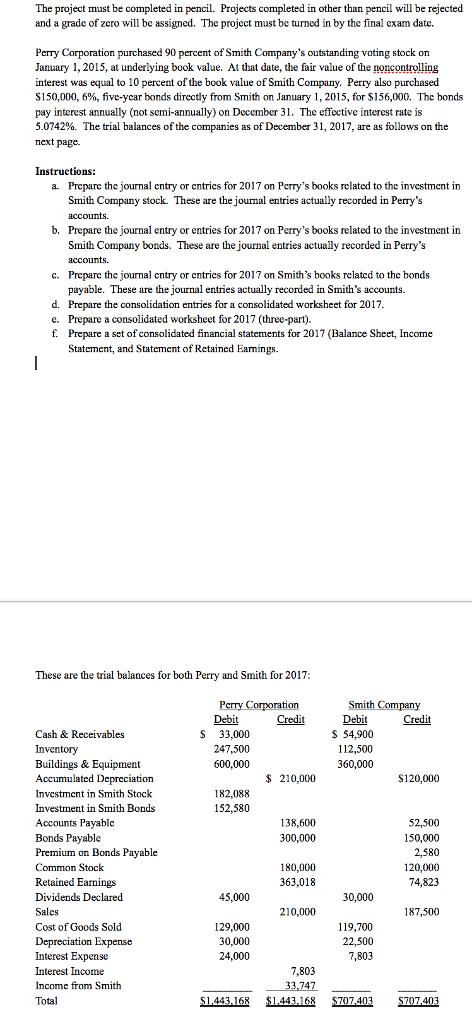

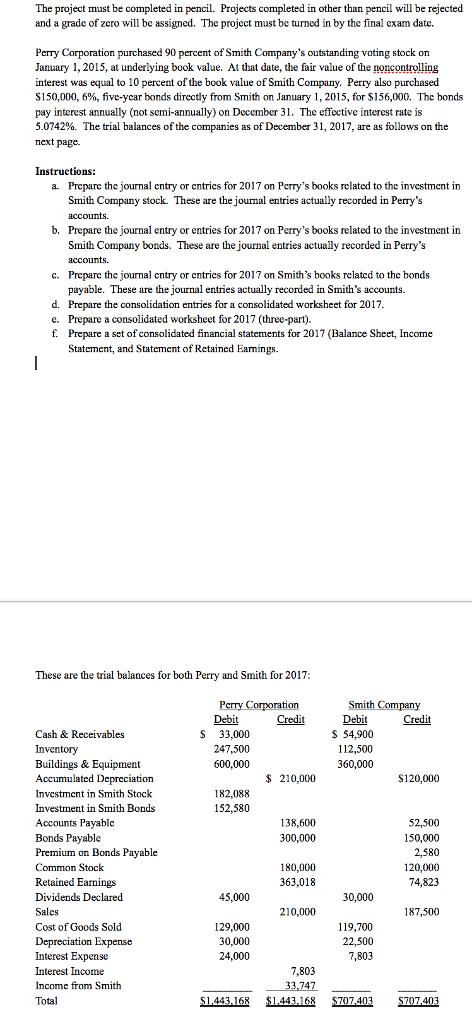

The project must be completed in pencil. Projects completed in other than pencil will be rejected and a grade of zero will be assigned. The project must be turned in by the final exam date. Perry Corporation purchased 90 percent of Smith Company's outstanding voting stock on January 1, 2015, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 10 percent of the book value of Smith Company. Perry also purchased $1 50,000, 6%, five-year bonds directly from Smith on January 1 , 2015, for $156,000. The bonds pay interest annually (not semi-annually) on December 31. The effective interest rate is 5.0742%. The trial balances of the companies as of December 31, 2017, are as follows on the Instructions: Prepare the journal cntry or cntrics for 2017 on Perry's books related to the investment in Smith Company stock. These are the journal entries actually recorded in Perry's a. b. Prepare the journal entry or entries for 2017 on Perry's books related to the investment in Smith Company bonds. These are the journal entries actually recorded in Perry's Prcpare the journal cntry or cntrics for 2017 on Smith's books related to the bonds payable. These are the journal entries actually recorded in Smith's accounts. c. d. Prepare the consolidation entries for a consolidated worksheet for 2017 e. Prepare a consolidated worksheet for 2017 (three-part). f. Prepare a set of consolidated financial statements for 2017 (Balance Sheet, Income Statement, and Statement of Retained Earning These are the trial balances for both Perry and Smith for 2017 Pcrry Corporation Smith Company Creds 54,900 S 33,000 Cash&Receivables Inventory Buildings & Equipment Accumulated Depreciation Investment in Smith Stock Investment in Smnith Bonds Accounts Payablc Bonds Payable Premium on Bonds Payable Common Stock Retained Earnings Dividends Declared 600,000 $ 210,000 S120,000 182,088 152,580 138,600 300,000 52,500 150,000 2,580 120,000 74,823 363,018 45,000 30,000 210,000 187,500 Cost of Goods Sold Depreciation Expense Interest Expense Interest Income Income from Smith 129,000 30,000 24,000 19,700 22,500 7,803 7,803 443,168 07,403 The project must be completed in pencil. Projects completed in other than pencil will be rejected and a grade of zero will be assigned. The project must be turned in by the final exam date. Perry Corporation purchased 90 percent of Smith Company's outstanding voting stock on January 1, 2015, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 10 percent of the book value of Smith Company. Perry also purchased $1 50,000, 6%, five-year bonds directly from Smith on January 1 , 2015, for $156,000. The bonds pay interest annually (not semi-annually) on December 31. The effective interest rate is 5.0742%. The trial balances of the companies as of December 31, 2017, are as follows on the Instructions: Prepare the journal cntry or cntrics for 2017 on Perry's books related to the investment in Smith Company stock. These are the journal entries actually recorded in Perry's a. b. Prepare the journal entry or entries for 2017 on Perry's books related to the investment in Smith Company bonds. These are the journal entries actually recorded in Perry's Prcpare the journal cntry or cntrics for 2017 on Smith's books related to the bonds payable. These are the journal entries actually recorded in Smith's accounts. c. d. Prepare the consolidation entries for a consolidated worksheet for 2017 e. Prepare a consolidated worksheet for 2017 (three-part). f. Prepare a set of consolidated financial statements for 2017 (Balance Sheet, Income Statement, and Statement of Retained Earning These are the trial balances for both Perry and Smith for 2017 Pcrry Corporation Smith Company Creds 54,900 S 33,000 Cash&Receivables Inventory Buildings & Equipment Accumulated Depreciation Investment in Smith Stock Investment in Smnith Bonds Accounts Payablc Bonds Payable Premium on Bonds Payable Common Stock Retained Earnings Dividends Declared 600,000 $ 210,000 S120,000 182,088 152,580 138,600 300,000 52,500 150,000 2,580 120,000 74,823 363,018 45,000 30,000 210,000 187,500 Cost of Goods Sold Depreciation Expense Interest Expense Interest Income Income from Smith 129,000 30,000 24,000 19,700 22,500 7,803 7,803 443,168 07,403