Answered step by step

Verified Expert Solution

Question

1 Approved Answer

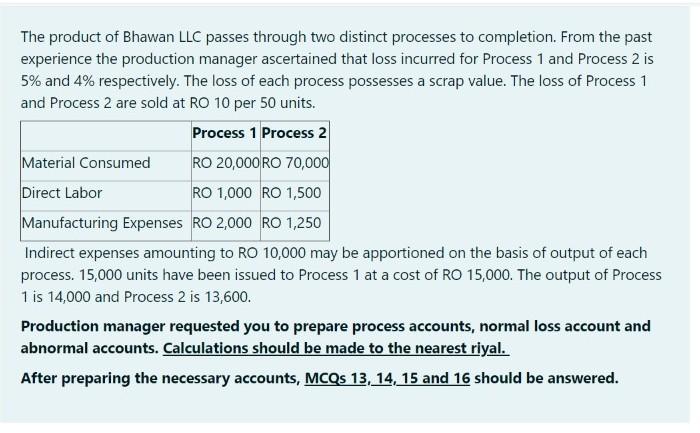

The product of Bhawan LLC passes through two distinct processes to completion. From the past experience the production manager ascertained that loss incurred for Process

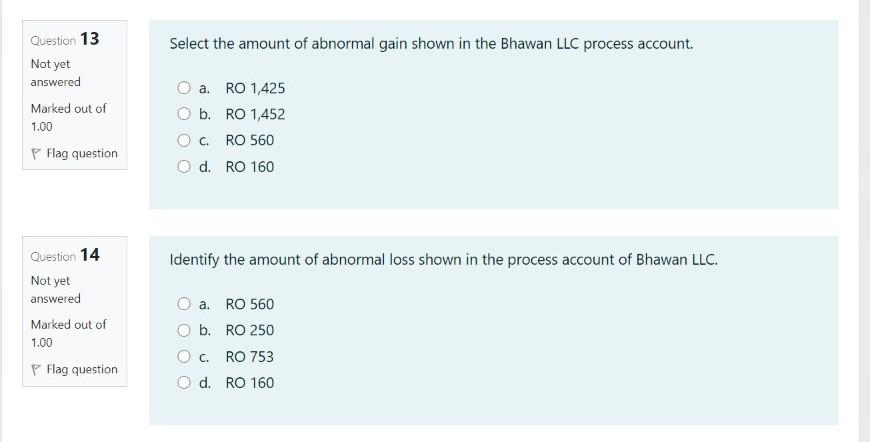

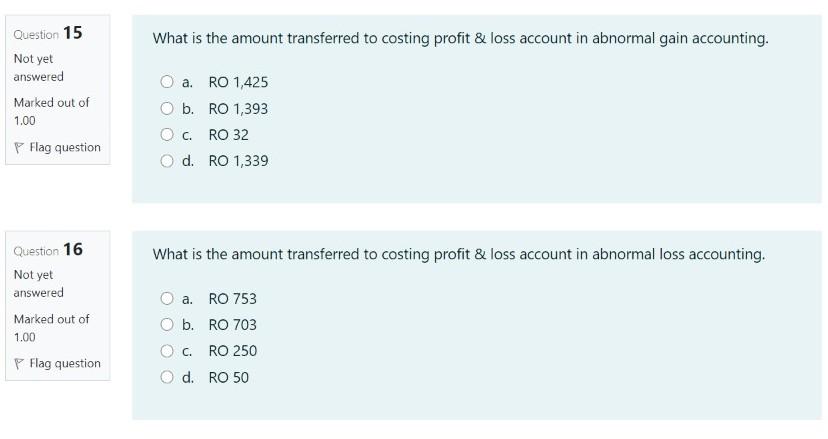

The product of Bhawan LLC passes through two distinct processes to completion. From the past experience the production manager ascertained that loss incurred for Process 1 and Process 2 is 5% and 4% respectively. The loss of each process possesses a scrap value. The loss of Process 1 and Process 2 are sold at RO 10 per 50 units. Process 1 Process 2 Material Consumed RO 20,000 RO 70,000 Direct Labor RO 1,000 RO 1,500 Manufacturing Expenses RO 2,000 RO 1,250 Indirect expenses amounting to RO 10,000 may be apportioned on the basis of output of each process. 15,000 units have been issued to Process 1 at a cost of RO 15,000. The output of Process 1 is 14,000 and Process 2 is 13,600. Production manager requested you to prepare process accounts, normal loss account and abnormal accounts. Calculations should be made to the nearest riyal. After preparing the necessary accounts, MCQs 13, 14, 15 and 16 should be answered. Select the amount of abnormal gain shown in the Bhawan LLC process account. Question 13 Not yet answered Marked out of 1.00 Flag question a. RO 1,425 O b. RO 1,452 RO 560 d. RO 160 Question 14 Identify the amount of abnormal loss shown in the process account of Bhawan LLC. Not yet answered Marked out of 1.00 Flag question O a RO 560 O b.RO 250 RO 753 d. RO 160 Question 15 What is the amount transferred to costing profit & loss account in abnormal gain accounting. Not yet answered Marked out of 1.00 P Flag question O a. RO 1,425 O b. RO 1,393 O c. RO 32 d. RO 1,339 Question 16 What is the amount transferred to costing profit & loss account in abnormal loss accounting. Not yet answered Marked out of 1.00 Flag question O a. RO 753 O b. RO 703 RO 250 d. RO 50 O c

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started