Question

The picture reveals differences in reporting deadlines for U.S. public companies. For example, nonaccelerated filers have an entire month longer than large accelerated filers to

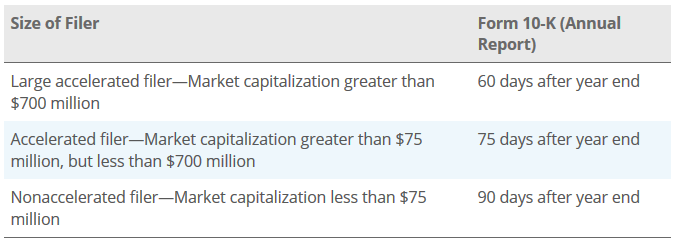

The picture reveals differences in reporting deadlines for U.S. public companies. For example, nonaccelerated filers have an entire month longer than large accelerated filers to provide information to users.

Does this difference seem fair to you from a user perspective? What reasons do you think that the SEC has for allowing nonaccelerated filers to have more time to provide these disclosures? All else held equal, would you prefer to invest in a company that provides disclosures after 60 days, or one that provides disclosures after 90 days?

Discuss.

Size of Filer Form 10-K (Annual Report) Large accelerated filer-Market capitalization greater than $700 million 60 days after year end 75 days after year end 90 days after year end Accelerated filer-Market capitalization greater than $75 million, but less than $700 million Nonaccelerated filer-Market capitalization less than $75 million Size of Filer Form 10-K (Annual Report) Large accelerated filer-Market capitalization greater than $700 million 60 days after year end 75 days after year end 90 days after year end Accelerated filer-Market capitalization greater than $75 million, but less than $700 million Nonaccelerated filer-Market capitalization less than $75 millionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started