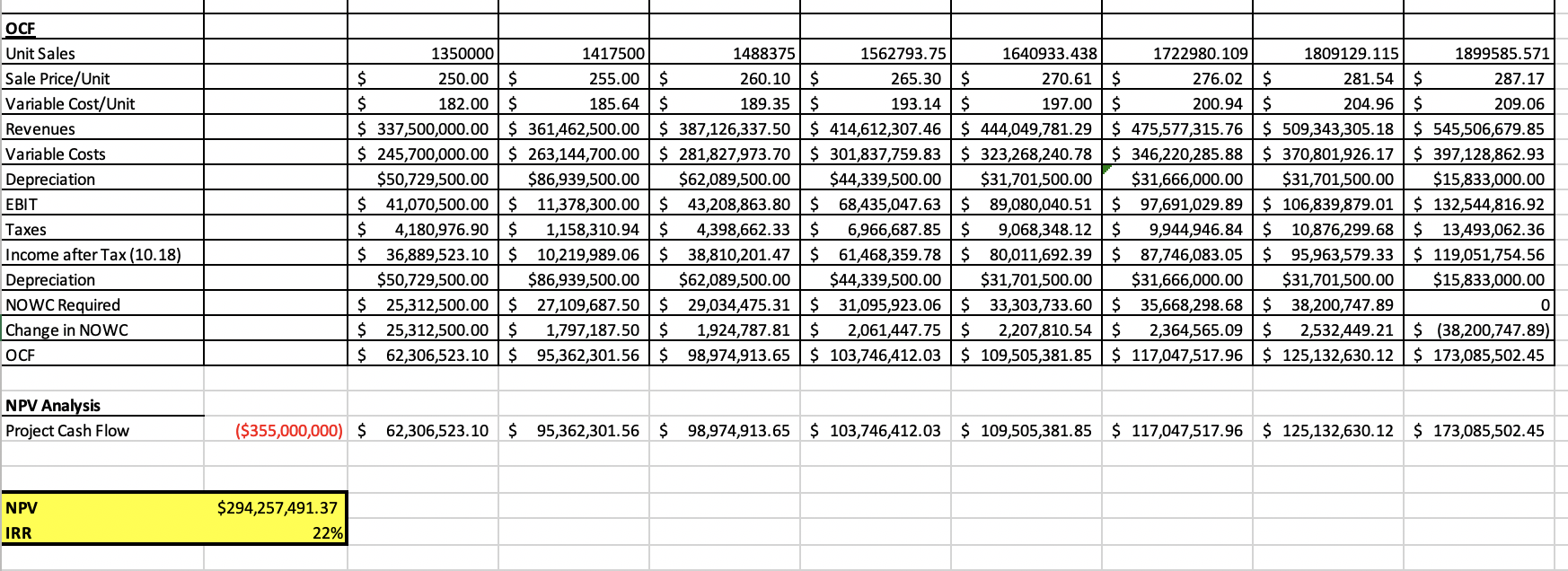

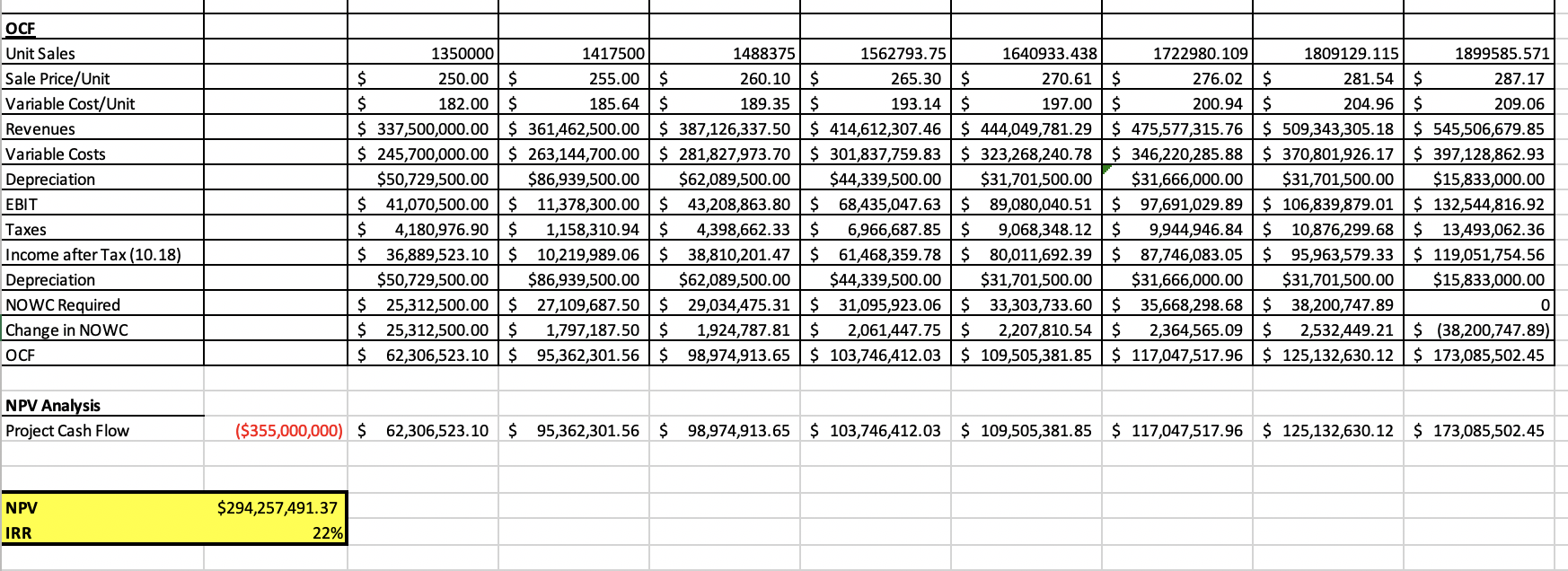

The project has 8 years life, initial investment of $330 million to purchase equipment, and $25 million for shipping & installation fee. 7-year MACRS class. The number of units of the new product expected to be sold in the first year is 1,350,000 and the expected annual growth rate is 5%. The sales price is $250 per unit and the variable cost is $182 per unit in the first year, but they should be adjusted accordingly based on the estimated annualized inflation rate of 2%. The required net operating working capital (NOWC) is 7.5%. Perform a sensitivity analysis for the effects of key variables (e.g., sales growth rate, cost of capital, unit costs, sales price) on the estimated NPV or IRR in order to demonstrate the sensitivity of the model.

$ $ $ $ OCF Unit Sales Sale Price/Unit Variable Cost/Unit Revenues Variable Costs Depreciation EBIT Taxes Income after Tax (10.18) Depreciation NOWC Required Change in NOWC OCF 1350000 1417500 1488375 1562793.75 1640933.438 1722980.109 1809129.115 1899585.571 $ 250.00 255.00 260.10 $ 265.30 270.61$ 276.02 281.54 $ 287.17 182.00 $ 185.64 $ 189.35 193.14 $ 197.00 $ 200.94 $ 204.96 $ 209.06 $ 337,500,000.00 $ 361,462,500.00 $ 387,126,337.50 $ 414,612,307.46 $ 444,049,781.29 $ 475,577,315.76 $ 509,343,305.18 $ 545,506,679.85 $ 245,700,000.00 $ 263,144,700.00 $ 281,827,973.70 $ 301,837,759.83 $ 323,268,240.78 $ 346,220,285.88 $ 370,801,926.17 $ 397,128,862.93 $50,729,500.00 $86,939,500.00 $62,089,500.00 $44,339,500.00 $31,701,500.00 $31,666,000.00 $31,701,500.00 $15,833,000.00 $ 41,070,500.00 $ 11,378,300.00 $ 43,208,863.80 $ 68,435,047.63 $ 89,080,040.51 $ 97,691,029.89 $ 106,839,879.01 $ 132,544,816.92 4,180,976.90 $ 1,158,310.94 $ 4,398,662.33 $ 6,966,687.85$ 9,068,348.12 9,944,946.84 10,876,299.68 $ 13,493,062.36 $ 36,889,523.10 $ 10,219,989.06 $ 38,810,201.47 $ 61,468,359.78 $ 80,011,692.39 $ 87,746,083.05 $ 95,963,579.33 $ 119,051,754.56 $50,729,500.00 $86,939,500.00 $62,089,500.00 $44,339,500.00 $31,701,500.00 $31,666,000.00 $31,701,500.00 $15,833,000.00 $ 25,312,500.00 $ 27,109,687.50 $ 29,034,475.31 $ 31,095,923.06 $ 33,303,733.60 $ 35,668,298.68 $ 38,200,747.89 0 $ 25,312,500.00 $ 1,797,187.50 $ 1,924,787.81 $ 2,061,447.75 $ 2,207,810.54 $ 2,364,565.09 2,532,449.21 $ (38,200,747.89) $ 62,306,523.10 $ 95,362,301.56 $ 98,974,913.65 $ 103,746,412.03 $ 109,505,381.85 $ 117,047,517.96 $ 125,132,630.12 $ 173,085,502.45 $ $ $ NPV Analysis Project Cash Flow ($355,000,000) $ 62,306,523.10 $ 95,362,301.56 $ 98,974,913.65 $ 103,746,412.03 $ 109,505,381.85 $ 117,047,517.96 $ 125,132,630.12 $ 173,085,502.45 NPV $294,257,491.37 22% IRR $ $ $ $ OCF Unit Sales Sale Price/Unit Variable Cost/Unit Revenues Variable Costs Depreciation EBIT Taxes Income after Tax (10.18) Depreciation NOWC Required Change in NOWC OCF 1350000 1417500 1488375 1562793.75 1640933.438 1722980.109 1809129.115 1899585.571 $ 250.00 255.00 260.10 $ 265.30 270.61$ 276.02 281.54 $ 287.17 182.00 $ 185.64 $ 189.35 193.14 $ 197.00 $ 200.94 $ 204.96 $ 209.06 $ 337,500,000.00 $ 361,462,500.00 $ 387,126,337.50 $ 414,612,307.46 $ 444,049,781.29 $ 475,577,315.76 $ 509,343,305.18 $ 545,506,679.85 $ 245,700,000.00 $ 263,144,700.00 $ 281,827,973.70 $ 301,837,759.83 $ 323,268,240.78 $ 346,220,285.88 $ 370,801,926.17 $ 397,128,862.93 $50,729,500.00 $86,939,500.00 $62,089,500.00 $44,339,500.00 $31,701,500.00 $31,666,000.00 $31,701,500.00 $15,833,000.00 $ 41,070,500.00 $ 11,378,300.00 $ 43,208,863.80 $ 68,435,047.63 $ 89,080,040.51 $ 97,691,029.89 $ 106,839,879.01 $ 132,544,816.92 4,180,976.90 $ 1,158,310.94 $ 4,398,662.33 $ 6,966,687.85$ 9,068,348.12 9,944,946.84 10,876,299.68 $ 13,493,062.36 $ 36,889,523.10 $ 10,219,989.06 $ 38,810,201.47 $ 61,468,359.78 $ 80,011,692.39 $ 87,746,083.05 $ 95,963,579.33 $ 119,051,754.56 $50,729,500.00 $86,939,500.00 $62,089,500.00 $44,339,500.00 $31,701,500.00 $31,666,000.00 $31,701,500.00 $15,833,000.00 $ 25,312,500.00 $ 27,109,687.50 $ 29,034,475.31 $ 31,095,923.06 $ 33,303,733.60 $ 35,668,298.68 $ 38,200,747.89 0 $ 25,312,500.00 $ 1,797,187.50 $ 1,924,787.81 $ 2,061,447.75 $ 2,207,810.54 $ 2,364,565.09 2,532,449.21 $ (38,200,747.89) $ 62,306,523.10 $ 95,362,301.56 $ 98,974,913.65 $ 103,746,412.03 $ 109,505,381.85 $ 117,047,517.96 $ 125,132,630.12 $ 173,085,502.45 $ $ $ NPV Analysis Project Cash Flow ($355,000,000) $ 62,306,523.10 $ 95,362,301.56 $ 98,974,913.65 $ 103,746,412.03 $ 109,505,381.85 $ 117,047,517.96 $ 125,132,630.12 $ 173,085,502.45 NPV $294,257,491.37 22% IRR