Question

The payroll register for Automotive Service Center for the pay period ended June 30, 20--, showed the following: Total Earnings Taxable Earnings: FUTA $623,000.00

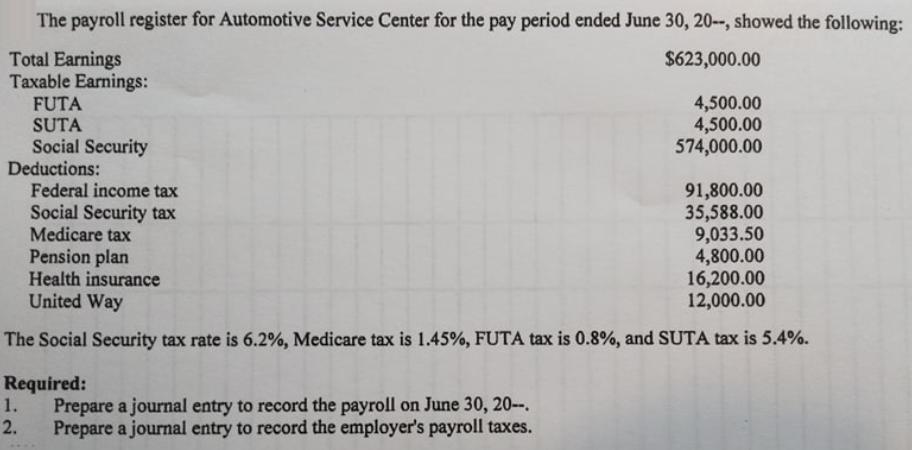

The payroll register for Automotive Service Center for the pay period ended June 30, 20--, showed the following: Total Earnings Taxable Earnings: FUTA $623,000.00 4,500.00 4,500.00 574,000.00 SUTA Social Security Deductions: Federal income tax Social Security tax Medicare tax Pension plan Health insurance United Way 91,800.00 35,588.00 9,033.50 4,800.00 16,200.00 12,000.00 The Social Security tax rate is 6.2%, Medicare tax is 1.45%, FUTA tax is 0.8%, and SUTA tax is 5.4%. Required: 1. Prepare a journal entry to record the payroll on June 30, 20-. 2. Prepare a journal entry to record the employer's payroll taxes.

Step by Step Solution

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Date General Journal Debit Credit 1 June 30 20 Salarie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Accounting A Practical Approach

Authors: Jeffrey Slater, Brian Zwicker

11th Canadian Edition

132564440, 978-0132564441

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App