Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Pen, Evan, and Torves Partnership has asked you to assist in winding-up its business affairs. You compile the following information: The partnerships trial balance

The Pen, Evan, and Torves Partnership has asked you to assist in winding-up its business affairs. You compile the following information:

- The partnerships trial balance on June 30, 20X1, is

| Debit | Credit | |||||||

| Cash | $ | 7,300 | ||||||

| Accounts Receivable (net) | 40,000 | |||||||

| Inventory | 28,000 | |||||||

| Plant and Equipment (net) | 98,300 | |||||||

| Accounts Payable | $ | 11,100 | ||||||

| Pen, Capital | 68,000 | |||||||

| Evan, Capital | 57,500 | |||||||

| Torves, Capital | 37,000 | |||||||

| Total | $ | 173,600 | $ | 173,600 | ||||

- The partners share profits and losses as follows: Pen, 50 percent; Evan, 25 percent; and Torves, 25 percent.

- The partners are considering an offer of $113,000 for the firms accounts receivable, inventory, and plant and equipment as of June 30. The $113,000 will be paid to creditors and the partners in installments, the number and amounts of which are to be negotiated.

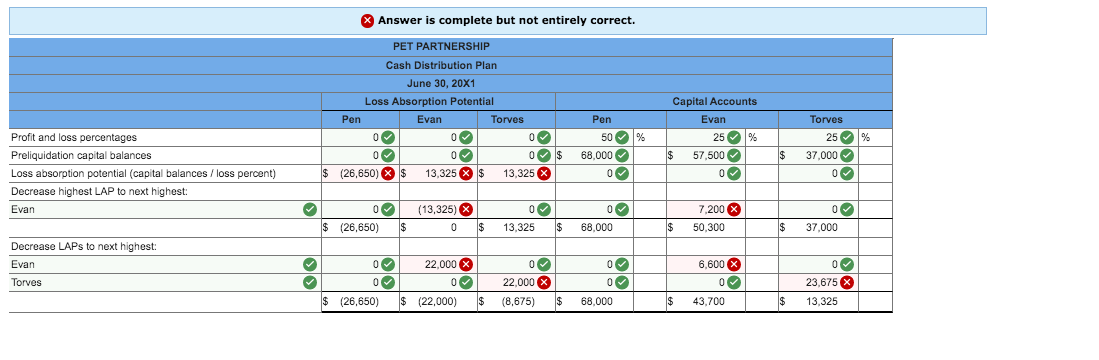

Required: Prepare a cash distribution plan as of June 30, 20X1, showing how much cash each partner will receive if the partners accept the offer to sell the assets.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started