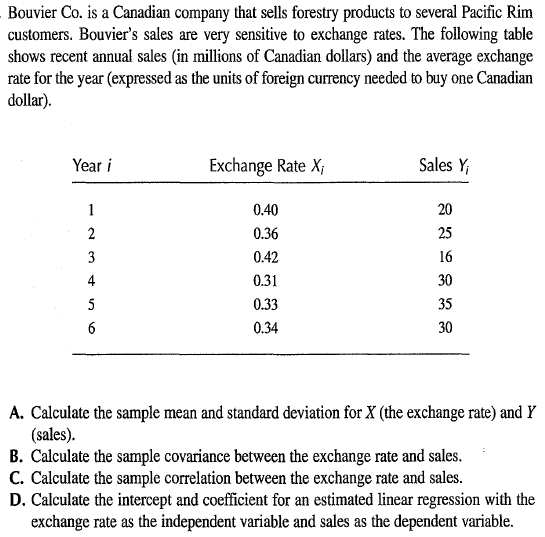

Question

The problem below presents the output from a linear regression model, and one implication of the regression output is that the bid-ask spread for NASDAQ-listed

The problem below presents the output from a linear regression model, and one implication of the regression output is that the bid-ask spread for NASDAQ-listed stocks declines by nearly one-half cent per share if the trading volume increases by 10%. Does it make sense that there should be a negative relationship between the bid-ask spread and trading volume? Does the magnitude of this estimated relationship (i.e., -$0.005 per share given a 10% increase in volume) seem reasonable to you? If not, would you expect the magnitude to be larger or smaller? Please explain your responses.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started