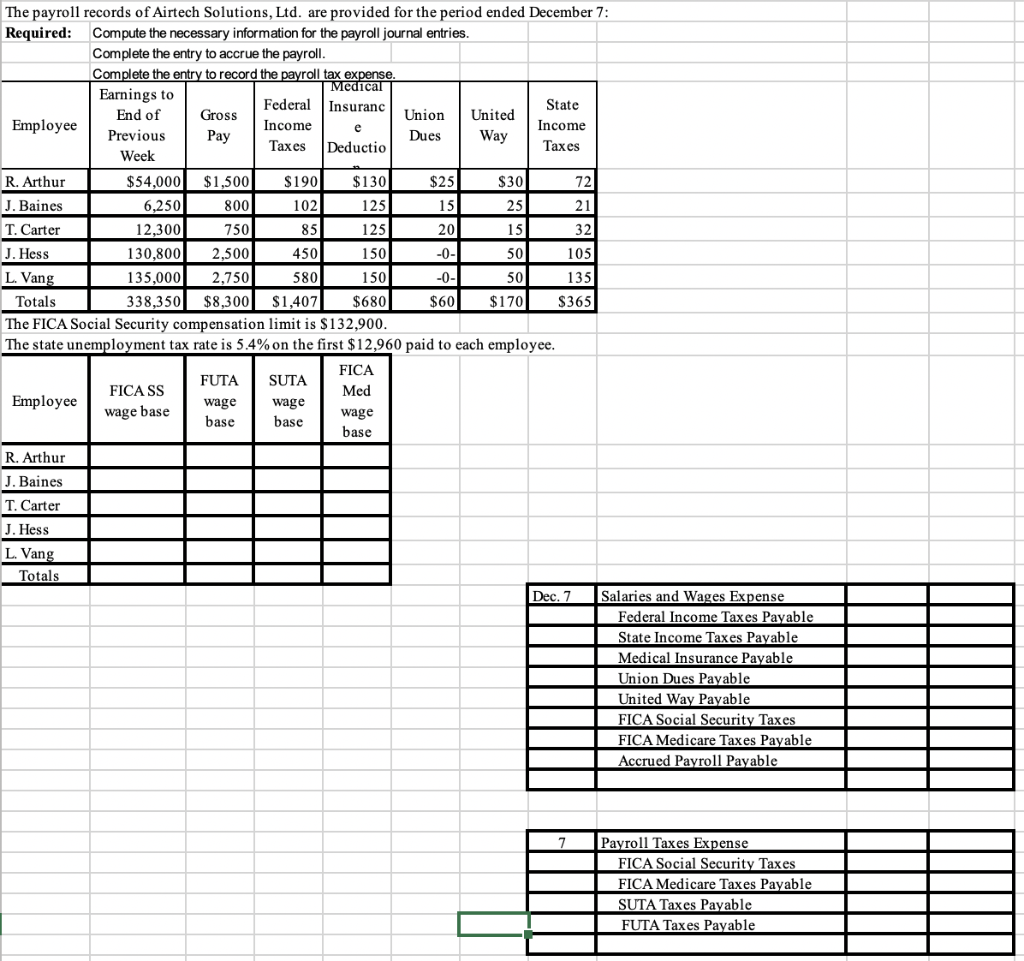

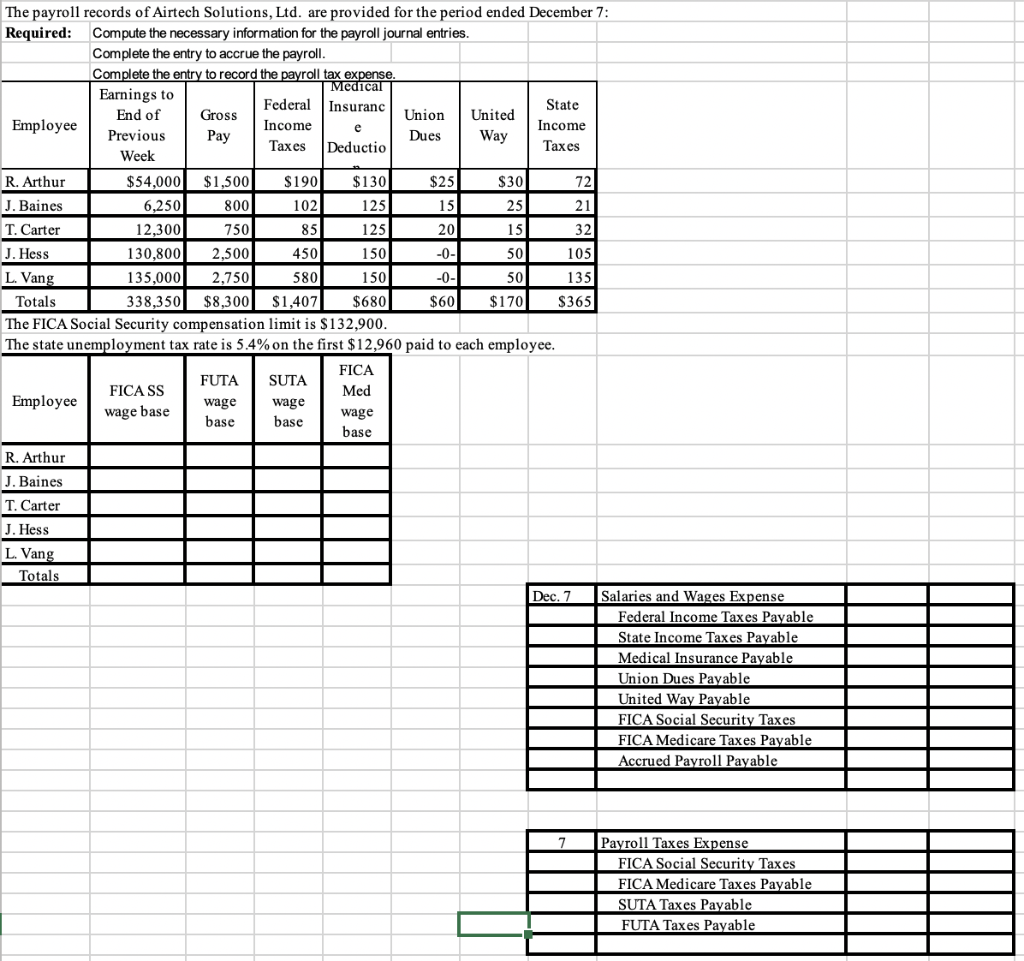

The payroll records of Airtech Solutions, Ltd. are provided for the period ended December 7 Required Compute the necessary information for the payroll journal entries. Complete the entry to accrue the payroll Complete the Earnings to to record the payroll tax expense Federal Insurano End of EmployeePrevious UnionUnited Way State Income Taxes Gross Income Dues Taxes Deductio Week S30 R. Arthur J. Baines T. Carter J. Hess L. Van $54,000 $1,500S190$130 125 125 150 150 338,350 $8,300S1,407 $680 The FICA Social Security compensation limit is $132,900 $25 72 800 750 130,800 2,500 135,000 2,750 6,250 12,300 102 85 450 580 25 50 50 $60 $170 20 -0 -0 32 105 135 $365 Totals The state unemployment tax rate is 5.4% on the first $12,960 paid to each employee FUTASUTA Med wage Employeewage basebasebase base FICA SS wage wage R. Arthur J. Baines T. Carter J. Hess L. Van Totals Dec. 7 Salaries and Wages Expense Federal Income Taxes Payable State Income Taxes Payable Medical Insurance Payable Union Dues Payable United Way Pavable FICA Social Security Taxes FICA Medicare Taxes Payable Accrued Payroll Payable Pavroll Taxes Expense FICA Social Security Taxes FICA Medicare Taxes Payable SUTA Taxes Payable FUTA Taxes Pavable The payroll records of Airtech Solutions, Ltd. are provided for the period ended December 7 Required Compute the necessary information for the payroll journal entries. Complete the entry to accrue the payroll Complete the Earnings to to record the payroll tax expense Federal Insurano End of EmployeePrevious UnionUnited Way State Income Taxes Gross Income Dues Taxes Deductio Week S30 R. Arthur J. Baines T. Carter J. Hess L. Van $54,000 $1,500S190$130 125 125 150 150 338,350 $8,300S1,407 $680 The FICA Social Security compensation limit is $132,900 $25 72 800 750 130,800 2,500 135,000 2,750 6,250 12,300 102 85 450 580 25 50 50 $60 $170 20 -0 -0 32 105 135 $365 Totals The state unemployment tax rate is 5.4% on the first $12,960 paid to each employee FUTASUTA Med wage Employeewage basebasebase base FICA SS wage wage R. Arthur J. Baines T. Carter J. Hess L. Van Totals Dec. 7 Salaries and Wages Expense Federal Income Taxes Payable State Income Taxes Payable Medical Insurance Payable Union Dues Payable United Way Pavable FICA Social Security Taxes FICA Medicare Taxes Payable Accrued Payroll Payable Pavroll Taxes Expense FICA Social Security Taxes FICA Medicare Taxes Payable SUTA Taxes Payable FUTA Taxes Pavable