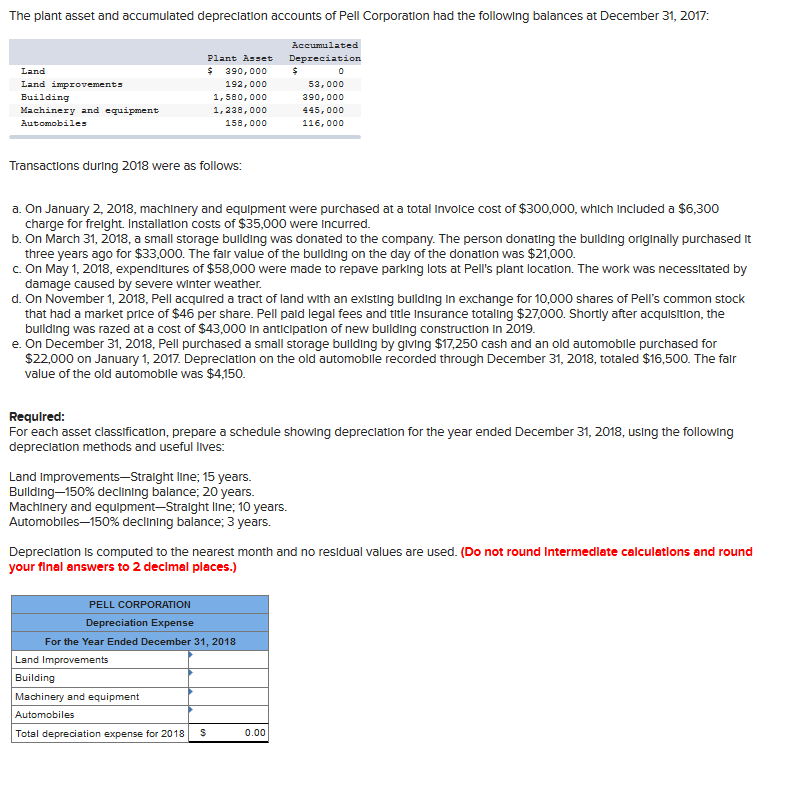

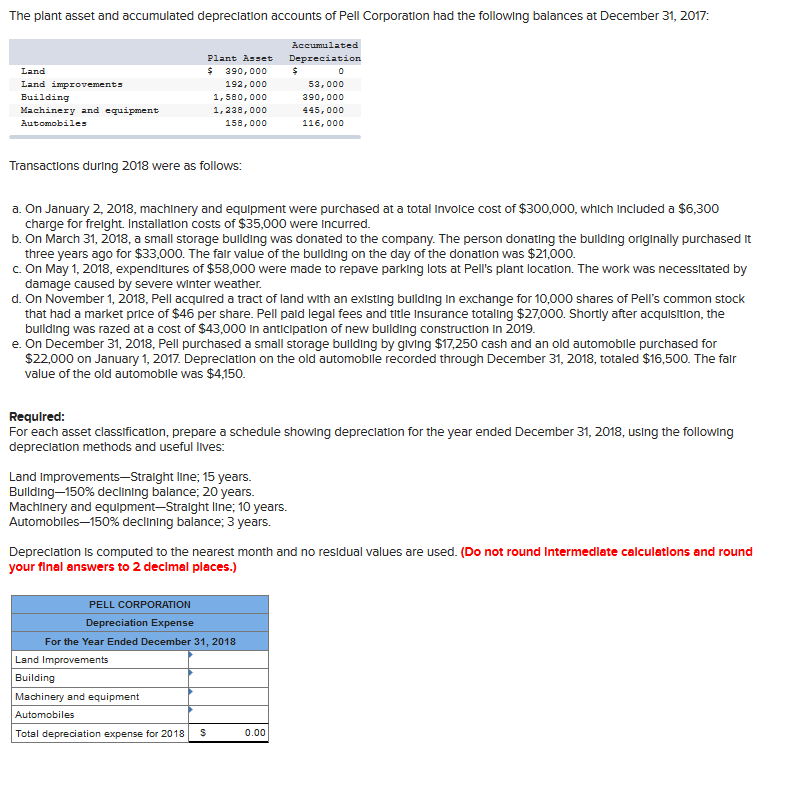

The plant asset and accumulated depreclation accounts of Pell Corporation had the folloWing balances at December 31, 2017: Accumulated Plant sset Depreciation S 390,000 192,000 1,580,000 1,238,000 158,000 Land 53,000 390,000 445,000 116,000 Land improvements Automobiles Transactions during 2018 were as follows a. On January 2, 2018, machinery and equlpment were purchased at a total Involce cost of $300,000, which Included a $6,300 b. On March 31, 2018, a small storage bullding was donated to the company. The person donating the bullding originally purchased It C. On May 1, 2018, expenditures of $58,000 were made to repave parking lots at Pell's plant location. The work was necessitated by d. On November 1, 2018, Pell acquired a tract of land with an existing building In exchange for 10,000 shares of Pell's common stock charge for freight. Installation costs of $35,000 were Incurred. three years ago for $33,000. The falr value of the bullding on the day of the donation was $21,000. damage caused by severe WInter weather that had a market price of $46 per share. Pell pald legal fees and title Insurance totaling $27,000. Shortly after acqulsition, the bulding was razed at a cost of $43,000 In anticlpation of new bullding construction In 2019 e. On December 31, 2018, Pell purchased a small storage bullding by glving $17,250 cash and an old automoblle purchased for $22,000 on January 1, 2017. Depreclation on the old automoblle recorded through December 31, 2018, totaled $16,500. The falr value of the old automoblle was $4150 Required For each asset classification, prepare a schedule showing depreciation for the year ended December 31, 2018, using the following depreclation methods and useful lives: Land Improvements-Stralght line; 15 years. Building-150% declining balance; 20 years. Machinery and equipment-Straight line; 10 years. Automobiles-150% declining balance: 3 years. Depreclation is computed to the nearest month and no resldual values are used. (Do not round Intermediete calculatlons and round your final answers to 2 declmal places.) For the Year Ended 31, 2018 Land I Building Machinery and equipment Automobiles Total depreciation expense f for 2018 S 0.00