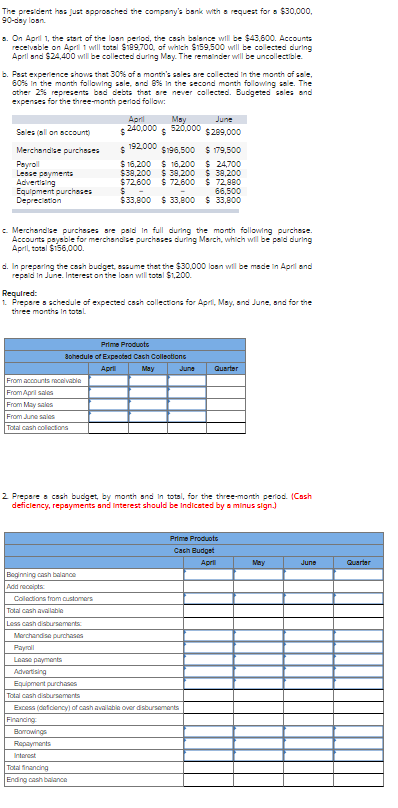

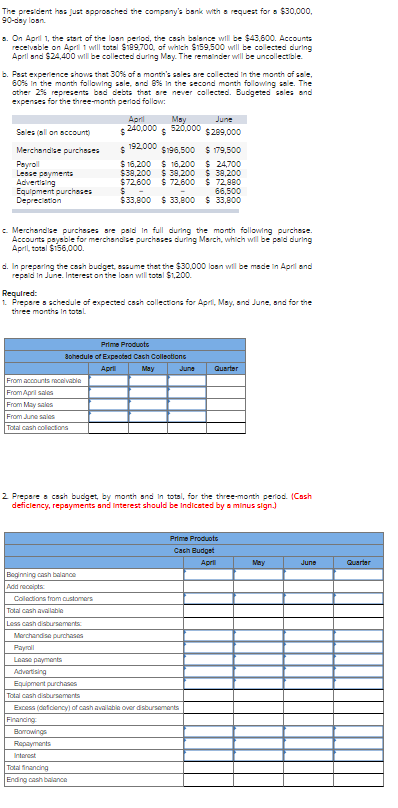

The president has just approaches the company's bank with a request for a $30,000, 90-day loan .. On April 1, the start of the los period, the cash balance will be $43,600. Accounts receivable on April 1 will total $199.700, of which 159,500 will be collected during April and $24,400 will be collected during May. The remainder will be uncollectible b. Post experience shows that 30% of a month's sales are collected in the month of sale, 60% In the month following ssle, and in the second month following sale. The other 2% represents bad debts that are never collected. Budgeted sales and expenses for the three- month period follow: April Msy June Sales (all on account) $240.000 $ 520,000 $299,000 Merchandise purchases $ 192.000 $196,500 $ 179,500 Peyrol $ 16,200 $ 16,200 $ 24700 Lesse payments $39,200 $ 39,200 $ 39,200 Advertising $72.600 $ 72,600 $72.980 Equipment purchases 66,500 Depreciation $33,800 $ 33,800 $ 33,800 c. Merchandise purchases sre paid in full during the month following purchase Accounts payable for merchandise purchases during March, which will be paid during April total $156,000 d. In preparing the cash budget, assume that the $30,000 loan will be made in April and repaid in June. Interest on the loan will total $1.200 Required: 1. Prepare a schedule of expected cash collections for April May, and June, and for the three months in total Guarter Prime Produto Schadule of Expected Cach Collection April May June From acounts receivable From April sales From May From une salos Total cash collections 2 Prepare a cash budget, by month and in total, for the three-month period (Cash deficiency, repayments and interest should be indicated by a minus sign.) May June Quarter Prime Products Caen Budget April Beginning cash balance Address: Collections from customers Total cash available Less cash disbursements Merchandise purchases Payroll Le payments Advertising Equipment purchase Total cash disbursements Excess deficiency of cash available over disbursements Finanding Borrowings Repayments Interest Total trancing Ending cash balance