Question

MS Share prices shown bel ow at the close of every 10 days. Zoom in an investor owns 10,000 shares of MS on Day

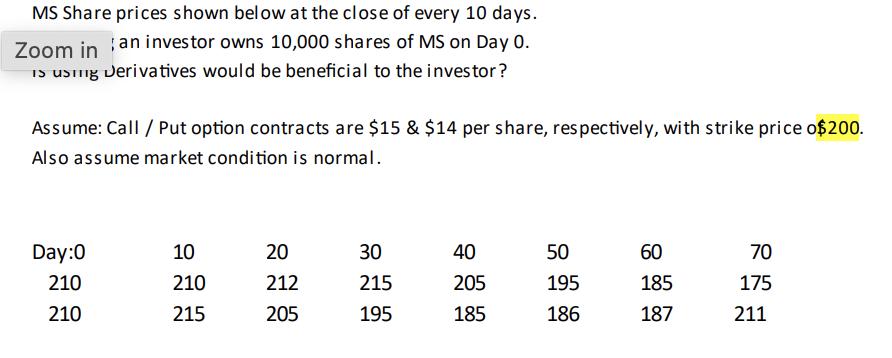

MS Share prices shown bel ow at the close of every 10 days. Zoom in an investor owns 10,000 shares of MS on Day 0. 1S usTng Derivatives would be beneficial to the investor? Assume: Call / Put option contracts are $15 & $14 per share, respectively, with strike price o$200. Also assume market condition is normal. Day:0 10 20 30 40 50 60 70 210 210 212 215 205 195 185 175 210 215 205 195 185 186 187 211

Step by Step Solution

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Solution Call options are beneficial when the share price rise in the futur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Risk Management and Financial Institutions

Authors: Hull John

4th edition

1118955943, 978-1118955949

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App