Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The previous problem asked for the price to Johnson at a market rate of 9% and reads as follows. The Johnson S&L originated a pool

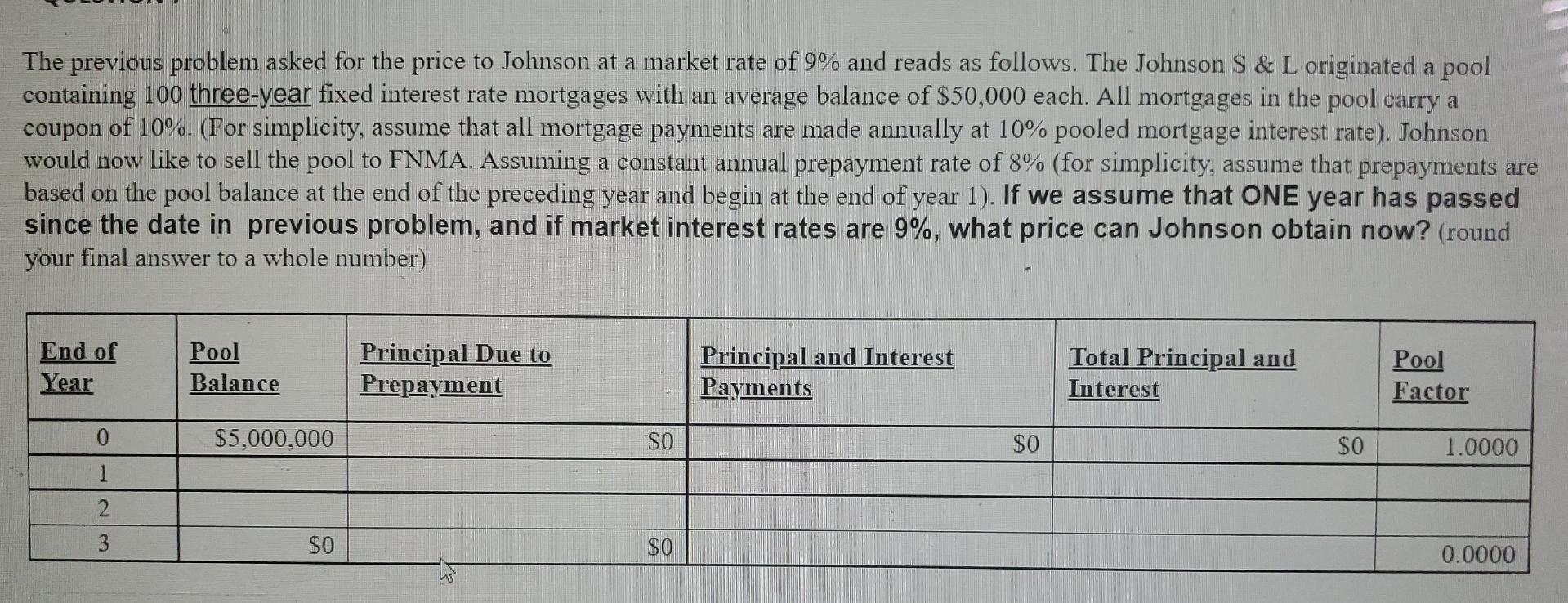

The previous problem asked for the price to Johnson at a market rate of 9% and reads as follows. The Johnson S&L originated a pool containing 100 three-year fixed interest rate mortgages with an average balance of $50,000 each. All mortgages in the pool carry a coupon of 10%. (For simplicity, assume that all mortgage payments are made annually at 10% pooled mortgage interest rate). Johnson would now like to sell the pool to FNMA. Assuming a constant annual prepayment rate of 8% (for simplicity, assume that prepayments are based on the pool balance at the end of the preceding year and begin at the end of year 1). If we assume that ONE year has passed since the date in previous problem, and if market interest rates are 9%, what price can Johnson obtain now? (round your final answer to a whole number) End of Year Pool Balance Principal Due to Prepayment Principal and Interest Payments Total Principal and Interest Pool Factor 0 $5,000,000 SO $0 SO 1.0000 1 2 3 $0 SO 0.0000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started