Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the problems 10-56 and 10-57 are one problem. the other problem is 10-63 Problems 10-56 and 10-57 (LO 10-3, 4) [The following information applies to

the problems 10-56 and 10-57 are one problem. the other problem is 10-63

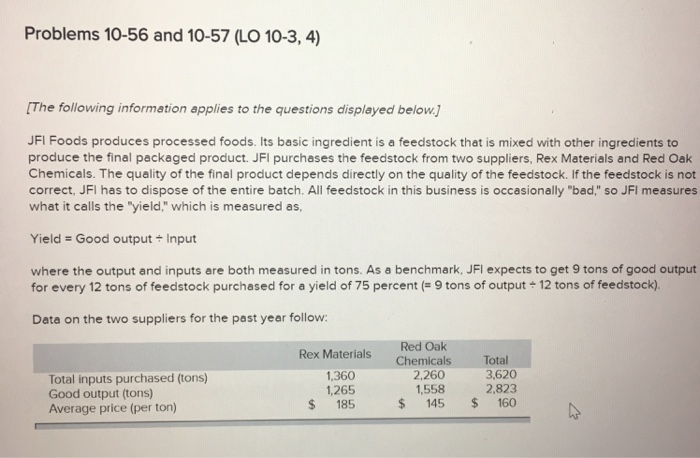

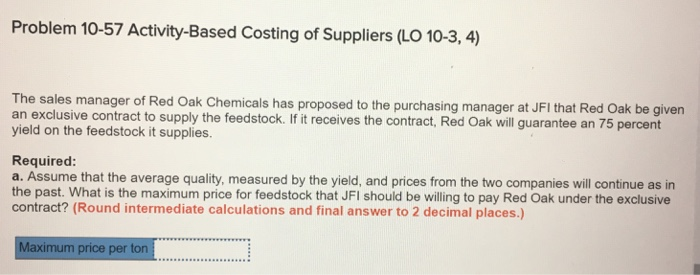

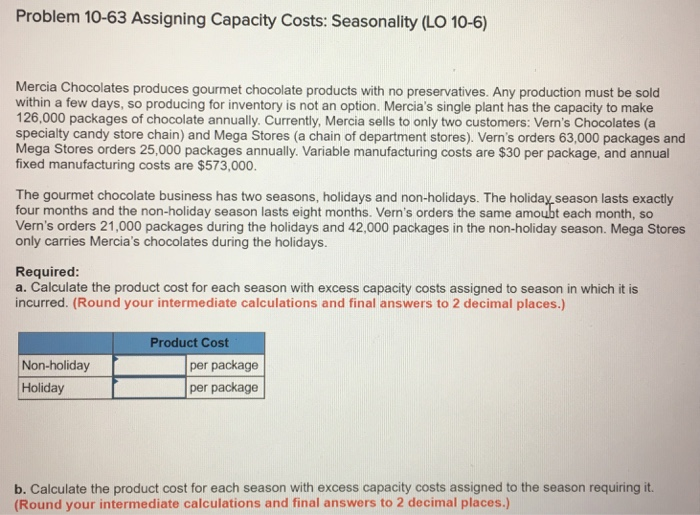

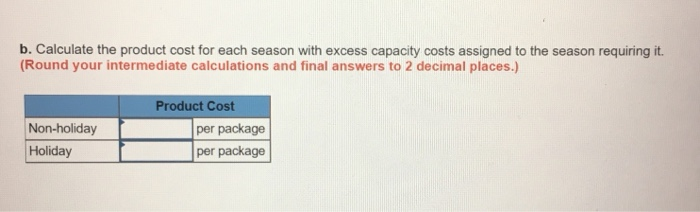

Problems 10-56 and 10-57 (LO 10-3, 4) [The following information applies to the questions displayed below JFI Foods produces processed foods. Its basic ingredient is a feedstock that is mixed with other ingredients to produce the final packaged product. JFI purchases the feedstock from two suppliers, Rex Materials and Red Oak Chemicals. The quality of the final product depends directly on the quality of the feedstock. If the feedstock is not correct, JFI has to dispose of the entire batch. All feedstock in this business is occasionally "bad," so JFI measures what it calls the "yield," which is measured as, Yield Good output Input where the output and inputs are both measured in tons. As a benchmark, JFl expects to get 9 tons of good output for every 12 tons of feedstock purchased for a yield of 75 percent (9 tons of output 12 tons of feedstock), Data on the two suppliers for the past year follow: Red Oak Rex Materials Chemicals 1,360 1,265 $ 185 Total 3,620 2,823 2,260 1,558 Total inputs purchased (tons) Good output (tons) Average price (per ton) $ 145 160 Problem 10-57 Activity-Based Costing of Suppliers (LO 10-3, 4) The sales manager of Red Oak Chemicals has proposed to the purchasing manager at JFI that Red Oak be given an exclusive contract to supply the feedstock. If it receives the contract, Red Oak will guarantee an 75 percent yield on the feedstock it supplies. Required a. Assume that the average quality, measured by the yield, and prices from the two companies will continue as in the past. What is the maximum price for feedstock that JFI should be willing to pay Red Oak under the exclusive contract? (Round intermediate calculations and final answer to 2 decimal places.) ximum price per ton Problem 10-63 Assigning Capacity Costs: Seasonality (LO 10-6) Mercia Chocolates produces gourmet chocolate products with no preservatives. Any production must be sold within a few days, so producing for inventory is not an option. Mercia's single plant has the capacity to make 126,000 packages of chocolate annually. Currently, Mercia sells to only two customers: Vern's Chocolates (a specialty candy store chain) and Mega Stores (a chain of department stores). Vern's orders 63,000 packages and Mega Stores orders 25,000 packages annually. Variable manufacturing costs are $30 per package, and annual fixed manufacturing costs are $573,000. The gourmet chocolate business has two seasons, holidays and non-holidays. The holiday.season lasts exactly four months and the non-holiday season lasts eight months. Vern's orders the same amoubt each month, so Vern's orders 21,000 packages during the holidays and 42,000 packages in the non-holiday season. Mega Stores only carries Mercia's chocolates during the holidays. Required: a. Calculate the product cost for each season with excess capacity costs assigned to season in which it is incurred. (Round your intermediate calculations and final answers to 2 decimal places.) Product Cost Non-holiday Holiday per package per package b. Calculate the product cost for each season with excess capacity costs assigned to the season requiring it. (Round your intermediate calculations and final answers to 2 decimal places.) b. Calculate the product cost for each season with excess capacity costs assigned to the season requiring it. Round your intermediate calculations and final answers to 2 decimal places.) Product Cost Non-holiday Holiday per package per package Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started