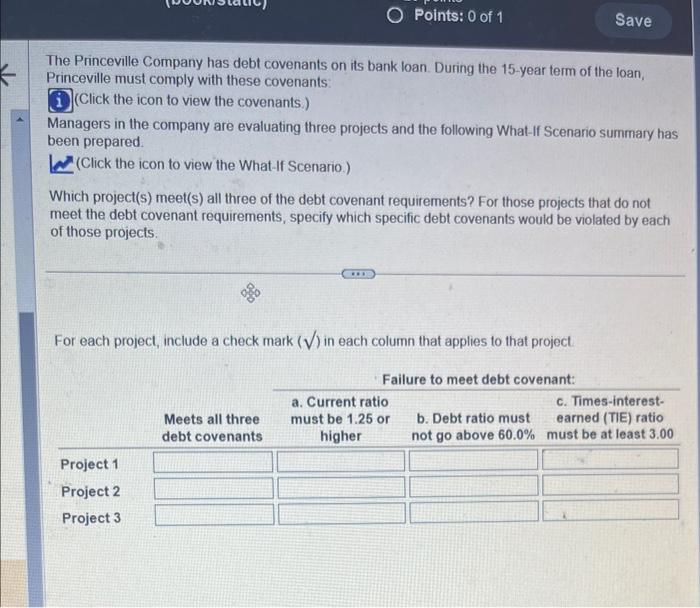

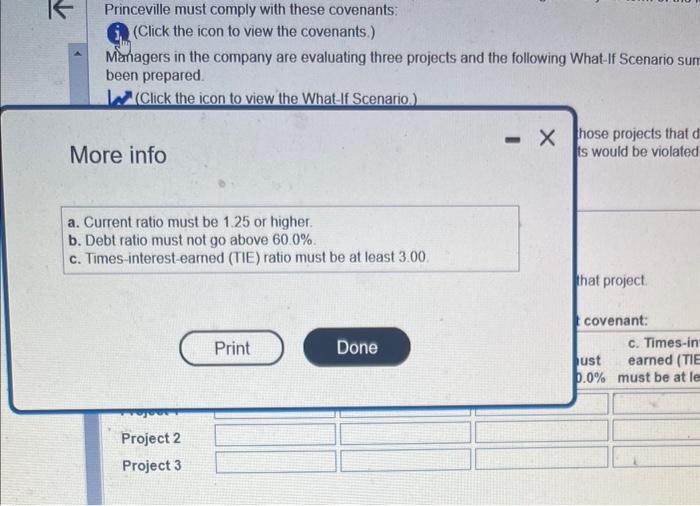

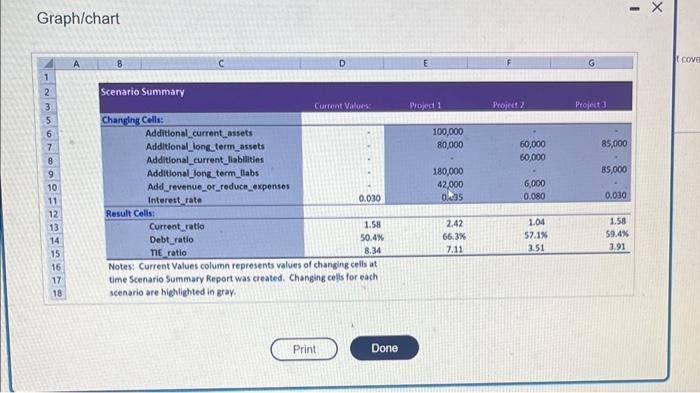

The Princeville Company has debt covenants on its bank loan. During the 15-year term of the loan, Princeville must comply with these covenants: i) (Click the icon to view the covenants.) Managers in the company are evaluating three projects and the following What-If Scenario summary has been prepared. (Click the icon to view the What-If Scenario.) Which project(s) meet(s) all three of the debt covenant requirements? For those projects that do not meet the debt covenant requirements, specify which specific debt covenants would be violated by each of those projects. For each project, include a check mark () in each column that applies to that project. Princeville must comply with these covenants: i. (Click the icon to view the covenants.) Mathagers in the company are evaluating three projects and the following What-If Scenario sun been prepared 1. (Click the icon to view the What-If Scenario.) hose projects that d More info is would be violated a. Current ratio must be 1.25 or higher. b. Debt ratio must not go above 60.0%. c. Times-interest-earned (TIE) ratio must be at least 3.00 . Graph/chart The Princeville Company has debt covenants on its bank loan. During the 15-year term of the loan, Princeville must comply with these covenants: i) (Click the icon to view the covenants.) Managers in the company are evaluating three projects and the following What-If Scenario summary has been prepared. (Click the icon to view the What-If Scenario.) Which project(s) meet(s) all three of the debt covenant requirements? For those projects that do not meet the debt covenant requirements, specify which specific debt covenants would be violated by each of those projects. For each project, include a check mark () in each column that applies to that project. Princeville must comply with these covenants: i. (Click the icon to view the covenants.) Mathagers in the company are evaluating three projects and the following What-If Scenario sun been prepared 1. (Click the icon to view the What-If Scenario.) hose projects that d More info is would be violated a. Current ratio must be 1.25 or higher. b. Debt ratio must not go above 60.0%. c. Times-interest-earned (TIE) ratio must be at least 3.00 . Graph/chart