Answered step by step

Verified Expert Solution

Question

1 Approved Answer

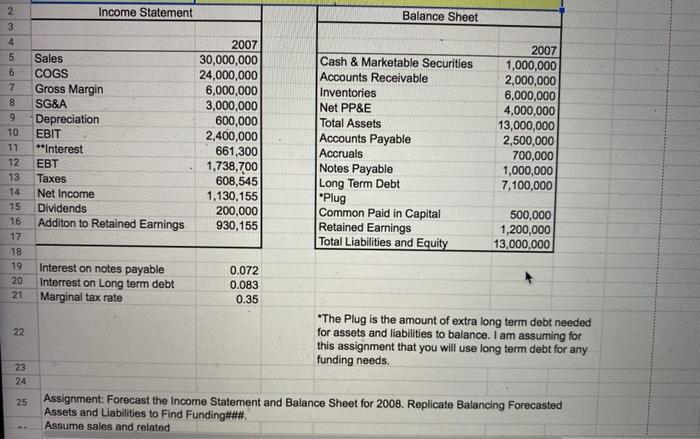

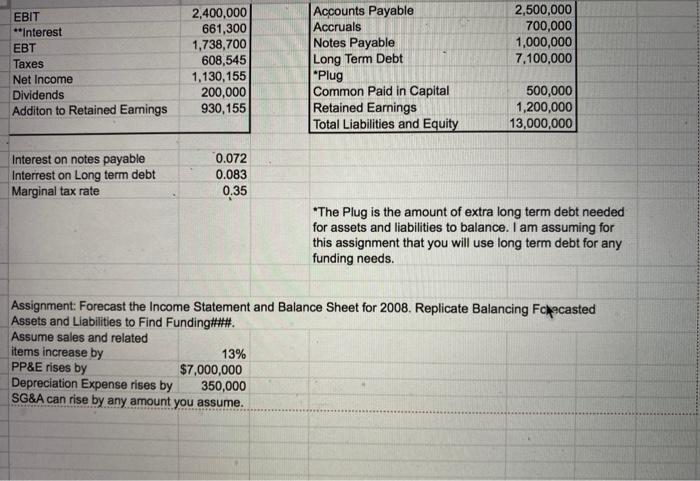

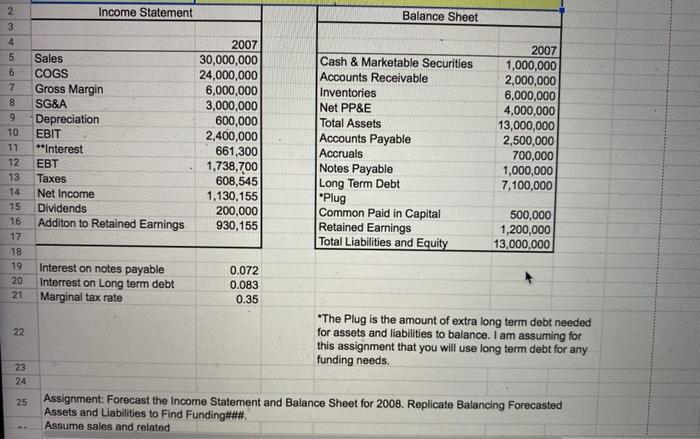

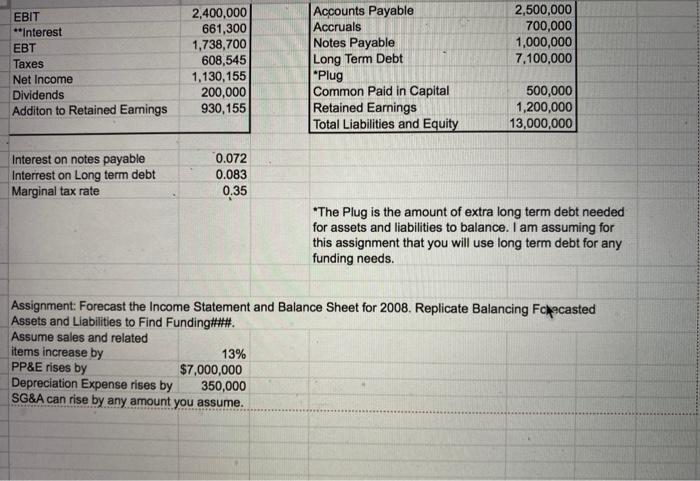

*The plug is the amount of extra long term debt needed for assets and liabilities to balance. I am assuming that for this assignment that

*The plug is the amount of extra long term debt needed for assets and liabilities to balance. I am assuming that for this assignment that you will use long term debt for any funding needs.

2 Income Statement Balance Sheet 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 78 19 20 21 Sales COGS Gross Margin SG&A Depreciation EBIT **Interest EBT Taxes Net Income Dividends Additon to Retained Earings 2007 30,000,000 24,000,000 6,000,000 3,000,000 600,000 2,400,000 661,300 1,738,700 608,545 1,130,155 200,000 930,155 Cash & Marketable Securities Accounts Receivable Inventories Net PP&E Total Assets Accounts Payable Accruals Notes Payable Long Term Debt *Plug Common Paid in Capital Retained Earnings Total Liabilities and Equity 2007 1,000,000 2,000,000 6,000,000 4,000,000 13,000,000 2,500,000 700,000 1,000,000 7,100,000 500,000 1,200,000 13,000,000 interest on notes payable Interrest on Long term debt Marginal tax rate 0.072 0.083 0.35 22 "The Plug is the amount of extra long term debt needed for assets and liabilities to balance. I am assuming for this assignment that you will use long term debt for any funding needs. 23 24 25 Assignment: Forecast the Income Statement and Balance Sheet for 2008. Replicate Balancing Forecasted Assets and Liabilities to Find Funding### Assume sales and related EBIT **Interest EBT Taxes Net Income Dividends Additon to Retained Eamings 2,400,000 661,300 1,738,700 608,545 1,130,155 200,000 930,155 2,500,000 700,000 1,000,000 7,100,000 Accounts Payable Accruals Notes Payable Long Term Debt "Plug Common Paid in Capital Retained Earnings Total Liabilities and Equity 500,000 1,200,000 13,000,000 Interest on notes payable Interrest on Long term debt Marginal tax rate 0.072 0.083 0.35 "The Plug is the amount of extra long term debt needed for assets and liabilities to balance. I am assuming for this assignment that you will use long term debt for any funding needs. Assignment: Forecast the Income Statement and Balance Sheet for 2008. Replicate Balancing Flecasted Assets and Liabilities to Find Funding### Assume sales and related items increase by 13% PP&E rises by $7,000,000 Depreciation Expense rises by 350,000 SG&A can rise by any amount you assume. 2 Income Statement Balance Sheet 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 78 19 20 21 Sales COGS Gross Margin SG&A Depreciation EBIT **Interest EBT Taxes Net Income Dividends Additon to Retained Earings 2007 30,000,000 24,000,000 6,000,000 3,000,000 600,000 2,400,000 661,300 1,738,700 608,545 1,130,155 200,000 930,155 Cash & Marketable Securities Accounts Receivable Inventories Net PP&E Total Assets Accounts Payable Accruals Notes Payable Long Term Debt *Plug Common Paid in Capital Retained Earnings Total Liabilities and Equity 2007 1,000,000 2,000,000 6,000,000 4,000,000 13,000,000 2,500,000 700,000 1,000,000 7,100,000 500,000 1,200,000 13,000,000 interest on notes payable Interrest on Long term debt Marginal tax rate 0.072 0.083 0.35 22 "The Plug is the amount of extra long term debt needed for assets and liabilities to balance. I am assuming for this assignment that you will use long term debt for any funding needs. 23 24 25 Assignment: Forecast the Income Statement and Balance Sheet for 2008. Replicate Balancing Forecasted Assets and Liabilities to Find Funding### Assume sales and related EBIT **Interest EBT Taxes Net Income Dividends Additon to Retained Eamings 2,400,000 661,300 1,738,700 608,545 1,130,155 200,000 930,155 2,500,000 700,000 1,000,000 7,100,000 Accounts Payable Accruals Notes Payable Long Term Debt "Plug Common Paid in Capital Retained Earnings Total Liabilities and Equity 500,000 1,200,000 13,000,000 Interest on notes payable Interrest on Long term debt Marginal tax rate 0.072 0.083 0.35 "The Plug is the amount of extra long term debt needed for assets and liabilities to balance. I am assuming for this assignment that you will use long term debt for any funding needs. Assignment: Forecast the Income Statement and Balance Sheet for 2008. Replicate Balancing Flecasted Assets and Liabilities to Find Funding### Assume sales and related items increase by 13% PP&E rises by $7,000,000 Depreciation Expense rises by 350,000 SG&A can rise by any amount you assume Assignment - forecast the income statement and balance sheet for 2008. Replicate balancing forecast assets and liabilities to find funding ###

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started