Answered step by step

Verified Expert Solution

Question

1 Approved Answer

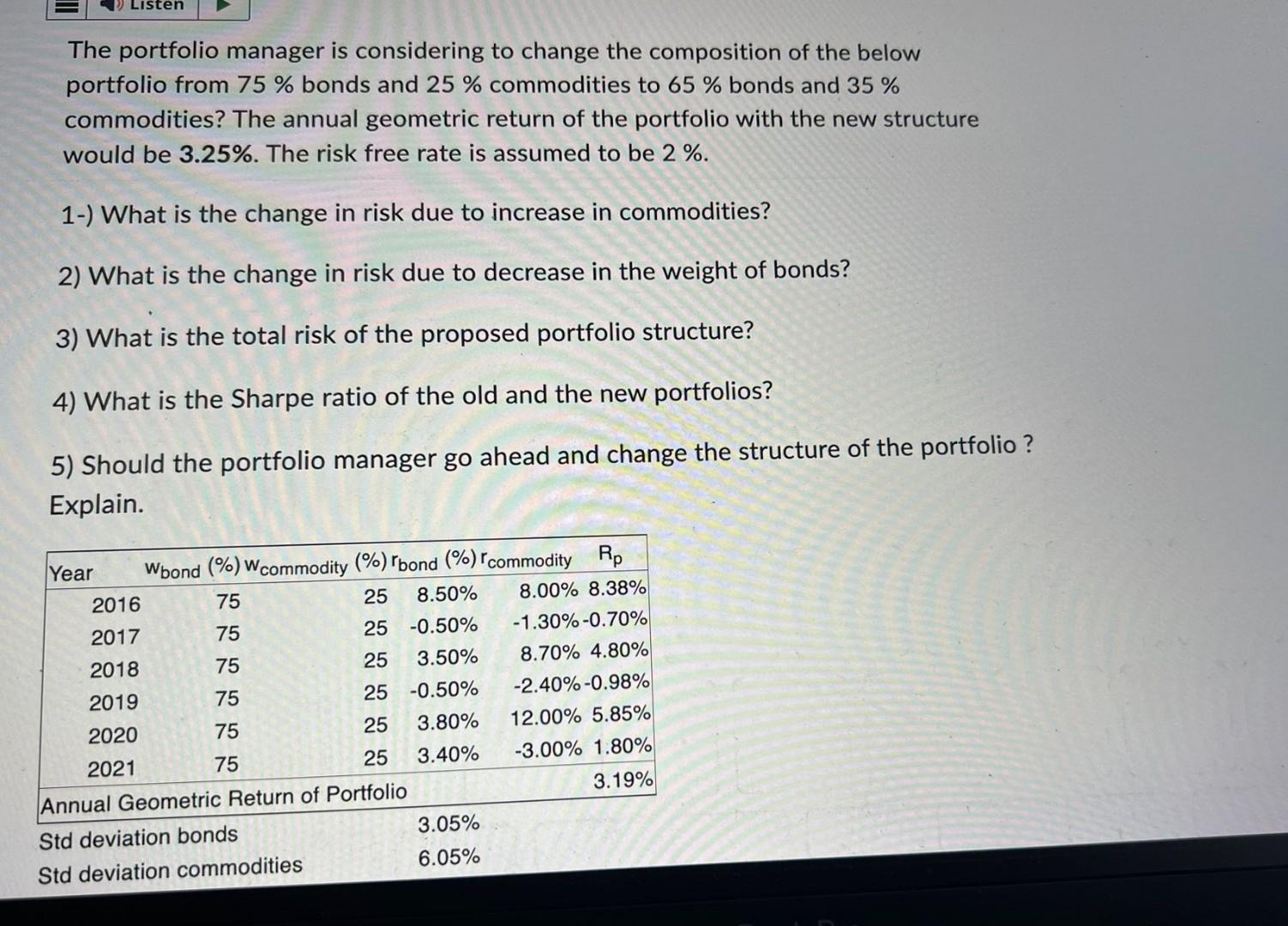

The portfolio manager is considering to change the composition of the below portfolio from 75 bonds and 25 commodities to 65 bonds and 35 commodities?

The portfolio manager is considering to change the composition of the below portfolio from \75 bonds and \25 commodities to \65 bonds and \35 commodities? The annual geometric return of the portfolio with the new structure would be \3.25. The risk free rate is assumed to be \2. 1-) What is the change in risk due to increase in commodities? 2) What is the change in risk due to decrease in the weight of bonds? 3) What is the total risk of the proposed portfolio structure? 4) What is the Sharpe ratio of the old and the new portfolios? 5) Should the portfolio manager go ahead and change the structure of the portfolio ? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started