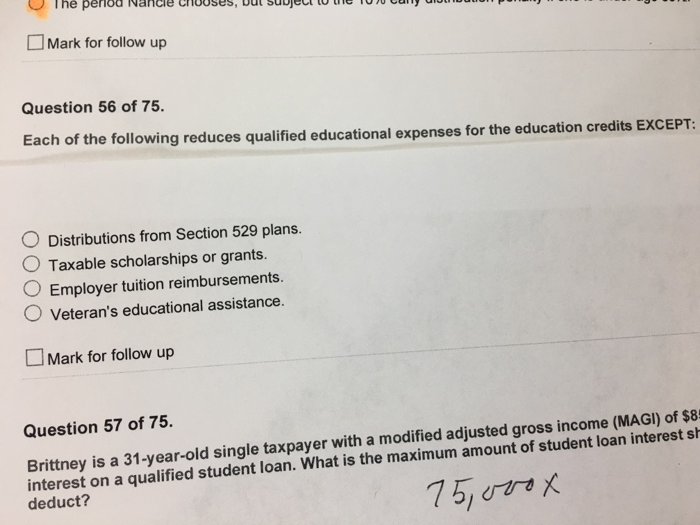

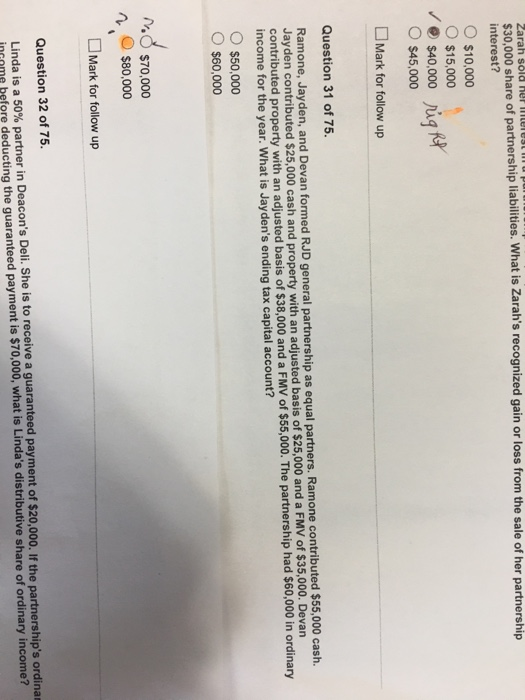

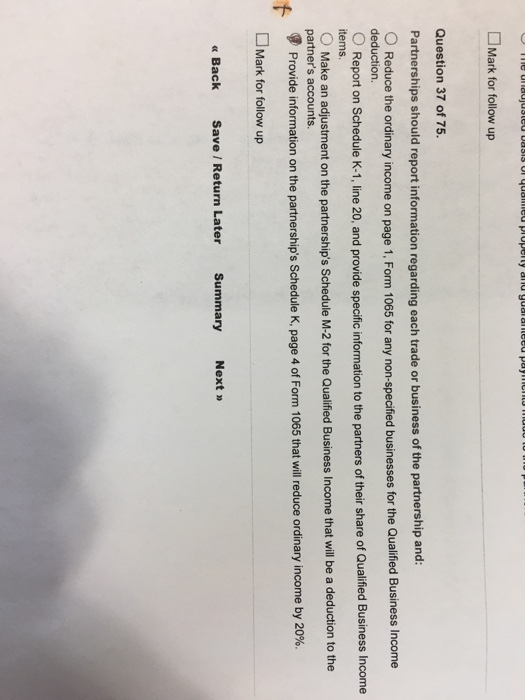

The period Nance Chuses, vul suujeci iu I TU Cumy u Mark for follow up Question 56 of 75. Each of the following reduces qualified educational expenses for the education credits EXCEPT: O Distributions from Section 529 plans. O Taxable scholarships or grants. O Employer tuition reimbursements. O Veteran's educational assistance. Mark for follow up Question 57 of 75. Brittney is a 31-year-old single taxpayer with a modified adjusted gross income (MAGI) of $8! interest on a qualified student loan. What is the maximum amount of student loan interest sh deduct? 75,000x Zarah sold her tu pun $30,000 share of partnership liabilities. What is Zarah's recognized gain or loss from the sale of her partnership interest? O $10,000 O $15,000 $40,000 rgte O $45,000 Mark for follow up Question 31 of 75. Ramone, Jayden, and Devan formed RJD general partnership as equal partners. Ramone contributed $55,000 cash. Jayden contributed $25,000 cash and property with an adjusted basis of $25,000 and a FMV of $35,000. Devan contributed property with an adjusted basis of $38,000 and a FMV of $55,000. The partnership had $60,000 in ordinary income for the year. What is Jayden's ending tax capital account? O $50,000 O $60,000 NO $70,000 $80,000 Mark for follow up Question 32 of 75. Linda is a 50% partner in Deacon's Deli. She is to receive a guaranteed payment of $20,000. If the partnership's ordinan income before deducting the guaranteed payment is $70,000, what is Linda's distributive share of ordinary income? The unajuatu Dago 1 quamcu property and yudialecu paym " Mark for follow up Question 37 of 75. Partnerships should report information regarding each trade or business of the partnership andi U Reduce the ordinary income on page 1. Form 1065 for any non-specified businesses for the Qualified Business Income deduction U Report on Schedule K-1, line 20, and provide specific information to the partners of their share of Qualified Business Income items. Make an adjustment on the partnership's Schedule M-2 for the Qualified Business Income that will be a deduction to the partner's accounts. Provide information on the partnership's Schedule K, page 4 of Form 1065 that will reduce ordinary income by 20%. Mark for follow up Back Save / Return Later Summary Next >>