Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The preferable file submission would be Word with embedded Excel tables/calculations. The audited financials for Best Buy (Ticker: BBY) are provided in Canvas. Conduct a

The preferable file submission would be Word with embedded

Excel tables/calculations.

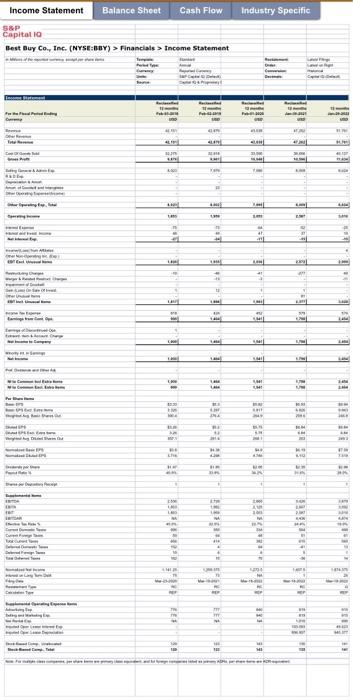

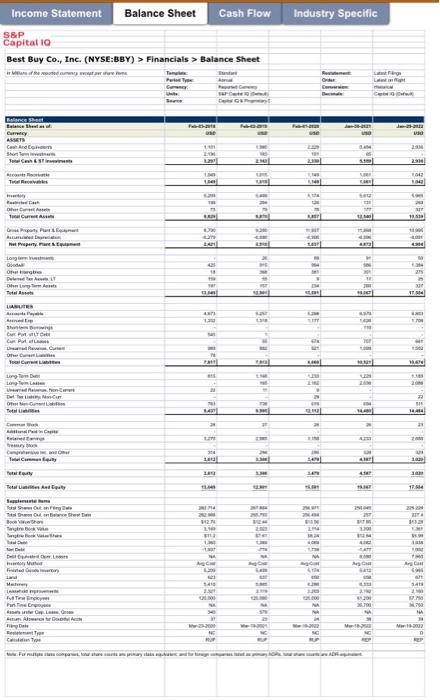

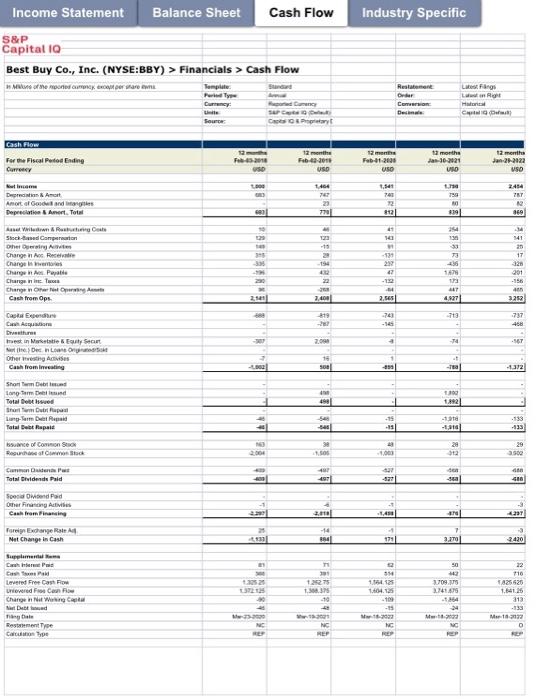

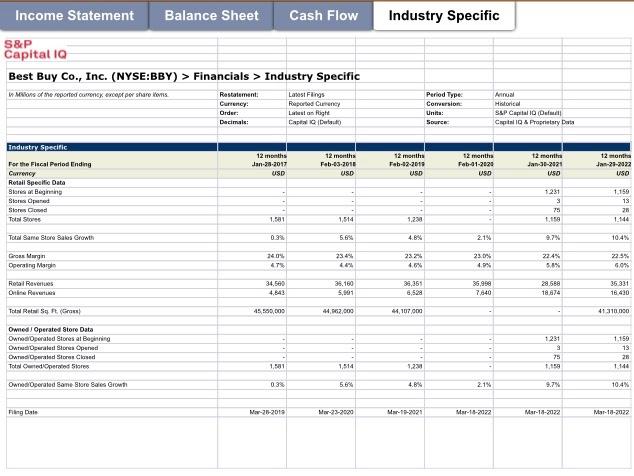

The audited financials for Best Buy (Ticker: BBY) are provided in Canvas. Conduct a financial analysis using the following steps:

- 1) Common-Sized Income Statements & Balance Sheets (5 years)

- 2) Du Pont System of Equations Analysis (5 years)

- 3) Ratio Analysis covering the ratios listed below (5 years)

- 4) Financial Health Analysis using the Altman Z-Score (5 years)

Once complete answer the following questions (Assume that BBY is at least average with respect to its competitors; i.e. focus on trend analysis and not on industry analysis.

- How does the company's financial performance compare to itself over time (trend), and what factors may be contributing to any differences?

- What trends can be observed in the company's revenue and profitability over the past few years, and what do you suggest about the company's business model and strategic positioning related to these metrics?

- How do the company's balance sheet and cash flow statement reflect its financial health and ability to fund future growth? Hint: utilize the growth metrics covered in Chapter 3

- Based on your analysis, what are the key risks and opportunities facing the company? Include how they impact its financial performance and stability. Hint: you may want to include metrics from the "Industry" tab in this answer.

- What recommendations would you make to the company's management team to improve its financial performance and position in the market?

- Based on the analysis including the identification of key risks and opportunities, what steps can the company take to improve its free cash flow and overall financial position in the market?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started