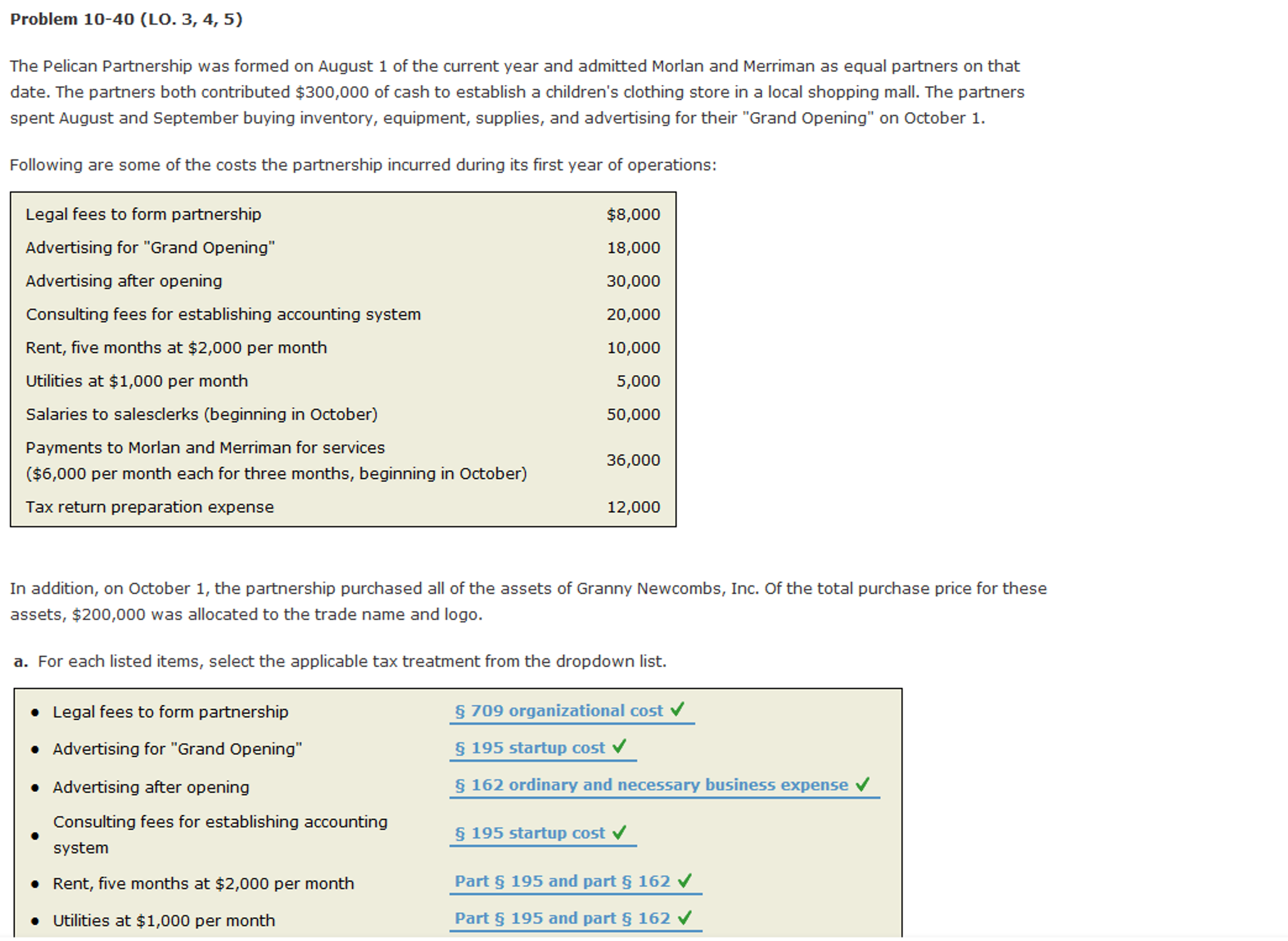

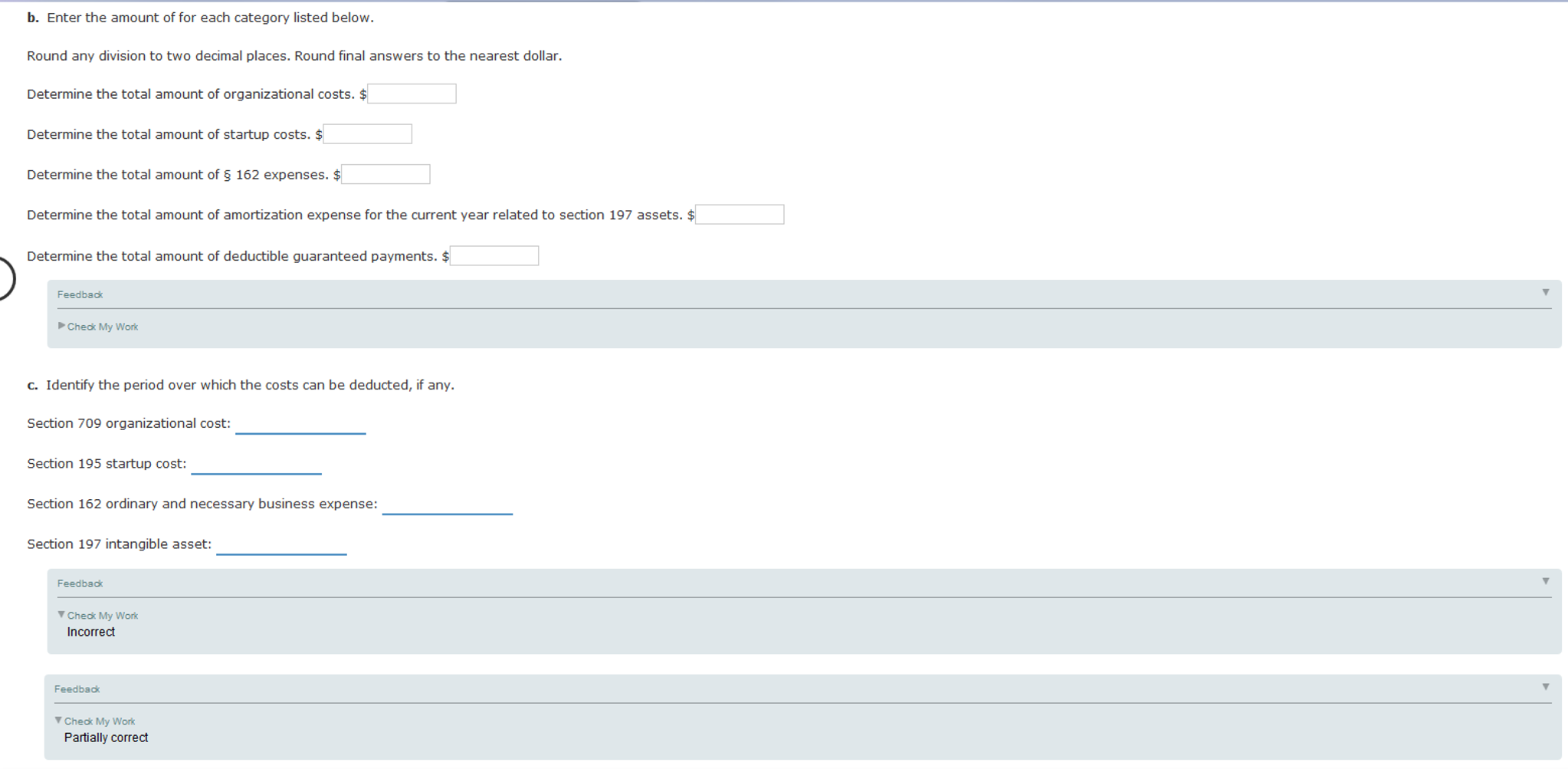

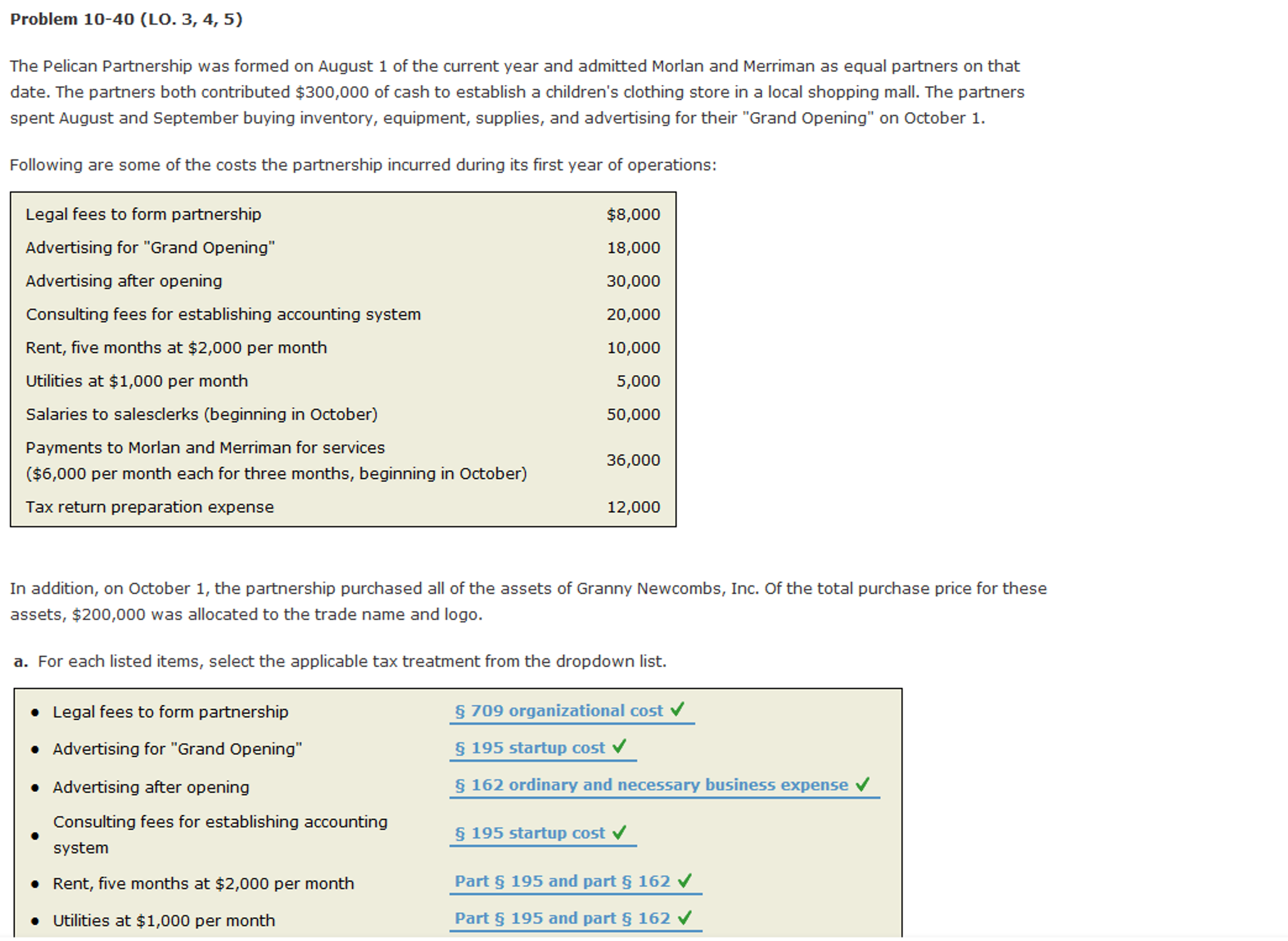

The Pelican Partnership was formed on August 1 of the current year and admitted Morlan and Merriman as equal partners on that date. The partners both contributed $300, 000 of cash to establish a children's clothing store in a local shopping mall. The partners spent August and September buying inventory, equipment, supplies, and advertising for their "Grand Opening" on October 1. Following are some of the costs the partnership incurred during its first year of operations: Legal fees to form partnership $8, 000 Advertising for "Grand Opening" 18, 000 Advertising after opening 30, 000 Consulting fees for establishing accounting system 20, 000 Rent, five months at $2, 000 per month 10, 000 Utilities at $1, 000 per month 5, 000 Salaries to salesclerks (beginning in October) 50, 000 Payments to Morlan and Merriman for services ($6, 000 per month each for three months, beginning in October) 36, 000 Tax return preparation expense 12, 000 In addition, on October 1, the partnership purchased all of the assets of Granny Newcombs, Inc. Of the total purchase price for these assets, $200, 000 was allocated to the trade name and logo. For each listed items, select the applicable tax treatment from the dropdown list. Legal fees to form partnership 709 organizational cost Advertising for "Grand Opening" 195 startup cost Advertising after opening 162 ordinary and necessary business expense Consulting fees for establishing accounting system 195 startup cost Rent, five months at $2, 000 per month Part 195 and part 162 Utilities at $1, 000 per month Part 195 and part 162 Enter the amount of for each category listed below. Round any division to two decimal places. Round final answers to the nearest dollar. Determine the total amount of organizational costs. $ Determine the total amount of startup costs. $ Determine the total amount of 162 expenses. $ Determine the total amount of amortization expense for the current year related to section 197 assets. $ Determine the total amount of deductible guaranteed payments. $ Identify the period over which the costs can be deducted, if any. Section 709 organizational cost: Section 195 startup cost: Section 162 ordinary and necessary business expense: Section 197 intangible asset