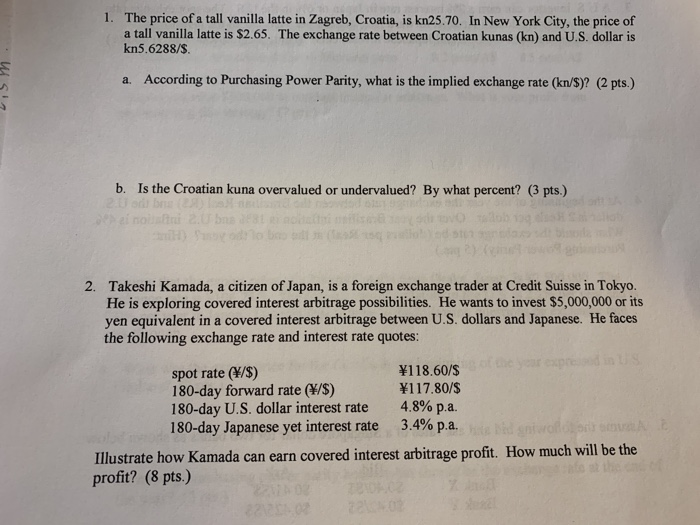

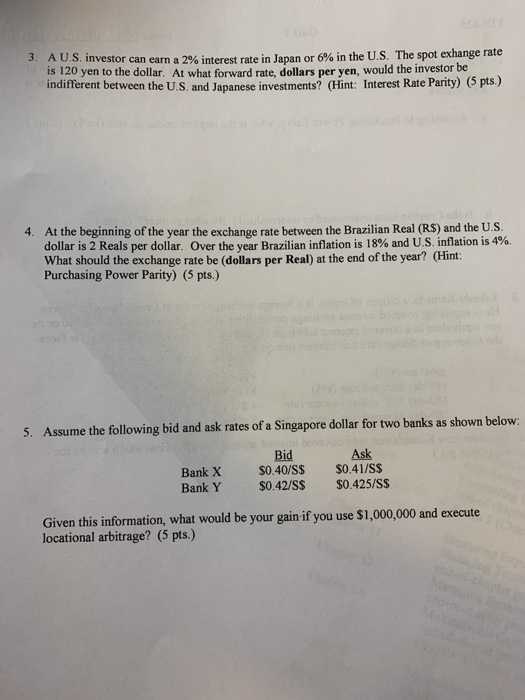

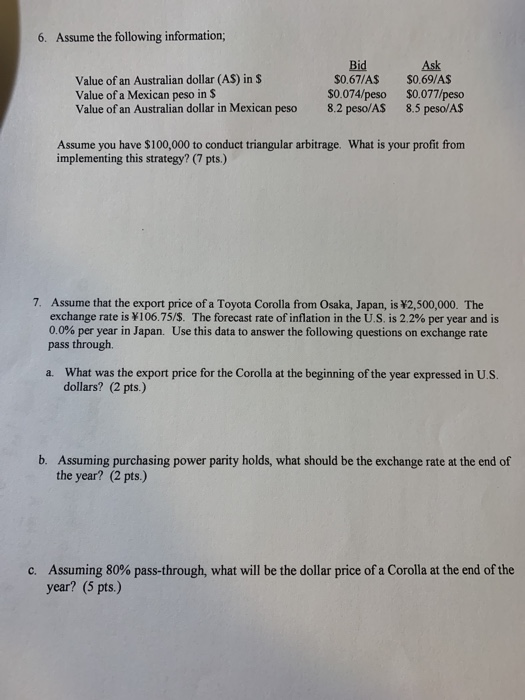

The price of a tall vanilla latte in Zagreb, Croatia, is kn25.70. In New York City, the price of a tall vanilla latte is $2.65. The exchange rate between Croatian kunas (kn) and U.S. dollar is kn5.6288/S 1. a. According to Purchasing Power Parity, what is the implied exchange rate (kn/S)? (2 pts.) b. Is the Croatian kuna overvalued or undervalued? By what percent? (3 pts.) Takeshi Kamada, a citizen of Japan, is a foreign exchange trader at Credit Suisse in Tokyo. He is exploring covered interest arbitrage possibilities. He wants to invest $5,000,000 or its yen equivalent in a covered interest arbitrage between U.S. dollars and Japanese. He faces the following exchange rate and interest rate quotes: 2. spot rate (/S) 180-day forward rate (/s) 180-day U.S. dollar interest rate 180-day Japanese yet interest rate 118.60$ 117.80/$ 4.8% pa. 3.4% pa. Illustrate how Kamada can earn covered interest arbitrage profit. How much will be the profit? (8 pts.) AUS investor can earn a 2% interest rate in Japan or 6% in the US is 120 yen to the dollar. At what forward rate, dollars per yen, would the investor be 3. The spot exhange rate indifferent between the U.S. and Japanese investments? (Hint: Interest Rate Parity) (5 pts.) 4. At the beginning of the year the exchange rate between the Brazilian Real (RS) and the U.S. dollar is 2 Reals per dollar. Over the year Brazilian inflation is 18% and US inflation is 4%. What should the exchange rate be (dollars per Real) at the end of the year? (Hint: Purchasing Power Parity) (5 pts.) Assume the following bid and ask rates of a Singapore dollar for two banks as shown below: Bid Bank X $0.40/SS $0.41/SS Bank Y$0.42/SS $0.425/SS 5. Ask Given this information, what would be your gain if you use $1,000,000 and execute locational arbitrage? (5 pts.) 6. Assume the following information; Bid $0.67/AS S0.69/AS Ask Value of an Australian dollar (AS) in$ Value of a Mexican peso in $ S0.074/peso $0.077/peso 8.5 peso/AS Value of an Australian dollar in Mexican peso 8.2 peso/AS Assume you have $100,000 to conduct triangular arbitrage. What is your profit from implementing this strategy? (7 pts.) 7. Assume that the export price of a Toyota Corolla from Osaka, Japan, is 2,500,000. The exchange rate is 106.75/$. The forecast rate of inflation in the US. is 2.2% per year and is 0.0% per year in Japan. Use this data to answer the following questions on exchange rate pass through. a. What was the export price for the Corolla at the beginning of the year expressed in U.S. dollars? (2 pts.) b. Assuming purchasing power parity holds, what should be the exchange rate at the end of the year? (2 pts.) Assuming 80% pass-through, what will be the dollar price of a Corolla at the end of the year? (5 pts.) C