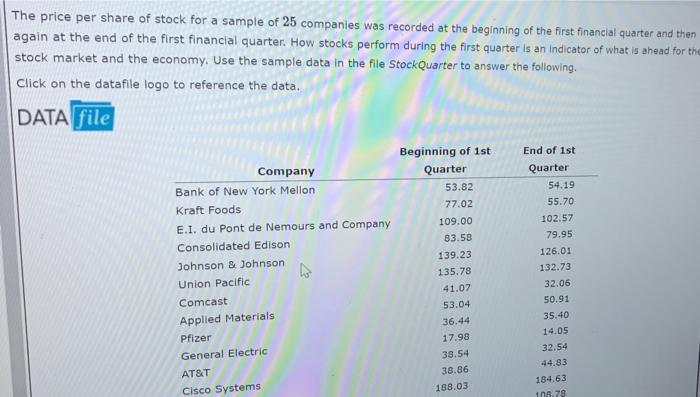

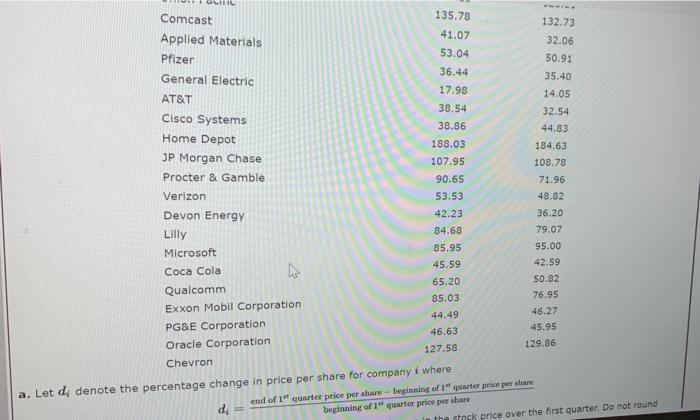

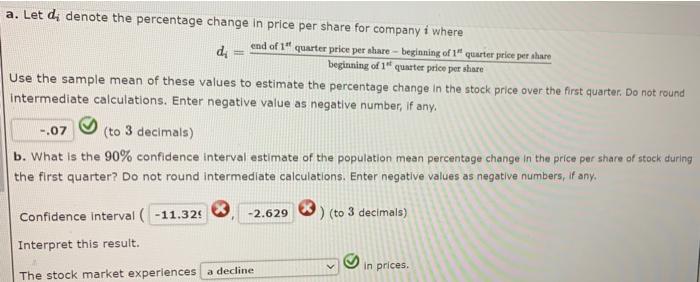

The price per share of stock for a sample of 25 companies was recorded at the beginning of the first financial quarter and then again at the end of the first financial quarter. How stocks perform during the first quarter is an indicator of what is ahead for the stock market and the economy. Use the sample data in the file StockQuarter to answer the following. Click on the datafile logo to reference the data. DATA file Beginning of 1st End of 1st Company Quarter Quarter Bank of New York Mellon 53.82 54.19 Kraft Foods 77.02 55.70 E.I. du Pont de Nemours and Company 109.00 102.57 Consolidated Edison 83.58 79.95 Johnson & Johnson 139.23 Union Pacific 135.78 41.07 Comcast 53.04 Applied Materials 36.44 Pfizer 17.98 General Electric 38.54 AT&T 38.86 Cisco Systems 188.03 126.01 132.73 32.06 50.91 35.40 14.05 32.54 44.83 184.63 108.79 Comcast 135.78 132.73 Applied Materials 41.07 32.06 Pfizer 53.04 50.91 General Electric 36.44 35.40 17.98 AT&T 14.05 38.54 32.54 Cisco Systems 38.86 44.83 Home Depot 188.03 184.63 JP Morgan Chase 107.95 108.78 Procter & Gamble 90.65 71.96 Verizon 53.53 48.82 Devon Energy 42.23 36:20 Lilly 84.68 79.07 Microsoft 85.95 95.00 45.59 42.59 Coca Cola 65.20 50.82 Qualcomm 85.03 76.95 Exxon Mobil Corporation 44.49 46.27 PG&E Corporation 46.63 45.95 Oracle Corporation 127.58 129.86 Chevron a. Let d, denote the percentage change in price per share for company i where end of 1" quarter price per share-beginning of 1" quarter price per share di = beginning of 1" quarter price per share the stock price over the first quarter. Do not round a. Let d, denote the percentage change in price per share for company i where di end of 1" quarter price per share - beginning of 1" quarter price per share beginning of 1" quarter price per share Use the sample mean of these values to estimate the percentage change in the stock price over the first quarter. Do not round intermediate calculations. Enter negative value as negative number, if any. -.07 (to 3 decimals) b. What is the 90% confidence interval estimate of the population mean percentage change in the price per share of stock during the first quarter? Do not round intermediate calculations. Enter negative values as negative numbers, if any. Confidence interval ( -11.324 -2.629 ) (to 3 decimals) Interpret this result. in prices. The stock market experiences a decline