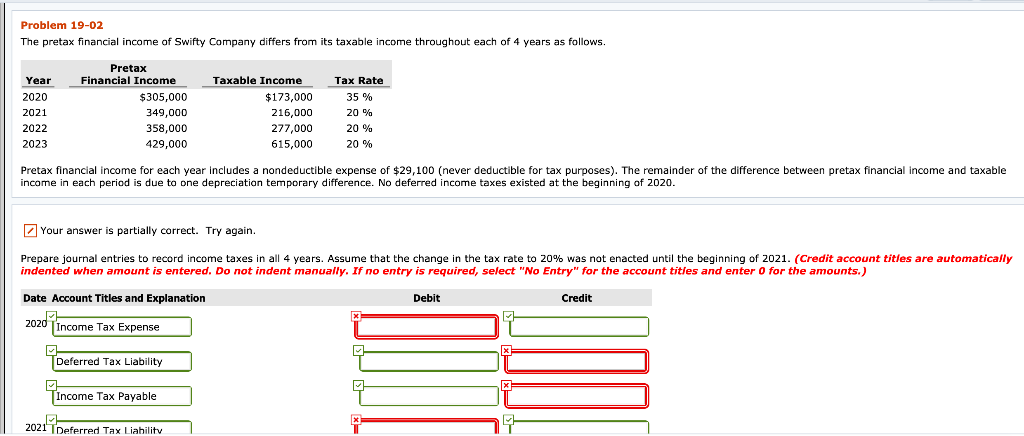

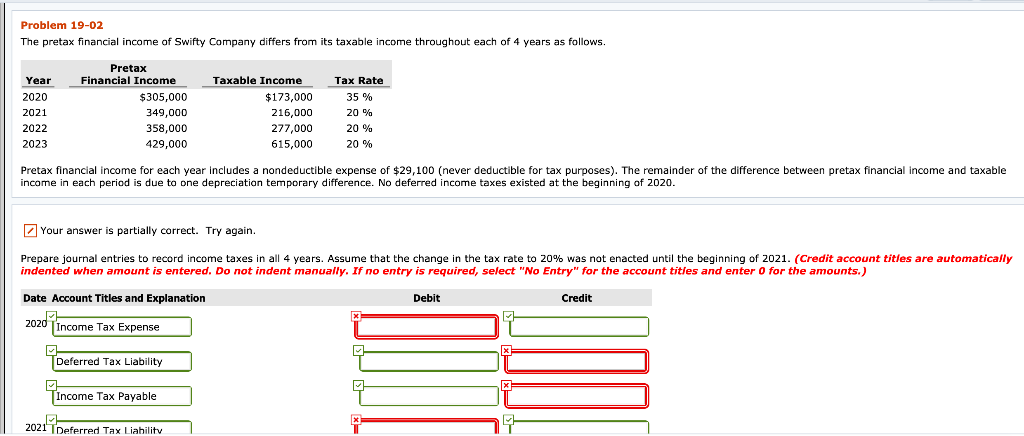

The pretax financial income of Swifty Company differs from its taxable income throughout each of 4 years as follows.

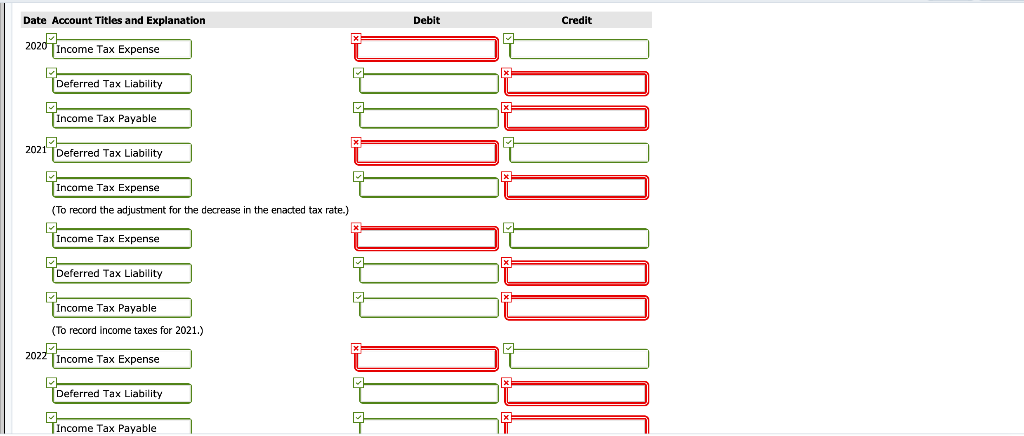

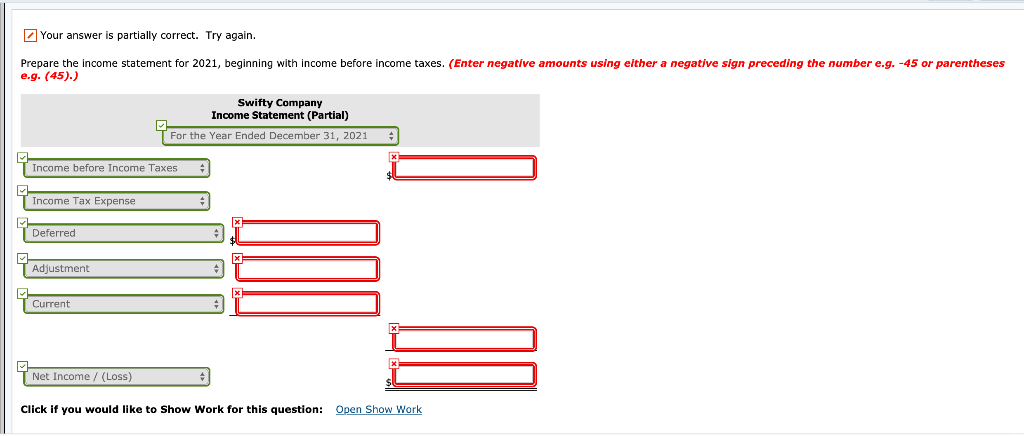

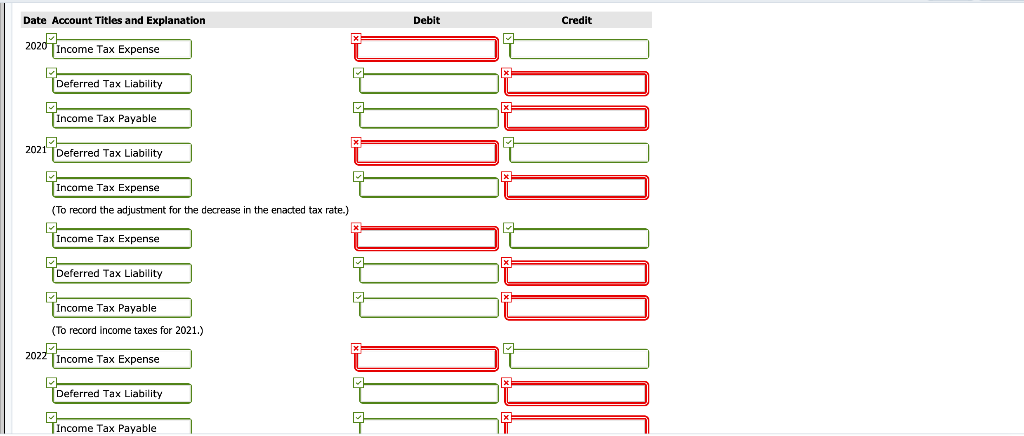

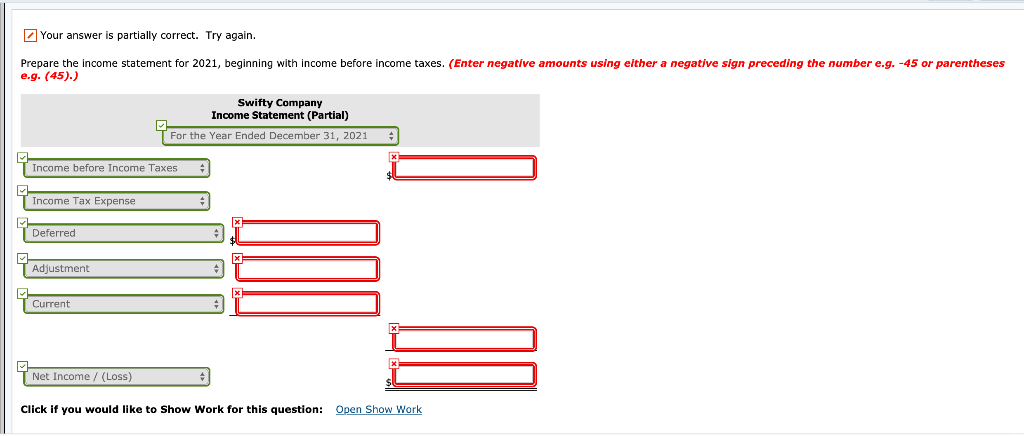

Problem 19-02 The pretax financial income of Swifty Company differs from its taxable income throughout each of 4 years as follows. Year 2020 2021 2022 2023 Pretax Financial Income $305,000 349,000 358,000 429,000 Taxable Income $173,000 216,000 277,000 615,000 Tax Rate 35 % 20 % 20 % 20 % Pretax financial income for each year includes a nondeductible expense of $29,100 (never deductible for tax purposes). The remainder of the difference between pretax financial income and taxable income in each period is due to one depreciation temporary difference. No deferred income taxes existed at the beginning of 2020. Your answer is partially correct. Try again. Prepare journal entries to record income taxes in all 4 years. Assume that the change in the tax rate to 20% was not enacted until the beginning of 2021. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account tities and enter o for the amounts.) Date Account Titles and Explanation Debit Credit 2020 Income Tax Expense Deferred Tax Liability Income Tax Payable 2021 TDeferred Tax Liability Date Account Titles and Explanation Debit Credit 2020 Income Tax Expense Deferred Tax Liability Tincome Tax Payable 2021 Deferred Tax Liability Income Tax Expense (To record the adjustment for the decrease in the enacted tax rate.) Income Tax Expense TDeferred Tax Liability Income Tax Payable (To record income taxes for 2021.) 2027 Income Tax Expense Deferred Tax Liability Income Tax Payable vable 2021 Deferred Tax Liability Tincome Tax Expense (To record the adjustment for the decrease in the enacted tax rate.) Income Tax Expense Deferred Tax Liability Income Tax Payable (To record income taxes for 2021.) 2022 Income Tax Expense TDeferred Tax Liability Income Tax Payable 2023 Income Tax Expense 2023 Indon Deferred Tax Liability Income Tax Payable Your answer is partially correct. Try again. Prepare the income statement for 2021, beginning with income before income taxes. (Enter negative amounts using either a negative sign preceding the number e.g.-45 or parentheses e.g. (45).) Swifty Company Income Statement (Partial) T For the Year Ended December 31, 2021 Income before Income Taxes Income Tax Expense . Deferred T Adjustment T Current T Net Income / (Loss) Click If you would like to Show Work for this question: Open Show Work