan | ||

Life Insurance | ||

401K | ||

Car Payment | ||

Total Tax and Deductions: | ||

Sam’s Take Home Pay: | ||

2. Employer Payroll Tax Chart | ||

Tax | Calculation | Tax Amount |

NYS Employment Tax (3.4%) | ||

Federal Unemployment Tax (0.8%) | ||

Social Security (matched) | ||

Medicare (matched) | ||

Presto’s Total Payroll Taxes for Sam | ||

Percentage Method Tables for Income Tax Withholding (For Wages Paid in 20XX) TABLE 1-WEEKLY Payroll Period (b) MARRIED person- If the amount of wages (after subtracting withholding allowances) is: Not over $222 . (a) SINGLE person (including head of household)- If the amount of wages (after subtracting withholding allowances) is: Not over $71 .. The amount of income tax to withhold is: The amount of income tax to withhold is: ...$0 ...$0 Over- $71 $254 $815 $1,658 3,100 $3,917 $9,687 of excess over- Over- -$71 -$254 -$815 --$1,658 -$3,100 -43,917 -39,687 of excess over- -$222 But not over- But not over- -$254 -$815 -$1,658 -$3,100 -$3,917 -$9,687 $0.00 plus 10% $18.30 plus 12% $85.62 plus 22% $271.08 plus 24% .$617.16 plus 32% $878.60 plus 35% $2,898.10 plus 37% $222 $588 $1,711 $3,395 $6,280 $7,914 $11,761 -$588 -$1,711 -$3,395 -$6,280 -$7,914 -$11,761 $0.00 plus 10% 36.60 plus 12% $171.36 plus 22% $541.84 plus 24% $1,234.24 plus 32% $1,757.12 plus 35% $3,103.57 plus 37% ..... -$588 -$1,711 -$3,395 -$6,280 -$7,914 -$11,761 ...... ....... TABLE 2-BIWEEKLY Payroll Period (a) SINGLE person (including head of household)- If the amount of wages (after subtracting withholding allowances) is: Not over $142 .. (b) MARRIED person- If the amount of wages (after subtracting withholding allowances) is: Not over $444 . The amount of income tax to withhold is: The amount of income tax to withhold is: ...s0 ...s0 of excess over- Over- -$142 -$509 -$1,631 -$3,315 -$6,200 -$7,835 -$19,373 Over- But not over- But not over- of excess over- $142 $509 $1,631 $3,315 $6,200 $7,835 $19,373 .$0.00 plus 10% $36.70 plus 12% $171.34 plus 22% $541.82 plus 24% $1,234.22 plus 32% $1,757.42 plus 35% $5,795.72 plus 37% $0.00 plus 10% $73.30 plus 12% $342.58 plus 22% $1,083.76 plus 24% $2,468.56 plus 32% $3,514.64 plus 35% $6,206.84 plus 37% -$509 -$1,631 -$3,315 -$6,200 -$7,835 -$19,373 $444 $1,177 $3,421 $6,790 $12,560 $15,829 $23,521 -$1,177 -$3,421 -$6,790 -$12,560 -$15,829 -$23,521 -$444 -$1,177 -$3,421 -$6,790 -$12,560 -$15,829 -$23,521 ....... a..... ...... ........

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution Python3 Program to interpolate using Bessels interpolation calculating u mentioned i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started