Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The pension fund manager of Utterback (a U.S. firm) purchased German 20-year Treasury bonds instead of U.S. 20-year Treasury bonds. The coupon rate was 2

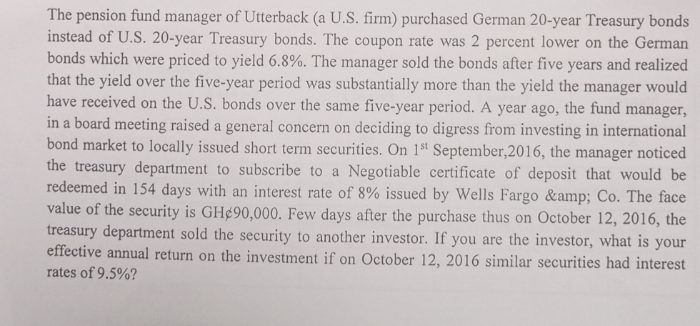

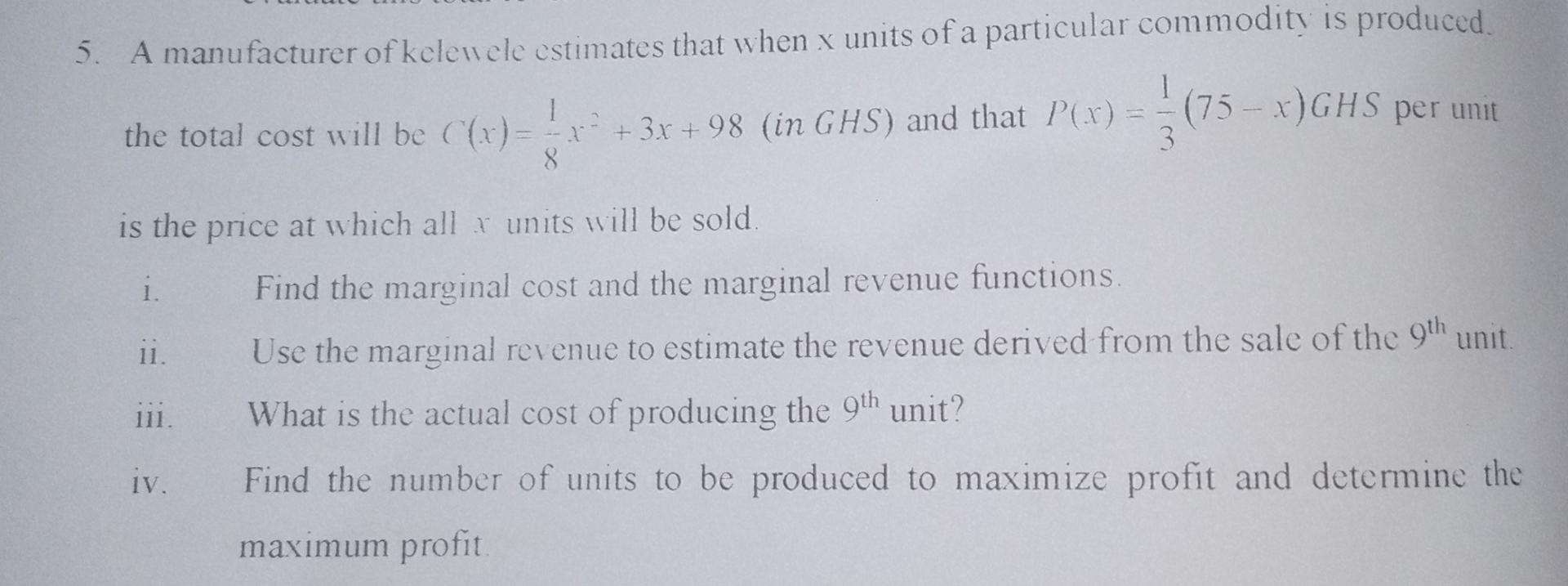

The pension fund manager of Utterback (a U.S. firm) purchased German 20-year Treasury bonds instead of U.S. 20-year Treasury bonds. The coupon rate was 2 percent lower on the German bonds which were priced to yield 6.8%. The manager sold the bonds after five years and realized that the yield over the five-year period was substantially more than the yield the manager would have received on the U.S. bonds over the same five-year period. A year ago, the fund manager, in a board meeting raised a general concern on deciding to digress from investing in international bond market to locally issued short term securities. On 1st September 2016, the manager noticed the treasury department to subscribe to a Negotiable certificate of deposit that would be redeemed in 154 days with an interest rate of 8% issued by Wells Fargo & Co. The face value of the security is GH90,000. Few days after the purchase thus on October 12, 2016, the treasury department sold the security to another investor. If you are the investor, what is your effective annual return on the investment if on October 12, 2016 similar securities had interest rates of 9.5%? A manufacturer of kelen ele estimates that when x units of a particular commodity is produced 1 1 the total cost will be C(.x) = -7 + 3x +98 (in GHS) and that P(-1) = + 3x +98 (in GHS) and that P(-1) = (75 - x)GHS per unit 3 is the price at which all / units will be sold. i. Find the marginal cost and the marginal revenue functions. 11. Use the marginal revenue to estimate the revenue derived from the sale of the 9th unit. 111. What is the actual cost of producing the 9th unit? iv. Find the number of units to be produced to maximize profit and determine the maximum profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started