Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The price of a stock is currently $40. Over each of the next two six-month periods, the stock is expected to go up by

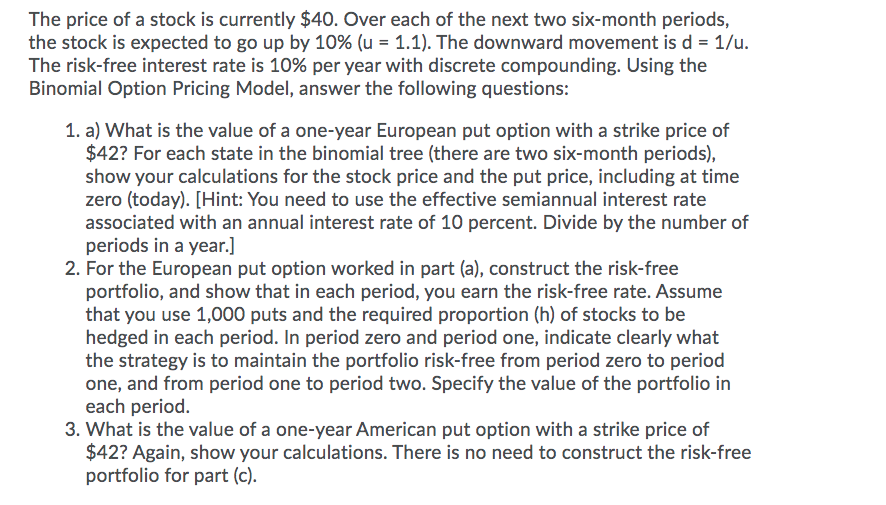

The price of a stock is currently $40. Over each of the next two six-month periods, the stock is expected to go up by 10% (u = 1.1). The downward movement is d = 1/u. The risk-free interest rate is 10% per year with discrete compounding. Using the Binomial Option Pricing Model, answer the following questions: 1. a) What is the value of a one-year European put option with a strike price of $42? For each state in the binomial tree (there are two six-month periods), show your calculations for the stock price and the put price, including at time zero (today). [Hint: You need to use the effective semiannual interest rate associated with an annual interest rate of 10 percent. Divide by the number of periods in a year.] 2. For the European put option worked in part (a), construct the risk-free portfolio, and show that in each period, you earn the risk-free rate. Assume that you use 1,000 puts and the required proportion (h) of stocks to be hedged in each period. In period zero and period one, indicate clearly what the strategy is to maintain the portfolio risk-free from period zero to period one, and from period one to period two. Specify the value of the portfolio in each period. 3. What is the value of a one-year American put option with a strike price of $42? Again, show your calculations. There is no need to construct the risk-free portfolio for part (c).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve the problem we can use the following steps 1 Calculate the stock price and put price for each state in the binomial tree a Stock price calculation At time zero the stock price is 40 Over each ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started