Question

The president of Univax, Inc., has just approached the company's bank seeking short-term financing for the coming year, Year 2. Univax is a distributor of

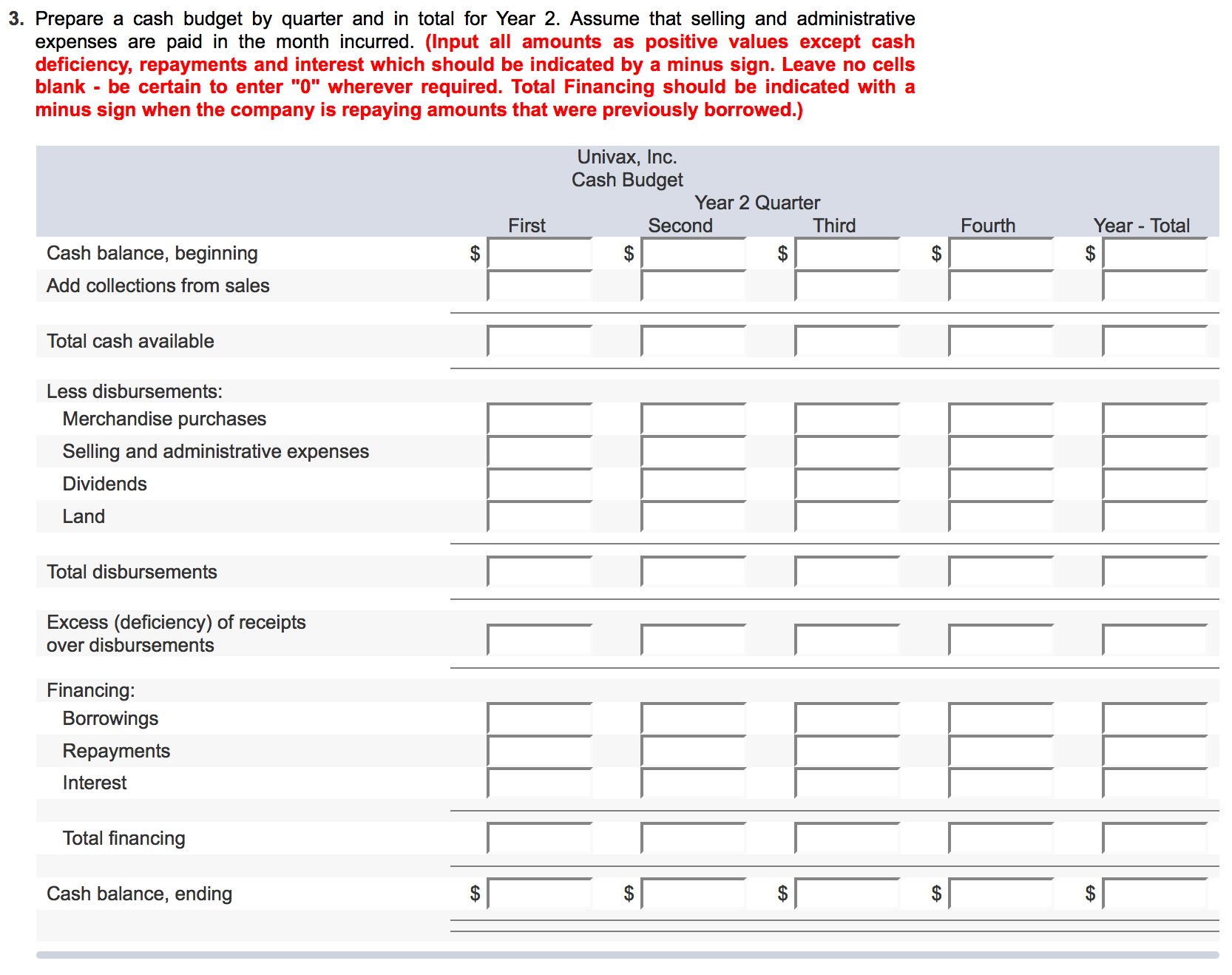

The president of Univax, Inc., has just approached the company's bank seeking short-term financing for the coming year, Year 2. Univax is a distributor of commercial vacuum cleaners. The bank has stated that the loan request must be accompanied by a detailed cash budget that shows the quarters in which financing will be needed, as well as the amounts that will be needed and the quarters in which repayments can be made.

To provide this information for the bank, the president has directed that the following data be gathered from which a cash budget can be prepared:

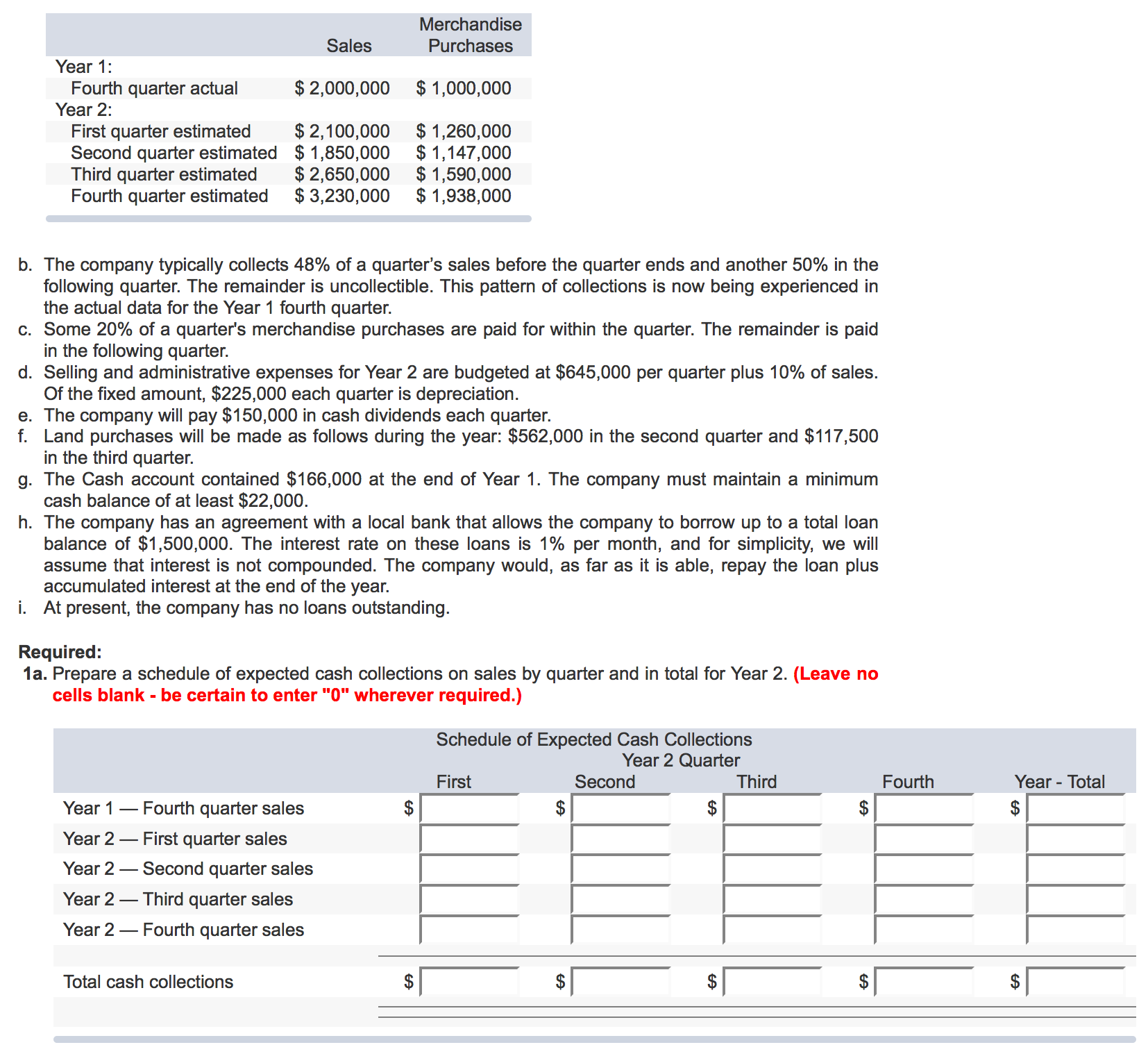

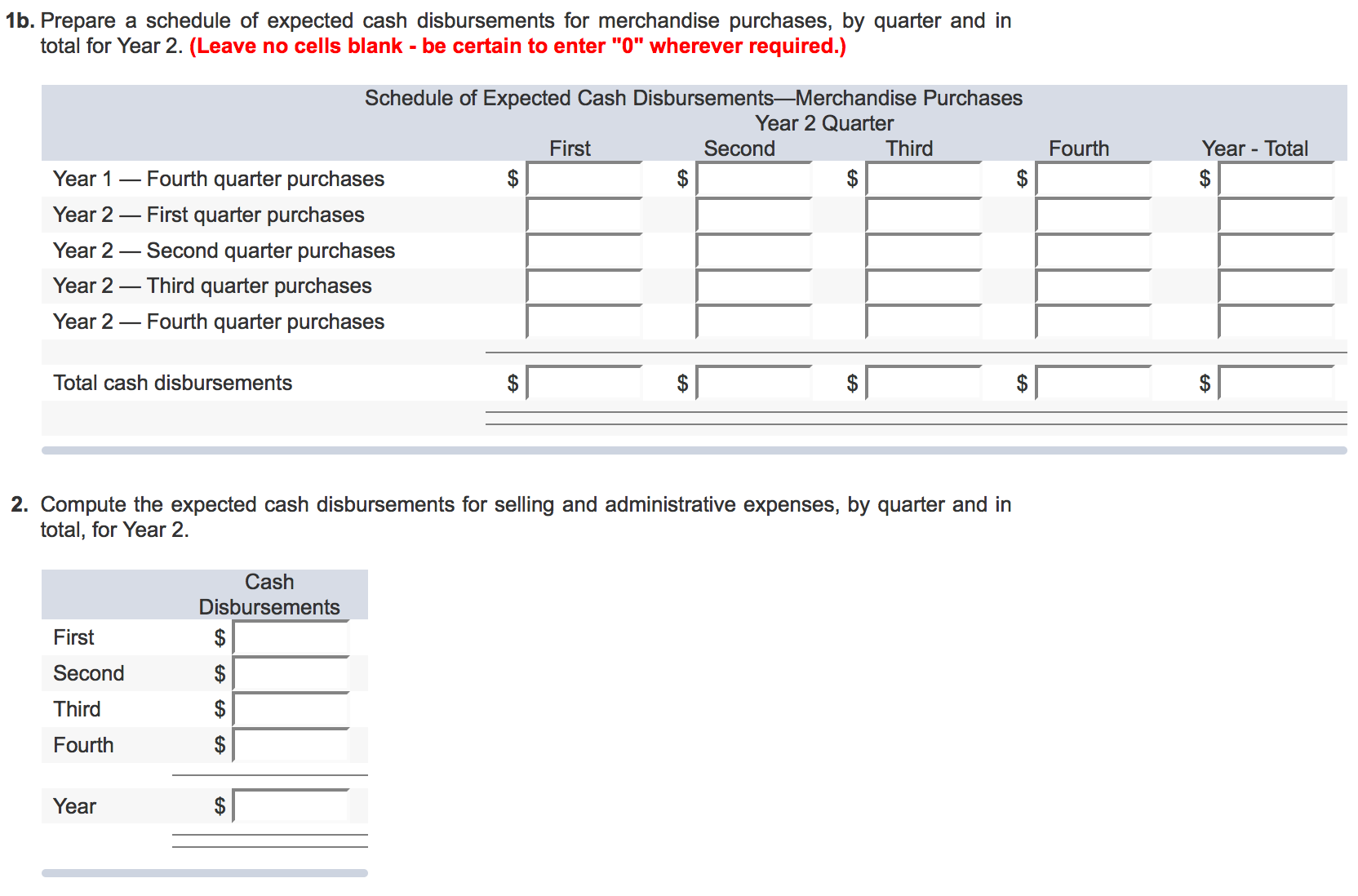

a. Budgeted sales and merchandise purchases for Year 2, as well as actual sales and purchases for the last quarter of Year 1, are as follows:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started