Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The problem is - Thomas company is considering two mutally exclusive projects. The firm, which has a cost of capital of 16% has estimated cash

The problem is -

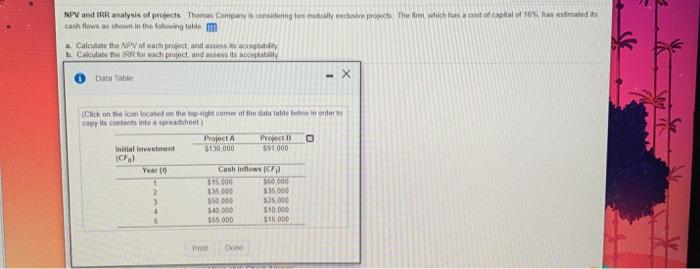

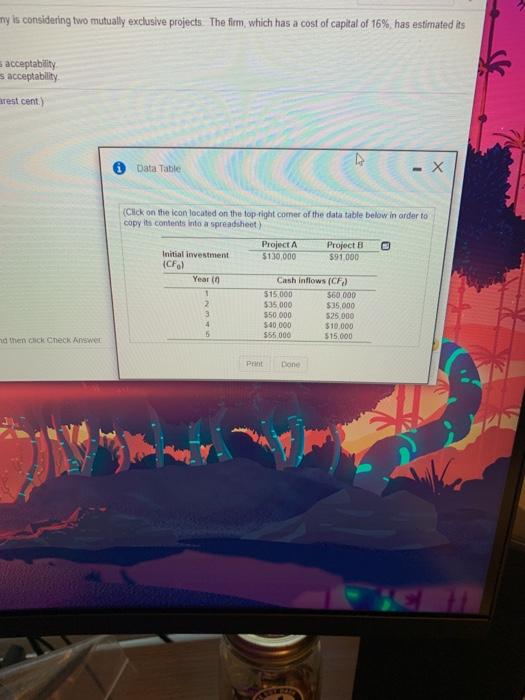

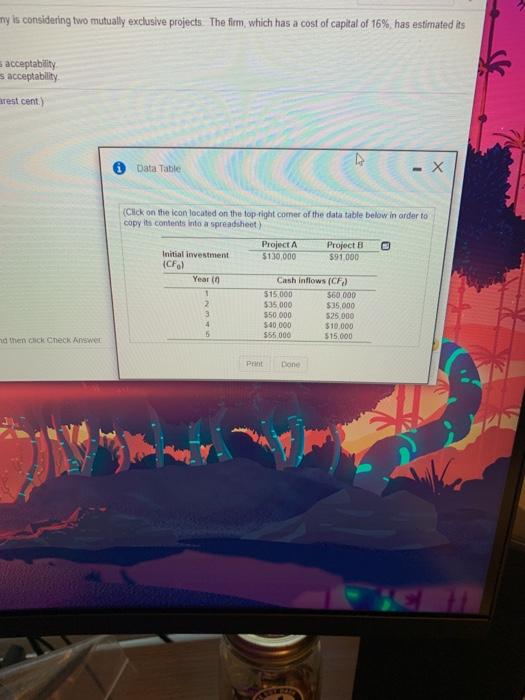

NPV and IRR analysis of projects The Company is comidering too muually exclusive projects. The firm which has a cost of capital of 16 has estimated its cash flow as shown in the following table a Calculate the NPV of each project and acceptably h. Calculate the IRR for each project and its aceptability Data Table - X (Click on the iconi located on the top right corner of the data fatte blew in order to copy its contents into a readsheet Project Project Initial investment 5130,000 591000 ICF Year Cash inflows 1 $15.000 000 2 395.000 3000 3 550.000 525.000 4 $40.000 510.000 355 000 516,000 P Done my is considering two mutually exclusive projects. The firm which has a cost of capital of 16%, has estimated its acceptability s acceptability arest cent) Data Table - X (Click on the icon located on the top right comer of the data table below in order to copy its contents into a spreadsheet Project A $130,000 Project $91000 Initial investment (CF) Year ( 1 2 Cash inflows (CF) 515000 560.000 $35.000 $35,000 550.000 525 000 $40.000 $10,000 555 000 $15.000 then click Check Awe Print Done Thomas company is considering two mutally exclusive projects. The firm, which has a cost of capital of 16% has estimated cash flows as shown in the following table.

a calculate the npv of each project

Calculate the IRR for each prject

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started