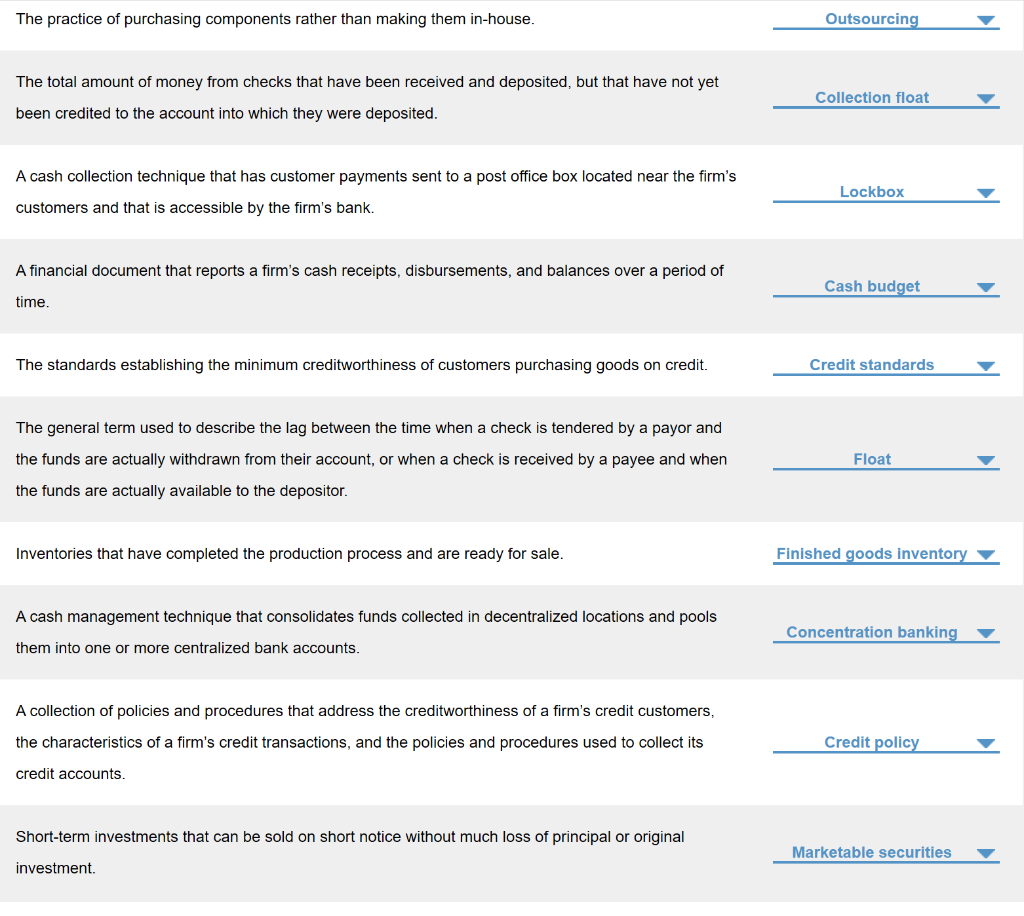

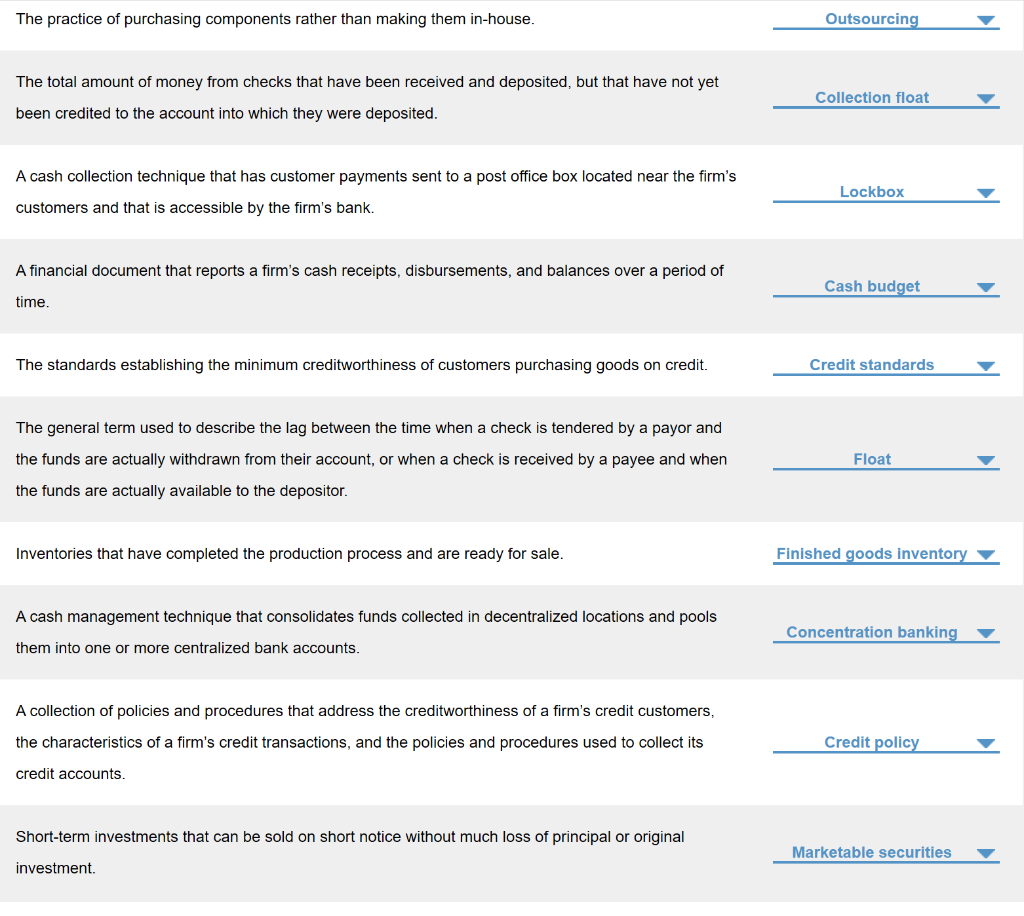

The practice of purchasing components rather than making them in-house. Outsourcing The total amount of money from checks that have been received and deposited, but that have not yet Collection float been credited to the account into which they were deposited. A cash collection technique that has customer payments sent to a post office box located near the firm's Lockbox customers and that is accessible by the firm's bank. A financial document that reports a firm's cash receipts, disbursements, and balances over a period of Cash budget time. The standards establishing the minimum creditworthiness of customers purchasing goods on credit. Credit standards The general term used to describe the lag between the time when a check is tendered by a payor and Float the funds are actually withdrawn from their account, or when a check is received by a payee and when the funds are actually available to the depositor. Inventories that have completed the production process and are ready for sale. Finished goods inventory A cash management technique that consolidates funds collected in decentralized locations and pools them into one or more centralized bank accounts. Concentration banking A collection of policies and procedures that address the creditworthiness of a firm's credit customers, the characteristics of a firm's credit transactions, and the policies and procedures used to collect its Credit policy credit accounts. Short-term investments that can be sold on short notice without much loss of principal or original Marketable securities investment The practice of purchasing components rather than making them in-house. Outsourcing The total amount of money from checks that have been received and deposited, but that have not yet Collection float been credited to the account into which they were deposited. A cash collection technique that has customer payments sent to a post office box located near the firm's Lockbox customers and that is accessible by the firm's bank. A financial document that reports a firm's cash receipts, disbursements, and balances over a period of Cash budget time. The standards establishing the minimum creditworthiness of customers purchasing goods on credit. Credit standards The general term used to describe the lag between the time when a check is tendered by a payor and Float the funds are actually withdrawn from their account, or when a check is received by a payee and when the funds are actually available to the depositor. Inventories that have completed the production process and are ready for sale. Finished goods inventory A cash management technique that consolidates funds collected in decentralized locations and pools them into one or more centralized bank accounts. Concentration banking A collection of policies and procedures that address the creditworthiness of a firm's credit customers, the characteristics of a firm's credit transactions, and the policies and procedures used to collect its Credit policy credit accounts. Short-term investments that can be sold on short notice without much loss of principal or original Marketable securities investment