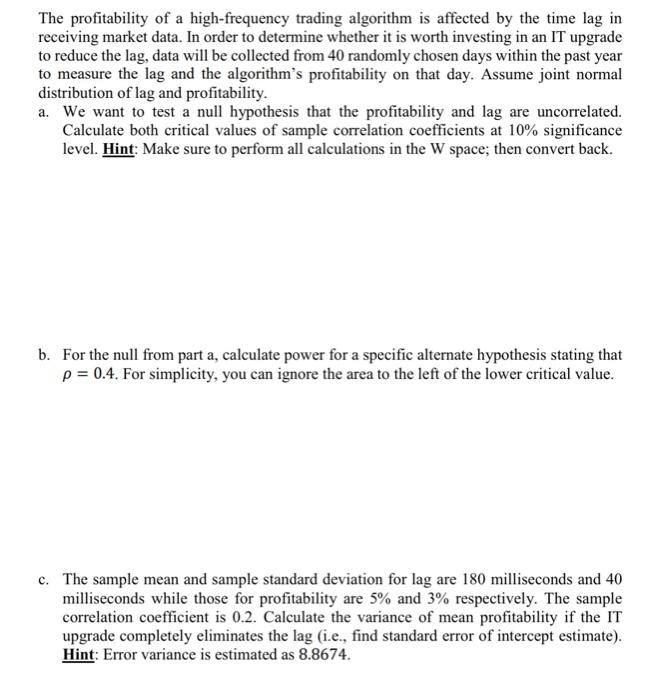

The profitability of a high-frequency trading algorithm is affected by the time lag in receiving market data. In order to determine whether it is worth investing in an IT upgrade to reduce the lag, data will be collected from 40 randomly chosen days within the past year to measure the lag and the algorithm's profitability on that day. Assume joint normal distribution of lag and profitability. a. We want to test a null hypothesis that the profitability and lag are uncorrelated. Calculate both critical values of sample correlation coefficients at 10% significance level. Hint: Make sure to perform all calculations in the W space; then convert back. b. For the null from part a, calculate power for a specific alternate hypothesis stating that p = 0.4. For simplicity, you can ignore the area to the left of the lower critical value. c. The sample mean and sample standard deviation for lag are 180 milliseconds and 40 milliseconds while those for profitability are 5% and 3% respectively. The sample correlation coefficient is 0.2. Calculate the variance of mean profitability if the IT upgrade completely eliminates the lag (i.e., find standard error of intercept estimate). Hint: Error variance is estimated as 8.8674. The profitability of a high-frequency trading algorithm is affected by the time lag in receiving market data. In order to determine whether it is worth investing in an IT upgrade to reduce the lag, data will be collected from 40 randomly chosen days within the past year to measure the lag and the algorithm's profitability on that day. Assume joint normal distribution of lag and profitability. a. We want to test a null hypothesis that the profitability and lag are uncorrelated. Calculate both critical values of sample correlation coefficients at 10% significance level. Hint: Make sure to perform all calculations in the W space; then convert back. b. For the null from part a, calculate power for a specific alternate hypothesis stating that p = 0.4. For simplicity, you can ignore the area to the left of the lower critical value. c. The sample mean and sample standard deviation for lag are 180 milliseconds and 40 milliseconds while those for profitability are 5% and 3% respectively. The sample correlation coefficient is 0.2. Calculate the variance of mean profitability if the IT upgrade completely eliminates the lag (i.e., find standard error of intercept estimate). Hint: Error variance is estimated as 8.8674