Answered step by step

Verified Expert Solution

Question

1 Approved Answer

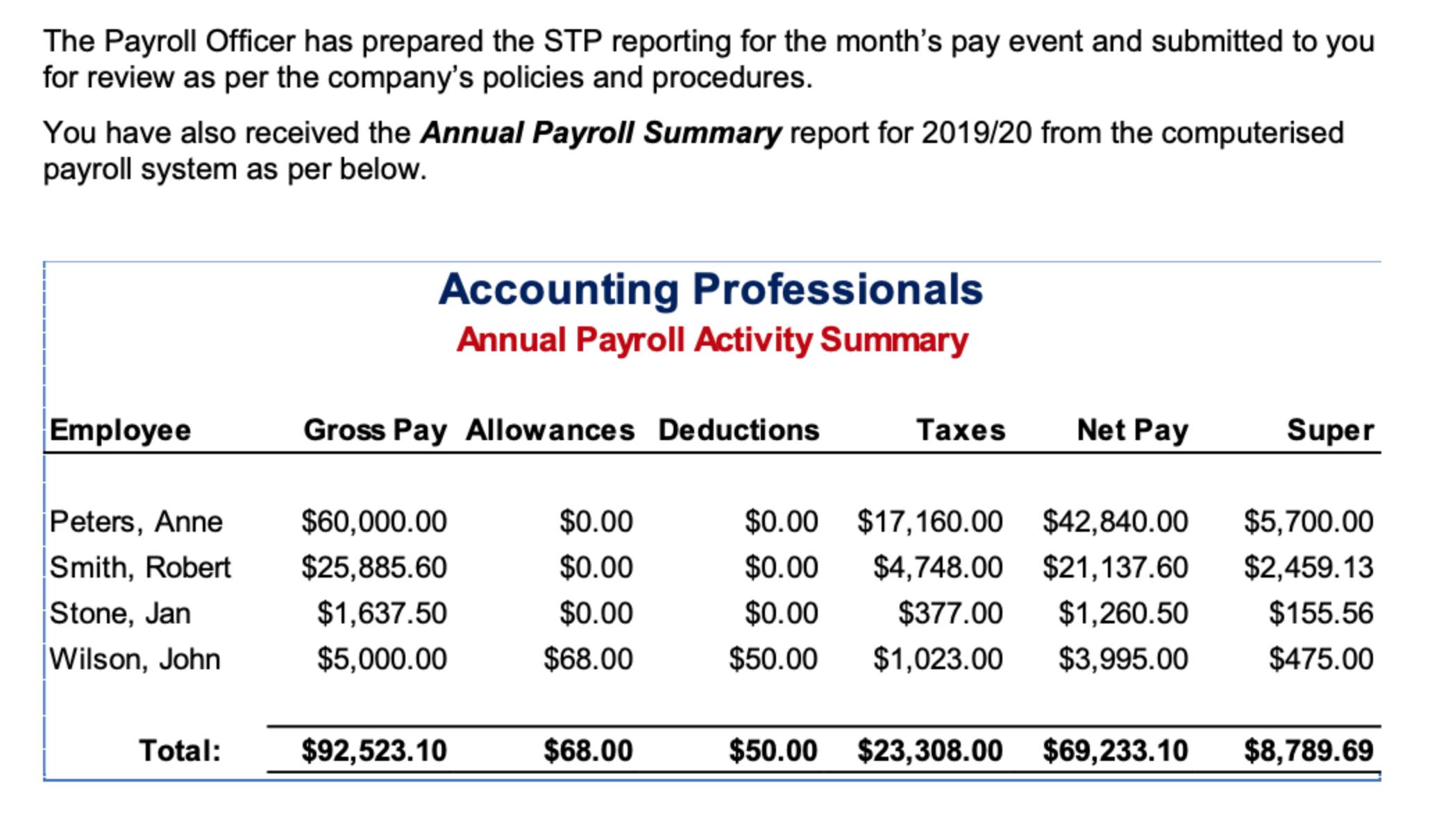

The Payroll Officer has prepared the STP reporting for the month's pay event and submitted to you for review as per the company's policies

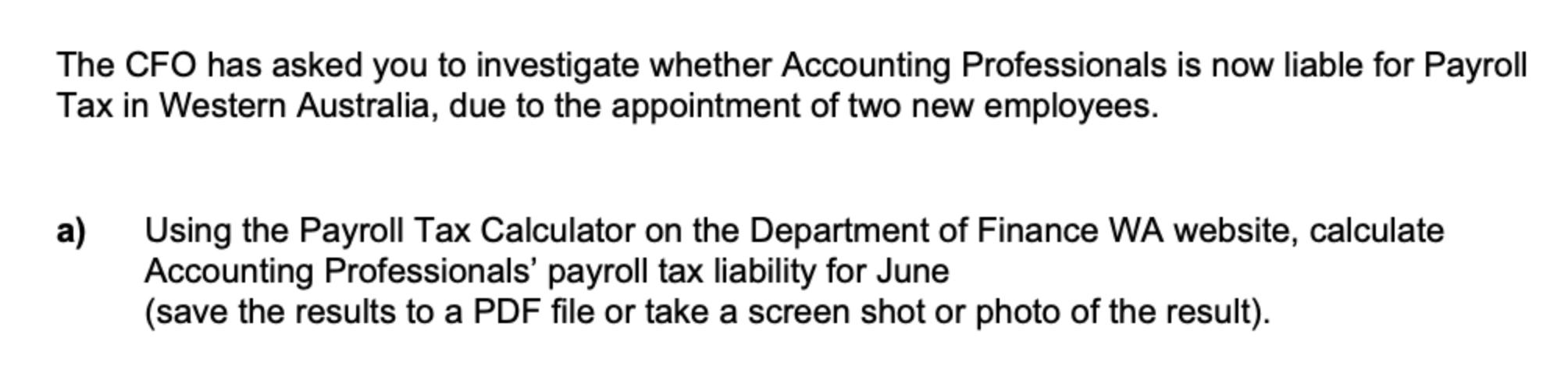

The Payroll Officer has prepared the STP reporting for the month's pay event and submitted to you for review as per the company's policies and procedures. You have also received the Annual Payroll Summary report for 2019/20 from the computerised payroll system as per below. Employee Peters, Anne Smith, Robert Stone, Jan Wilson, John Total: Accounting Professionals Annual Payroll Activity Summary Gross Pay Allowances Deductions Taxes $60,000.00 $25,885.60 $1,637.50 $5,000.00 $92,523.10 $0.00 $0.00 $0.00 $68.00 $68.00 Net Pay Super $0.00 $17,160.00 $42,840.00 $5,700.00 $0.00 $4,748.00 $21,137.60 $2,459.13 $0.00 $377.00 $1,260.50 $155.56 $50.00 $1,023.00 $3,995.00 $475.00 $50.00 $23,308.00 $69,233.10 $8,789.69 The CFO has asked you to investigate whether Accounting Professionals is now liable for Payroll Tax in Western Australia, due to the appointment of two new employees. a) Using the Payroll Tax Calculator on the Department of Finance WA website, calculate Accounting Professionals' payroll tax liability for June (save the results to a PDF file or take a screen shot or photo of the result). Calculate an estimate * * Frequency Monthly Annual Client Status Local Group Start Date 01/06/2020 * End Date 30/06/2020 * WA Taxable Wages $21,019 Calculate Clear Deductable Amount $21,019.00 Taxable Amount Tax Rate Tax Estimate $0.00 5.5000% $0.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started