Answered step by step

Verified Expert Solution

Question

1 Approved Answer

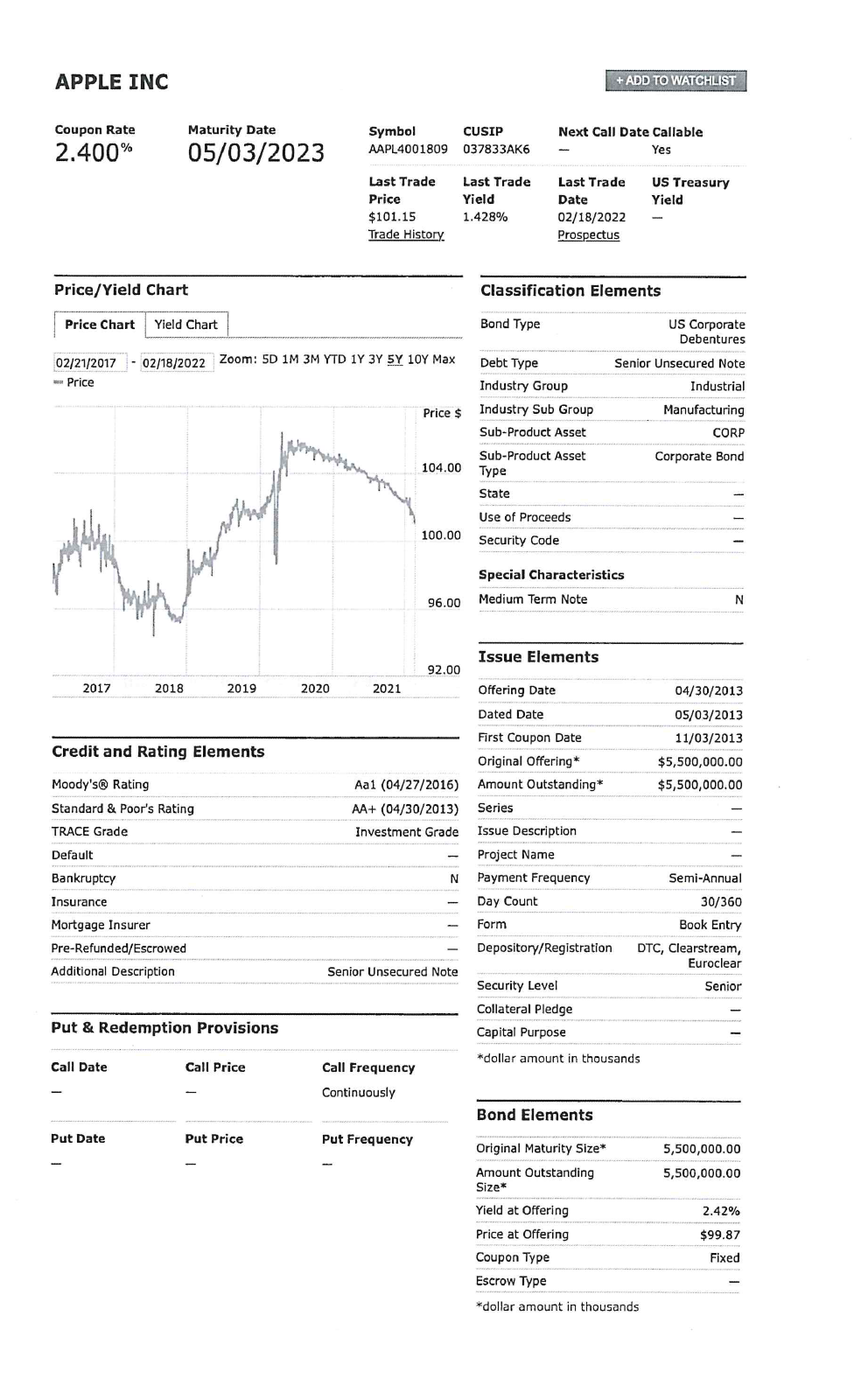

the picture is attached above the questions that is the article APPLE INC Coupon Rate 2.400% Price/Yield Chart Price Chart Yield Chart 2017 Maturity Date

the picture is attached above the questions that is the article

APPLE INC Coupon Rate 2.400% Price/Yield Chart Price Chart Yield Chart 2017 Maturity Date 05/03/2023 02/21/2017 - 02/18/2022 Zoom: 5D 1M 3M YTD 1Y 3Y 5Y 10Y Max ****Price postrof 2018 Bankruptcy Insurance Mortgage Insurer Pre-Refunded/Escrowed Additional Description Call Date Credit and Rating Elements Moody's Rating Standard & Poor's Rating TRACE Grade Default Put Date 2019 Put & Redemption Provisions Call Price Put Price CUSIP Symbol AAPL4001809 037833AK6 2020 Last Trade Price $101.15 Trade History. 2021 Call Frequency Price $ 104.00 Continuously 100.00 Aa1 (04/27/2016) AA+ (04/30/2013) Put Frequency 96.00 Investment Grade 92.00 Senior Unsecured Note N Last Trade Yield 1.428% Bond Type Next Call Date Callable Yes Last Trade Date 02/18/2022 Prospectus Classification Elements Debt Type Industry Group Industry Sub Group Sub-Product Asset Sub-Product Asset + ADD TO WATCHLIST Type State Use of Proceeds Security Code Issue Elements Offering Date Dated Date First Coupon Date Original Offering* Amount Outstanding* Series Special Characteristics Medium Term Note Issue Description Project Name Payment Frequency Day Count Form Bond Elements Depository/Registration Security Level Collateral Pledge Capital Purpose *dollar amount in thousands US Treasury Yield Senior Unsecured Note Industrial Manufacturing US Corporate Debentures Original Maturity Size* Amount Outstanding Size* Yield at Offering Price at Offering Coupon Type Escrow Type *dollar amount in thousands CORP Corporate Bond N 04/30/2013 05/03/2013 11/03/2013 $5,500,000.00 $5,500,000.00 Semi-Annual 30/360 Book Entry DTC, Clearstream, Euroclear Senior 5,500,000.00 5,500,000.00 2.42% $99.87 Fixed Bond Valuation and Bond markets Critically review the information provided on Apple Inc bond below and the scientific article Sustainable financing practices through green bonds: What affects the funding size?" and answer the questions as per the requirement below. 69 Required: (a) The Apple bond below was $101.15. If the YTM rise from 1.428 %to 1.5%, re- estimate the price of Apple and find out the bond's interest-rate risk? (3 marks) (b) Briefly discuss the current degree and key drivers of Apple Inc capacity in meeting their contractional obligation. (3 marks) (c) According to EY's 2021 CEO Imperative Study, 80% of CEOs believe it's likely "companies will take significant new steps to take responsibility for the social and environmental impacts of their operations" over the next five years. Financing decisions needs to be linked to Go green" objectives to foster corporate engagement with sustainability practices. In doing so, a key development are green bonds, which are used as raise funds for long-term financing sustainable development and climate-related projects (World Bank, 2015). Do you agree. Justify your answer (4 marks) APPLE INC Coupon Rate 2.400% Price/Yield Chart Price Chart Yield Chart 2017 Maturity Date 05/03/2023 02/21/2017 - 02/18/2022 Zoom: 5D 1M 3M YTD 1Y 3Y 5Y 10Y Max ****Price postrof 2018 Bankruptcy Insurance Mortgage Insurer Pre-Refunded/Escrowed Additional Description Call Date Credit and Rating Elements Moody's Rating Standard & Poor's Rating TRACE Grade Default Put Date 2019 Put & Redemption Provisions Call Price Put Price CUSIP Symbol AAPL4001809 037833AK6 2020 Last Trade Price $101.15 Trade History. 2021 Call Frequency Price $ 104.00 Continuously 100.00 Aa1 (04/27/2016) AA+ (04/30/2013) Put Frequency 96.00 Investment Grade 92.00 Senior Unsecured Note N Last Trade Yield 1.428% Bond Type Next Call Date Callable Yes Last Trade Date 02/18/2022 Prospectus Classification Elements Debt Type Industry Group Industry Sub Group Sub-Product Asset Sub-Product Asset + ADD TO WATCHLIST Type State Use of Proceeds Security Code Issue Elements Offering Date Dated Date First Coupon Date Original Offering* Amount Outstanding* Series Special Characteristics Medium Term Note Issue Description Project Name Payment Frequency Day Count Form Bond Elements Depository/Registration Security Level Collateral Pledge Capital Purpose *dollar amount in thousands US Treasury Yield Senior Unsecured Note Industrial Manufacturing US Corporate Debentures Original Maturity Size* Amount Outstanding Size* Yield at Offering Price at Offering Coupon Type Escrow Type *dollar amount in thousands CORP Corporate Bond N 04/30/2013 05/03/2013 11/03/2013 $5,500,000.00 $5,500,000.00 Semi-Annual 30/360 Book Entry DTC, Clearstream, Euroclear Senior 5,500,000.00 5,500,000.00 2.42% $99.87 Fixed Bond Valuation and Bond markets Critically review the information provided on Apple Inc bond below and the scientific article Sustainable financing practices through green bonds: What affects the funding size?" and answer the questions as per the requirement below. 69 Required: (a) The Apple bond below was $101.15. If the YTM rise from 1.428 %to 1.5%, re- estimate the price of Apple and find out the bond's interest-rate risk? (3 marks) (b) Briefly discuss the current degree and key drivers of Apple Inc capacity in meeting their contractional obligation. (3 marks) (c) According to EY's 2021 CEO Imperative Study, 80% of CEOs believe it's likely "companies will take significant new steps to take responsibility for the social and environmental impacts of their operations" over the next five years. Financing decisions needs to be linked to Go green" objectives to foster corporate engagement with sustainability practices. In doing so, a key development are green bonds, which are used as raise funds for long-term financing sustainable development and climate-related projects (World Bank, 2015). Do you agree. Justify your answer (4 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started