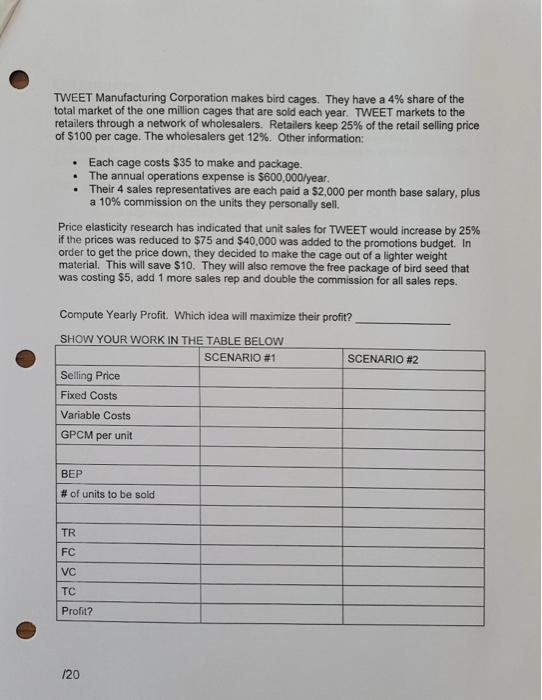

. The Prairie Plastic Company (PPC) was considering manufacturing a plastic ski carrier. The car-top carrier would completely encase 6 pairs of downhill skiis. The marketing plan the PPC took to the bank outlined the following strategy PPC was planning on leasing a warehouse in an industrial park which would be solely dedicated to manufacturing the ski carriers. The warehouse would lease for $90,000 a year. Utilities were estimated to be $200 for natural gas for a month, and $400 (month) for city utilities which includes electricity, water, and garbage disposal. The plant would require one full-time salaried supervisor at $60,000 per year. Each ski carrier would require $34 worth of raw materials (plastic, dyes, hinges and lock). The plant would employ a number of labourers to make and package the carriers. It was estimated that to make and package one ski carrier would cost $16. PPC told the bank that they could make a huge profit if they could sell 700 carriers each month to a wholesaler for $80. Thus, the bank should loan them $150,000 which they would pay back at $3,000 a month for 10 years (add this in as a fixed cost). Be the banker - calculate the net profits that they will make if they produce and sell 700 each month. Then calculate the break-even point on a monthly basis. Show all your work and recommend the action the bank should take. . /10 . TWEET Manufacturing Corporation makes bird cages. They have a 4% share of the total market of the one million cages that are sold each year. TWEET markets to the retailers through a network of wholesalers. Retailers keep 25% of the retail selling price of $100 per cage. The wholesalers get 12%. Other information: Each cage costs $35 to make and package. The annual operations expense is $600,000/year. Their 4 sales representatives are each paid a $2,000 per month base salary, plus a 10% commission on the units they personally sell. Price elasticity research has indicated that unit sales for TWEET would increase by 25% if the prices was reduced to $75 and $40,000 was added to the promotions budget. In order to get the price down, they decided to make the cage out of a lighter weight material. This will save $10. They will also remove the free package of bird seed that was costing $5, add 1 more sales rep and double the commission for all sales reps. Compute Yearly Profit. Which idea will maximize their profit? SHOW YOUR WORK IN THE TABLE BELOW SCENARIO #1 SCENARIO #2 Selling Price Fixed Costs Variable Costs GPCM per unit BEP # of units to be sold TR FC VC TC Profit? 120