Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The powercuts are expected to last for 5 years. (please use this) I got a Crypto company which was not making any profit for 40

The powercuts are expected to last for 5 years. (please use this)

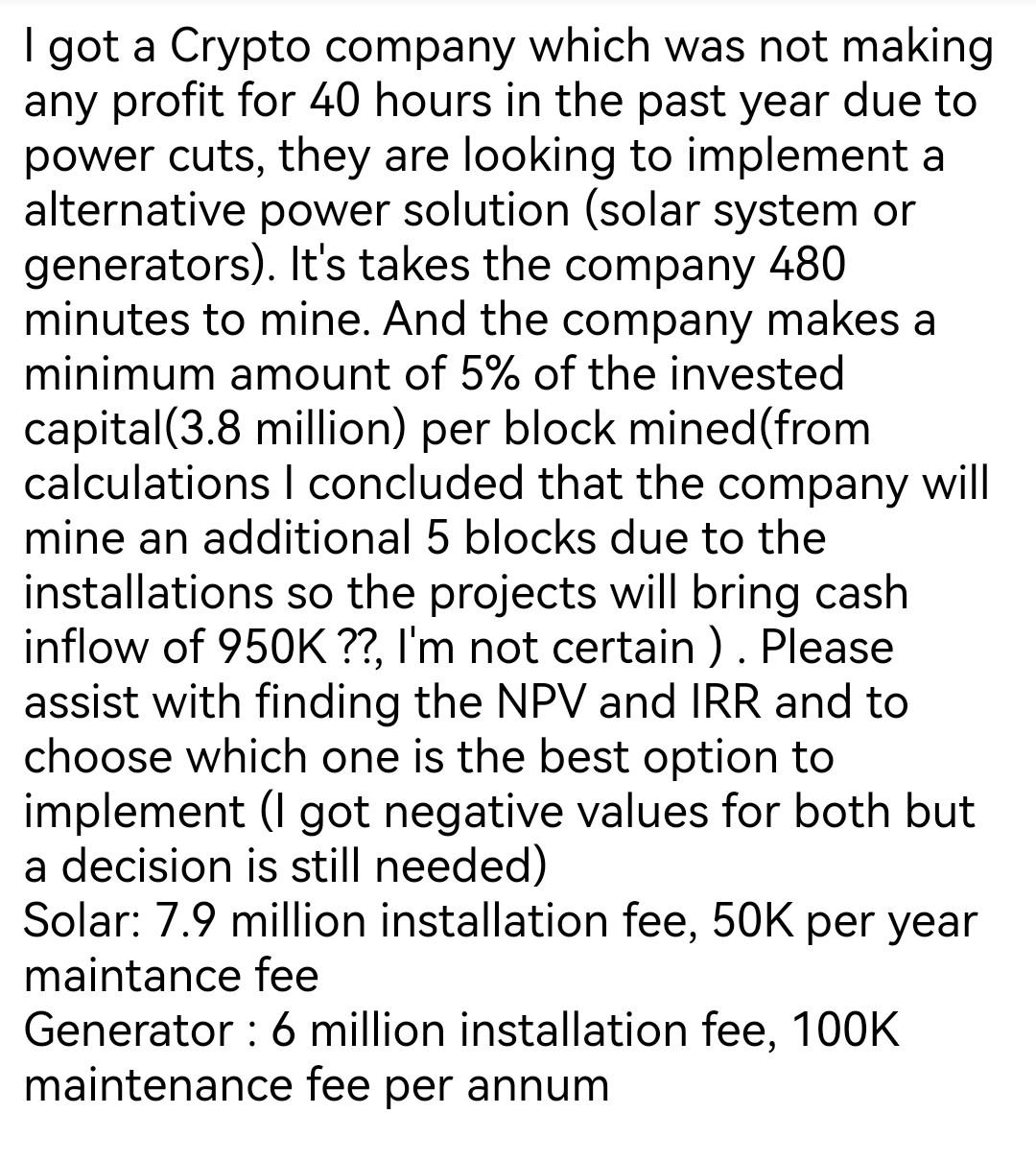

I got a Crypto company which was not making any profit for 40 hours in the past year due to power cuts, they are looking to implement a alternative power solution (solar system or generators). It's takes the company 480 minutes to mine. And the company makes a minimum amount of 5% of the invested capital(3.8 million) per block mined(from calculations I concluded that the company will mine an additional 5 blocks due to the installations so the projects will bring cash inflow of 950K ??, I'm not certain ). Please assist with finding the NPV and IRR and to choose which one is the best option to implement (I got negative values for both but a decision is still needed) Solar: 7.9 million installation fee, 50K per year maintance fee Generator : 6 million installation fee, 100K maintenance fee per annumStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started