Question

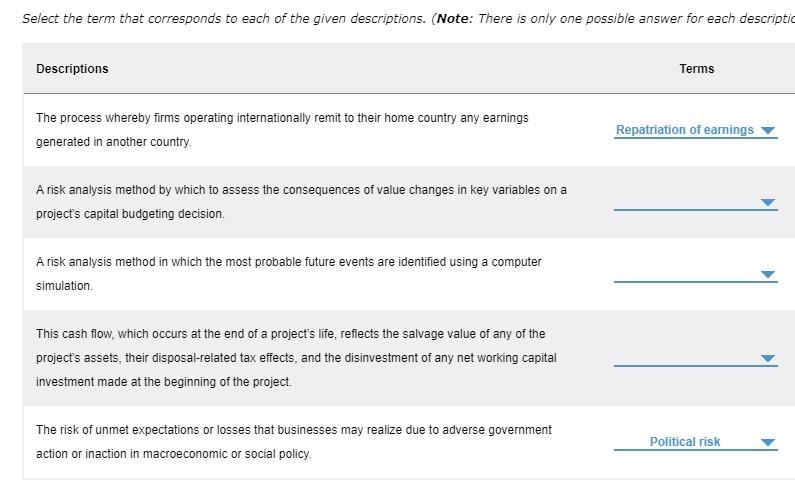

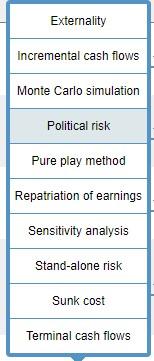

The process whereby firms operating internationally remit to their home country any earnings generated in another country. A risk analysis method by which to assess

The process whereby firms operating internationally remit to their home country any earnings generated in another country.

A risk analysis method by which to assess the consequences of value changes in key variables on a projects capital budgeting decision.

A risk analysis method in which the most probable future events are identified using a computer simulation

This cash flow, which occurs at the end of a projects life, reflects the salvage value of any of the projects assets, their disposal-related tax effects, and the disinvestment of any net working capital investment made at the beginning of the project.

The risk of unmet expectations or losses that businesses may realize due to adverse government action or inaction in macroeconomic or social policy.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started