Question

The projected benefit obiligation and plan assets were $160 million and $200 million, respectively, at the beginning of the year. Due primarily to favorable

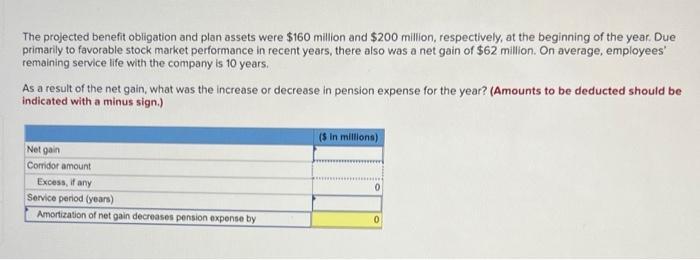

The projected benefit obiligation and plan assets were $160 million and $200 million, respectively, at the beginning of the year. Due primarily to favorable stock market performance in recent years, there also was a net gain of $62 million. On average, employees remaining service life with the company is 10 years. As a result of the net gain, what was the increase or decrease in pension expense for the year? (Amounts to be deducted should be indicated with a minus sign.) ($ in milliona) Net gain Coridor amount Excess, if any Service period (years) Amortization of net gain decreases pension expense by

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer S in millions 62 Net gain Corridor amount Excess if any Service ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: J. David Spiceland, James Sepe, Mark Nelson

6th edition

978-0077328894, 71313974, 9780077395810, 77328892, 9780071313971, 77395816, 978-0077400163

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App