Answered step by step

Verified Expert Solution

Question

1 Approved Answer

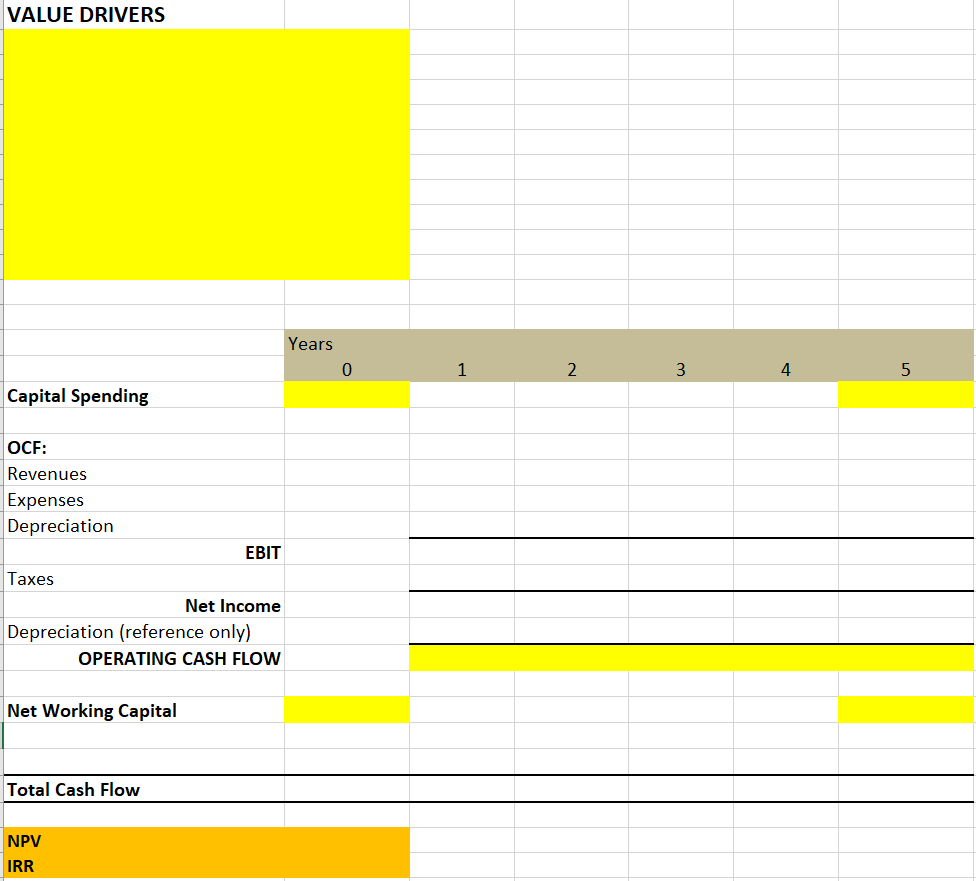

The project has a 5 year timeline. The company purchased the land in Mason that the factory would be built on for $10,000,000. The purchase

- The project has a 5 year timeline.

- The company purchased the land in Mason that the factory would be built on for $10,000,000. The purchase was made in 2007.

- The factory site will require $1,000,000 in infrastructure improvements should they decide to build the factory on that site.

- The company has performed Research and Development on the products that the factory would build over the past year in the amount of $500,000.

- The cost of building and equipping the factory is estimated at $28,000,000.

- The Marketing Department of the company has spent $250,000 over the past year to try to increase demand in the companys products.

- Both the factory and its equipment would be depreciated straight-line to $0 over their estimated 7-year useful life.

- A residential property developer has offered the company $10,000,000 for the site should they not decide to build the factory on it.

- If the company decides to build the factory, they will sell a factory that they own that has been closed for several years located Portland, MI. Mid-Michigan Manufacturing has made an offer to purchase the closed facility for $1,265,823. This transaction would take place immediately at the beginning of the project (Year 0).

- A competitor, Williamston Widgets, Inc., has told the company that they will buy the new factory and all of its equipment for $5,000,000 at the end of the project (the end of Year 5).

- Products produced by the factory will add an estimated $45,500,000 to the companys revenue in Year 1.

- Sales growth in Years 2 & 3 is expected to be 4.5% per year.

- As the market begins to become saturated, sales are expected to decline in Years 4 & 5 by 5% per year.

- Total Costs (Expenses) are estimated to be 76% of sales.

- Additional Net Working Capital will be required in Year 0 of $500,000, 30% of which will be recovered in the projects terminal year.

- The companys tax rate is 21%.

- The required rate of return on the project is 10.0%.

Part 1 Base Case:

Using the above data, complete the DCF Model in Excel. Compute the Base Cases NPV and IRR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started