Answered step by step

Verified Expert Solution

Question

1 Approved Answer

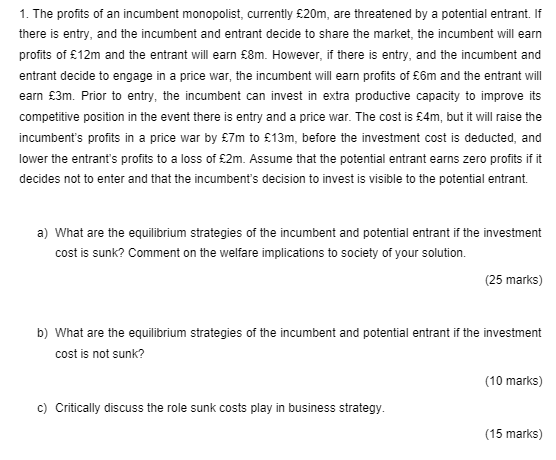

The profits of an incumbent monopolist, currently 2 0 m , are threatened by a potential entrant. If there is entry, and the incumbent and

The profits of an incumbent monopolist, currently are threatened by a potential entrant. If

there is entry, and the incumbent and entrant decide to share the market, the incumbent will earn

profits of and the entrant will earn However, if there is entry, and the incumbent and

entrant decide to engage in a price war, the incumbent will earn profits of and the entrant will

earn Prior to entry, the incumbent can invest in extra productive capacity to improve its

competitive position in the event there is entry and a price war. The cost is but it will raise the

incumbent's profits in a price war by to before the investment cost is deducted, and

lower the entrant's profits to a loss of Assume that the potential entrant earns zero profits if it

decides not to enter and that the incumbent's decision to invest is visible to the potential entrant.

a What are the equilibrium strategies of the incumbent and potential entrant if the investment

cost is sunk? Comment on the welfare implications to society of your solution.

marks

b What are the equilibrium strategies of the incumbent and potential entrant if the investment

cost is not sunk?

marks

c Critically discuss the role sunk costs play in business strategy.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started