Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The price of the apartment is $50,000. 20% of down payment has to be done and the mortgage amount will become $40,000. If we calculate

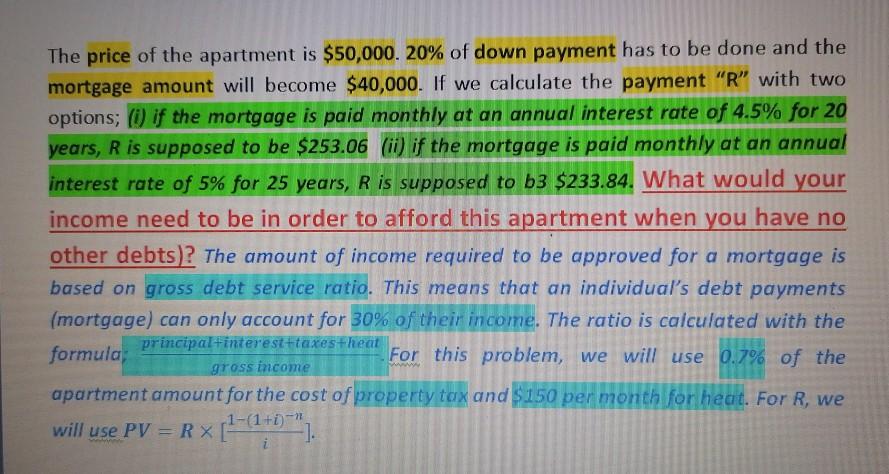

The price of the apartment is $50,000. 20% of down payment has to be done and the mortgage amount will become $40,000. If we calculate the payment "R" with two options; (i) if the mortgage is paid monthly at an annual interest rate of 4.5% for 20 years, R is supposed to be $253.06 (ii) if the mortgage is paid monthly at an annual interest rate of 5% for 25 years, R is supposed to b3 $233.84. What would your income need to be in order to afford this apartment when you have no other debts)? The amount of income required to be approved for a mortgage is based on gross debt service ratio. This means that an individual's debt payments (mortgage) can only account for 30% of their income. The ratio is calculated with the principal interest taxestheat formula, For this problem, we will use 0.7% of the gross income apartment amount for the cost of property tax and $150 per month for heat. For R, we will use PV = RX [-(1+0)*")

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started