Question

The project manager of a steel manufacturing factory in Hamilton puts forth a proposal to the senior management for the immediate purchase of a

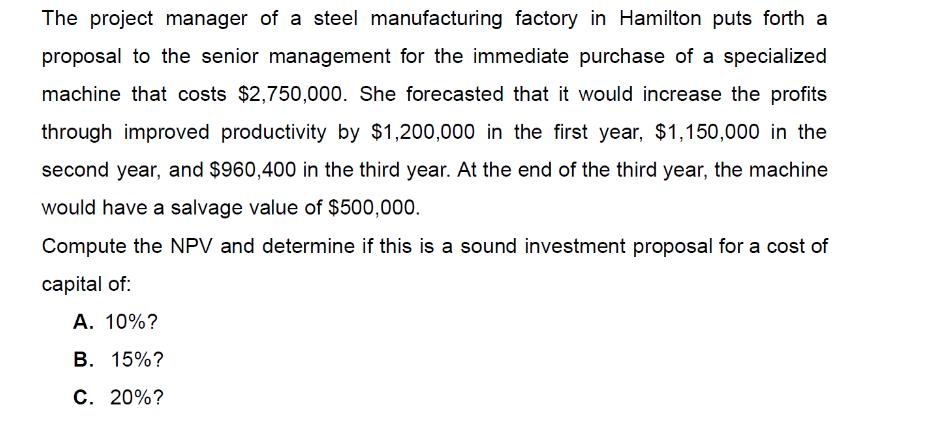

The project manager of a steel manufacturing factory in Hamilton puts forth a proposal to the senior management for the immediate purchase of a specialized machine that costs $2,750,000. She forecasted that it would increase the profits through improved productivity by $1,200,000 in the first year, $1,150,000 in the second year, and $960,400 in the third year. At the end of the third year, the machine would have a salvage value of $500,000. Compute the NPV and determine if this is a sound investment proposal for a cost of capital of: A. 10%? B. 15%? C. 20%?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Operations Management

Authors: William J Stevenson

12th edition

2900078024107, 78024102, 978-0078024108

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App