Answered step by step

Verified Expert Solution

Question

1 Approved Answer

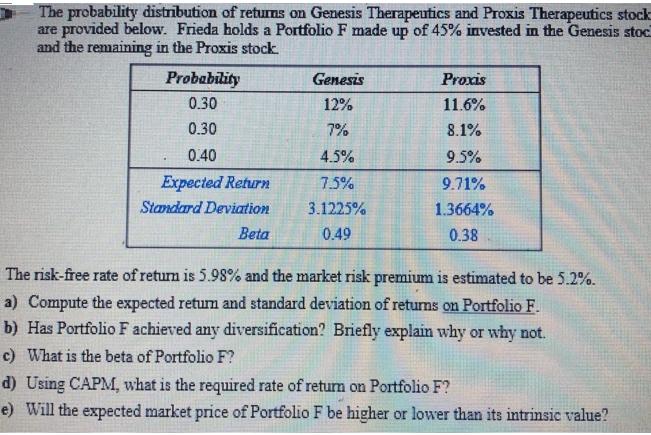

The probability distribution of retums on Genesis Therapeutics and Proxis Therapeutics stock are provided below. Frieda holds a Portfolio F made up of 45%

The probability distribution of retums on Genesis Therapeutics and Proxis Therapeutics stock are provided below. Frieda holds a Portfolio F made up of 45% invested in the Genesis stoc and the remaining in the Proxis stock Probability Genesis Proxis 0.30 12% 11.6% 0.30 7% 8.1% 0.40 4.5% 9.5% Expected Return 7.5% 9.71% Standard Deviation 3.1225% 1.3664% Beta 0.49 0.38 The risk-free rate of return is 5.98% and the market risk premium is estimated to be 5.2%. a) Compute the expected retum and standard deviation of returms on Portfolio F. b) Has Portfolio F achieved any diversification? Briefly explain why or why not. c) What is the beta of Portfolio F? d) Using CAPM, what is the required rate of retum on Portfolio F? e) Will the expected market price of Portfolio F be higher or lower than its intrinsic value?

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

A Expected return is Weighted Average WA of two ret...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started