the picture with the green backgroud is what needs to be answer and the other attachments are information that can be used to answer the questions.

extra details for the question

extra info

Carltons tax rate is 1.0%

The 10 year risk free rate is 1.740% (which can be used as the risk free rate in the capital asset pricing,)

The 2 year risk free rate is 0.070%. You can use this percentage to determine the before- tax cost of the companys bonds.

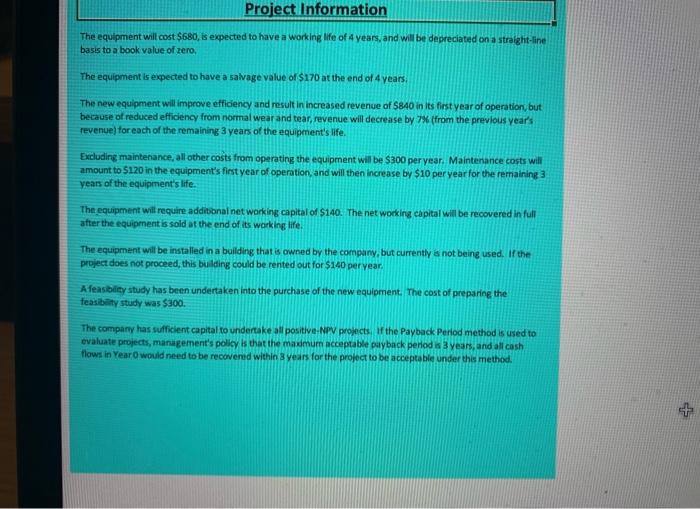

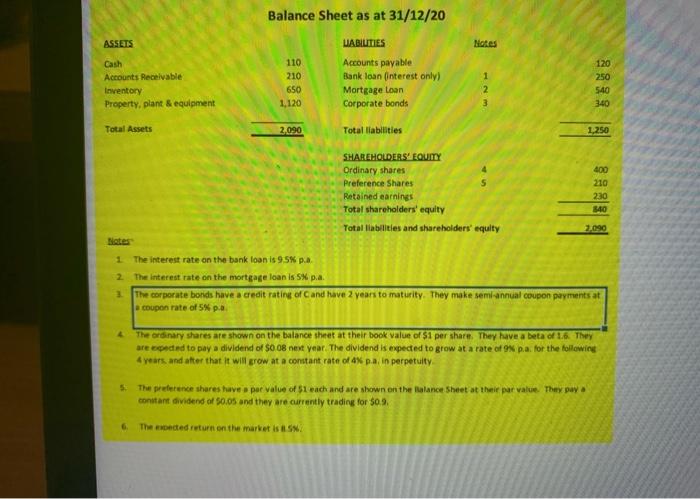

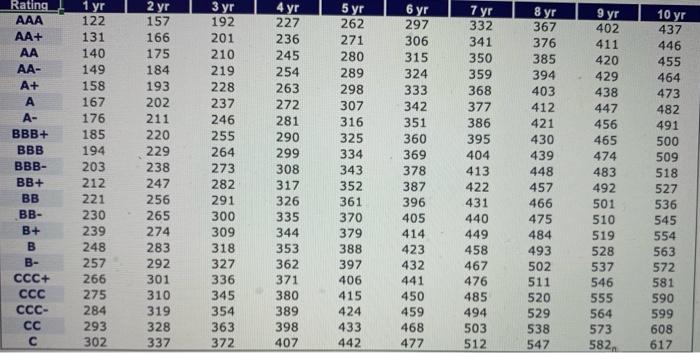

Number of perence shares Totul mate value of preference shares SO Project Information The equipment will cost $680, is expected to have a working life of 4 years, and will be depreciated on a straight-line basis to a book value of zero, The equipment is expected to have a salvage value of $170 at the end of 4 years The new equipment will improve efficiency and result in increased revenue of S840 in its first year of operation, but because of reduced efficiency from normal wear and tear, revenue will decrease by 7% (from the previous year's revenue) for each of the remaining 3 years of the equipment's life Excluding maintenance, all other costs from operating the equipment will be $300 per year. Maintenance costs will amount to 5120 in the equipment's first year of operation, and will then increase by $10 per year for the remaining 3 years of the equipment's life. The equipment will require additional networking capital of $140. The networking capital will be recovered in full after the equipment is sold at the end of its working life. The equipment will be installed in a building that is owned by the company, but currently is not being used. If the project does not proceed, this building could be rented out for $140 per year. A feasibility study has been undertaken into the purchase of the new equipment. The cost of preparing the feasibility study was $300 The company has sufficient capital to undertake all positive-NPV projects. If the Payback period method is used to evaluate projects, management's policy is that the maxdmum acceptable payback period 3 years, and all cash flows in Year Owould need to be recovered within 3 years for the project to be acceptable under the method + Balance Sheet as at 31/12/20 ASSETS UABILITIES Notes 120 250 Cash Accounts Receivable Inventory Property, plant & equipment 110 210 650 1,120 Accounts payable Bank loan interest only) Mortgage loan Corporate bonds 1 2 540 340 Total Assets 2,090 Total liabilities 1.250 SHAREHOLDERS' EQUITY Ordinary shares Preference Shares Retained earnings Total shareholders' equity Tatal liabilities and shareholders' equity 400 210 230 840 2.090 1 The interest rate on the bank loan is 9.5% pa 2 The interest rate on the mortgage loan is 5% pa. 3 The corporate bords have a credit rating of Cand have 2 years to maturity. They make semi-annual coupon payments at coupon rate of 5pa The ordinary shares are shown on the balance sheet at their book value of $1 per share. They have a beta of 16. They are corded to pay a dividend of $008 not year. The dividend is expected to grow at a rate of 9 p.a. for the following 4 years, and after that it will grow at a constant rate of pain perpetuity 5. The preference shares have per value of each and are shown on the walance Sheet at their par value. They w constant dividend of 0.05 and they are currently trading for $0.9 The ended return on the market is 6 Rating AA+ AA- + - BBB+ BBB- BB+ BB- + - CCC+ - 1 122 131 140 149 158 167 176 185 194 203 212 221 230 23 248 257 266 275 284 293 302 2 157 166 175 184 193 202 211 220 229 238 247 256 265 274 283 292 301 310 319 328 337 192 201 210 219 228 237 246 255 264 273 282 291 300 309 318 327 336 345 354 363 372 227 236 245 254 263 272 281 290 299 308 317 326 335 344 353 362 371 380 389 398 407 262 271 280 289 298 307 316 325 334 343 352 361 370 379 388 397 406 415 424 433 442 297 306 315 324 333 342 351 360 369 378 387 396 405 414 423 432 441 450 459 468 477 332 341 350 359 368 377 386 395 404 413 422 431 440 449 458 467 476 485 494 503 512 367 376 385 394 403 412 421 430 439 448 457 466 475 484 493 502 511 520 529 538 547 9 402 411 420 429 438 447 456 465 474 483 492 501 510 519 528 537 546 555 564 573 582 10 437 446 455 464 473 482 491 500 509 518 527 536 545 554 563 572 581 590 599 608 617