Question

The pecking-order theory starts with asymmetric information a fancy term indicating that managers know more about their companies prospects, risks, and values than do outside

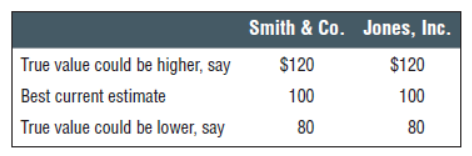

The pecking-order theory starts with asymmetric information a fancy term indicating that managers know more about their companies prospects, risks, and values than do outside investors. Managers obviously know more than investors. We can prove that by observing stock price changes caused by announcements by managers. For example, when a company announces an increased regular dividend, stock price typically rises, because investors interpret the increase as a sign of managements confidence in future earnings. In other words, the dividend increase transfers information from managers to investors. This can happen only if managers know more in the first place. Asymmetric information affects the choice between internal and external financing and between new issues of debt and equity securities. This leads to a pecking order, in which investment is financed first with internal funds, reinvested earnings primarily; then by new issues of debt; and finally with new issues of equity. New equity issues are a last resort when the company runs out of debt capacity, that is, when the threat of costs of financial distress brings regular insomnia to existing creditors and to the financial manager. We will take a closer look at the pecking order in a moment. First, you must appreciate how asymmetric information can force the financial manager to issue debt rather than common stock. Debt and Equity Issues with Asymmetric Information To the outside world Smith & Company and Jones, Inc., our two example companies, are identical. Each runs a successful business with good growth opportunities. The two businesses are risky, however, and investors have learned from experience that current expectations are frequently bettered or disappointed. Current expectations price each companys stock at $100 per share, but the true values could be higher or lower:

Now suppose that both companies need to raise new money from investors to fund capital investment. They can do this either by issuing bonds orby issuing new shares of common stock. How would the choice be made? One financial managerwe will not tell you which onemight reason as follows: Sell stock for $100 per share? Ridiculous! Its worth at least $120. A stock issue now would hand a free gift to new investors. I just wish those skeptical shareholders would appreciate the true value of this company. Our new factories will make us the worlds

lowest-cost producer. Weve painted a rosy picture for the press and security analysts, but it just doesnt seem to be working. Oh well, the decision is obvious: well issue debt, not underpriced equity. A debt issue will save underwriting fees too. The other financial manager is in a different mood: Beefalo burgers were a hit for a while, but it looks like the fad is fading. The fast-food divisions gotta find some good new products or its all downhill from here. Export markets are OK for now, but how are we going to compete with those new Siberian ranches? Fortunately the stock price has held up pretty wellweve had some good short-run news for the press and security analysts. Nows the time to issue stock. We have major investment sunder way, and why add increased debt service to my other worries? Of course, outside investors cant read the financial managers minds. If they could, one stock might trade at $120 and the other at $80.Why doesnt the optimistic financial manager simply educate investors? Then the company could sell stock on fair terms, and there would be no reason to favor debt over equity or vice versa. This is not so easy. (Note that both companies are issuing upbeat press releases.) Investors cant be told what to think; they have to be convinced. That takes a detailed layout of the companys plans and prospects, including the inside scoop on new technology, product design, marketing plans, and so on. Getting this across is expensive for the company and also valuable to its competitors. Why go to the trouble? Investors will learn soon enough, as revenues and earnings evolve. In the meantime the optimistic financial manager can finance growth by issuing debt. Now suppose there are two press releases:1.Jones, Inc., will issue $120 million of five-year seniornotes.2.Smith & Co. announced plans today to issue 1.2 million new shares of common stock. The company expects to raise $120 million. As a rational investor, you immediately learn two things. First, Joness financial manager is optimistic and Smiths is pessimistic. Second, Smiths financial manager is also naive to think that investors would pay $100 per share. The attempt to sell stock shows that it must be worth less. Smith might sell stock at $80 per share, but certainly not at $100.Smart financial managers think this through ahead of time. The end result? Both Smith and Jones end up issuing debt. Jones, Inc., issues debt because its financial manager is optimistic and doesnt want to issue undervalued equity. A smart, but pessimistic, financial manager at Smith issues debt because an attempt to issue equity would force the stock price down and

eliminate any advantage from doing so. (Issuing equity also reveals the managers pessimism immediately. Most managers prefer to wait. A debt issue lets bad news come out later through other channels.)The story of Smith and Jones illustrates how asymmetric information favors debt issues over equity issues. If managers are better informed than investors and both groups are rational, then any company that can borrow will do so rather than issuing fresh equity. In other words, debt issues will be higher in the pecking order. Taken literally this reasoning seems to rule out any issue of equity. Thats not right, because asymmetric information is not always important and there are other forces at work. For example, if Smith had already borrowed heavily, and would risk financial distress by borrowing more, then it would have a good reason to issue common stock. In this case announcement of a stock issue would not be entirely bad news. The announcement would still depress the stock priceit would highlight managers concerns about financial distressbut the fall in price would not necessarily make the issue unwise or infeasible. High-tech, high-growth companies can also be credible issuers of common stock. Such companies assets are mostly intangible, and bankruptcy or financial distress would be especially costly. This calls for conservative financing. The only way to grow rapidly and keep a conservative debt ratio is to issue equity. If investors see equity issued for these reasons, problems of the sort encountered by Smiths financial manager become much less serious. With such exceptions noted, asymmetric information can explain the dominance of debt financing over new equity issues, at least for mature public corporations. Debt issues are frequent; equity issues, rare. The bulk of external financing comes from debt, even in the United States, where equity markets are highly information-efficient. Equity issues are even more difficult in countries with less well developed stock markets. None of this says that firms ought to strive for high debt ratiosjust that its better to raise equity by plowing back earnings than issuing stock. In fact, a firm with ample internally generated funds doesnt have to sell any kind of security and thus avoids issue cost sand information problems completely.

Q1: Firms prefer internal Finance. Why?

Q2: Why do firms avoid sudden changes in dividends?

Q3: Why do firms prefer to invest their internally generated surplus funds in Marketable Securities instead of increasing dividends?

Q4: Why do firms use issuing the equities as the last resort, after debt and hybrid securities, to get the external funding?

True value could be higher, say Best current estimate True value could be lower, say Smith & Co. Jones, Inc. $120 $120 100 100 80 80Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started