Answered step by step

Verified Expert Solution

Question

1 Approved Answer

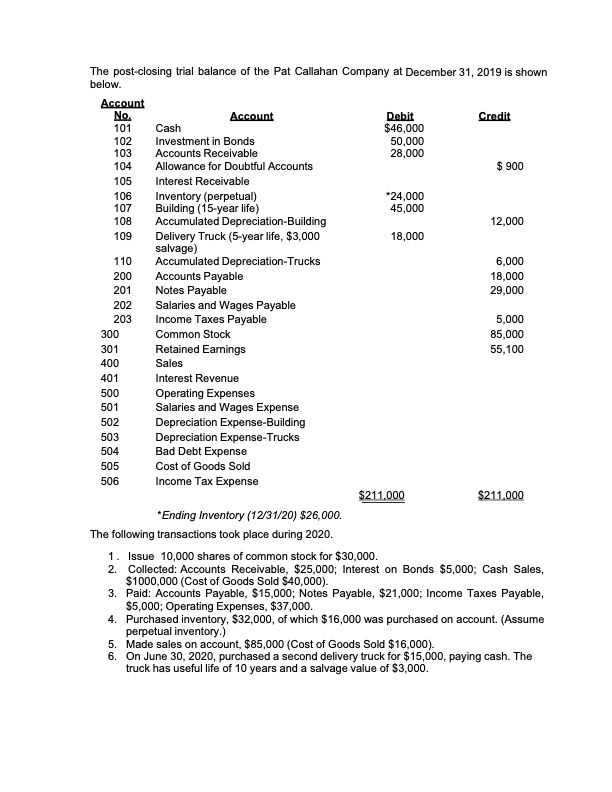

The post - closing trial balance of the Pat Callahan Company at December 3 1 , 2 0 1 9 is shown below. ( see

The postclosing trial balance of the Pat Callahan Company at December is shown below. see image

The following transactions took place during

Issue shares of common stock for $

Collected: Accounts Receivable, $; Interest on Bonds $; Cash Sales,

$Cost of Goods Sold $

Paid: Accounts Payable, $; Notes Payable, $; Income Taxes Payable,

$; Operating Expenses, $

Purchased inventory, $ of which $ was purchased on account. Assume

perpetual inventory.

Made sales on account, $Cost of Goods Sold $

On June purchased a second delivery truck for $ paying cash. The

truck has useful life of years and a salvage value of $

Ending Inventory $

Instructions

a Journalize each of the transactions above of the Pat Callahan Company. Some items

require more than one journal entry.

b Post the entries to appropriate accounts. You should set up a Taccount for each

account noted on the trial balance.

c Prepare a trial balance after posting the journal entries and enter the amounts on a

column work sheet like the one shown in the text. Enter all the accounts shown on

the original trial balance.

d Enter the following adjustments on the work sheet: a Accrued wages at year end

total $; b Bad debt expense is estimated at of credit sales; c Record

straightline depreciation on the building and trucks; d Accrued interest on the

investments in bonds is $; e Income tax expense for is $ The tax

is not due until

e Prepared the Adjusted Trial Balance.

f Complete the income statement and balance sheet columns of the work sheet.

g Prepare closing journal entries and Postclosing Trial Balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started