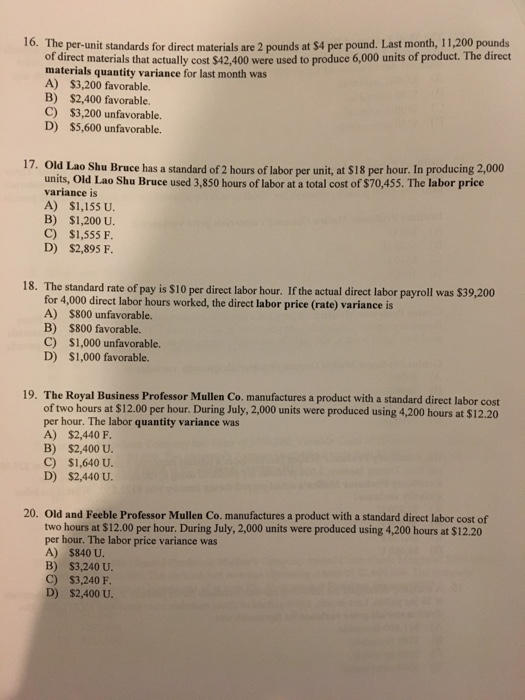

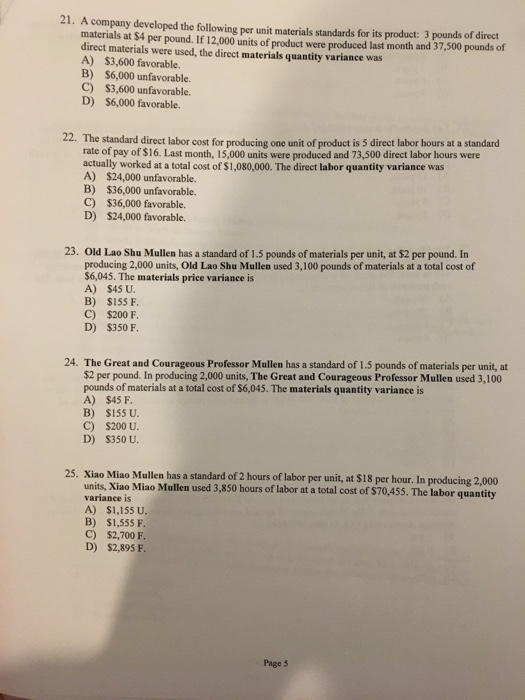

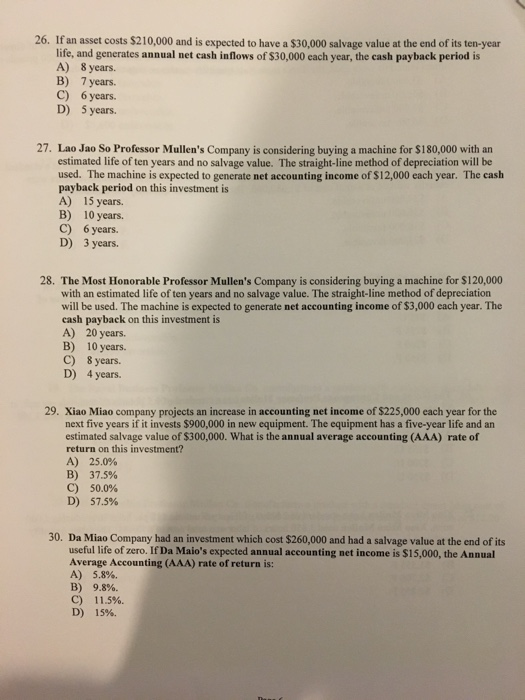

The per-unit standards for direct materials are 2 pounds at $4 per pound. Last month, 11,200 pounds of direct materials that actually cost $42,400 were used to produce 6,000 units of product. The direct 16. materials quantity variance for last month was A) $3,200 favorable. B) $2,400 favorable. C) $3,200 unfavorable. D) $5,600 unfavorable. Old Lao Shu Bruce has a standard of 2 hours of labor per unit, at $18 per hour. In producing 2,000 units, Old Lao Shu Bruce used 3,850 hours of labor at a total cost of $70,455. The labor price 17. variance is A) $1,155 U. B) $1,200 U. C) $1,555 F. D) $2,895 F. labor hour. If the actual direct labor payroll was $39,200 18. The standard rate of pay is $10 per direct for 4,000 direct labor hours worked, the direct labor price (rate) variance is A) $800 unfavorable. B) $800 favorable. C) $1,000 unfavorable D) $1,000 favorable. 19. The Royal Business Professor Mullen Co. manufactures a product with a standard direct labor cost of two hours at $12.00 per hour. During July, 2,000 units were produced using 4,200 hours at $12.20 per hour. The labor quantity variance was A) $2,440 F B) $2,400 U. C) $1,640 U. D) $2,440 U. Old and Feeble Professor Mullen Co. manufactures a product with a standard direct labor cost of two hours at $12.00 per hour. During July, 2,000 units were produced using 4,200 hours at $12.20 per hour. The labor price variance was A) $840 U. 20. B) S3,240 U C) $3,240 F D) $2,400 U 21. A company developed the following per unit materials standards for its product: 3 pounds of direct materials at $4 per pound. If 12,000 units of product were produced last month and 37,500 pounds of direct materials were used, the direct materials quantity variance was A) $3,600 favorable. B) $6,000 unfavorable. C) $3,600 unfavorable D) $6,000 favorable. 22. The standard direct labor cost for producing one unit of product is 5 direct labor hours at a standard rate of pay of $16. Last month, 15,000 units were produced and 73,500 direct labor hours were actually worked at a total cost of $1,080,000. The direct labor quantity variance was A) $24,000 unfavorable. B) $36,000 unfavorable. C) $36,000 favorable. D) $24,000 favorable. 23. Old Lao Shu Mullen has a standard of 1.5 pounds of materials per unit, at $2 per pound. In producing 2,000 units, Old Lao Shu Mullen used 3,100 pounds of materials at a total cost of 6,045. The materials price variance is A) $45 U. B) $155 F C) $200 F D) $350 F The Great and Courageous Professor Mullen has a standard of 1.5 pounds of materials per unit, at $2 per pound. In producing 2,000 units, The Great and Courageous Professor Mullen used 3,100 pounds of materials at a total cost of $6,045. The materials quantity variance is A) $45 F B) $155 U. C) $200 U D) $350 U. 24. 25. Xiao Miao Mullen has a standard of 2 hours of labor per unit, at $18 per hour. In producing 2,000 units, Xiao Miao Mullen used 3,850 hours of labor at a total cost of $70,455. The labor quantity variance is A) $1,155 U B) $1,555 F C) $2,700F. D) $2,895 F Page 5 26. If an asset costs $210,000 and is expected to have a $30,000 salvage value at the end of its ten-year life, and generates annual net cash inflows of $30,000 each year, the cash payback period is A) 8 years. B) 7 years. C) 6 years. D) 5 years. 27. Lao Jao So Professor Mullen's Company is considering buying a machine for $180,000 with an estimated life of ten years and no salvage value. The straight-line method of depreciation will be used. The machine is expected to generate net accounting income of $12,000 each year. The cash payback period on this investment is A) 15 years. B) 10 years. C) 6 years. D) 3 years. 28. The Most Honorable Professor Mullen's Company is considering buying a machine for $120,000 with an estimated life of ten years and no salvage value. The straight-line method of depreciation will be used. The machine is expected to generate net accounting income of $3,000 each year. The cash payback on this investment is A) 20 years. B) 10 years. C) 8 years D) 4 years. 29. Xiao Miao company projects an increase in accounting net income of $225,000 each year for the next five years if it invests $900,000 in new equipment. The equipment has a five-year life and an estimated salvage value of $300,000. What is the annual average accounting (AAA) rate of return on this investment? A) 25.0% B) 37.5% C) 50.0% D) 57.5% 30. Da Miao Company had an investment which cost $260,000 and had a salvage value at the end of its useful life of zero. If Da Maio's expected annual accounting net income is $15,000, the Annual Average Accounting (AAA) rate of return is: A) 5.8%. B) 9.8%. C) 11.5%. D) 15%