Answered step by step

Verified Expert Solution

Question

1 Approved Answer

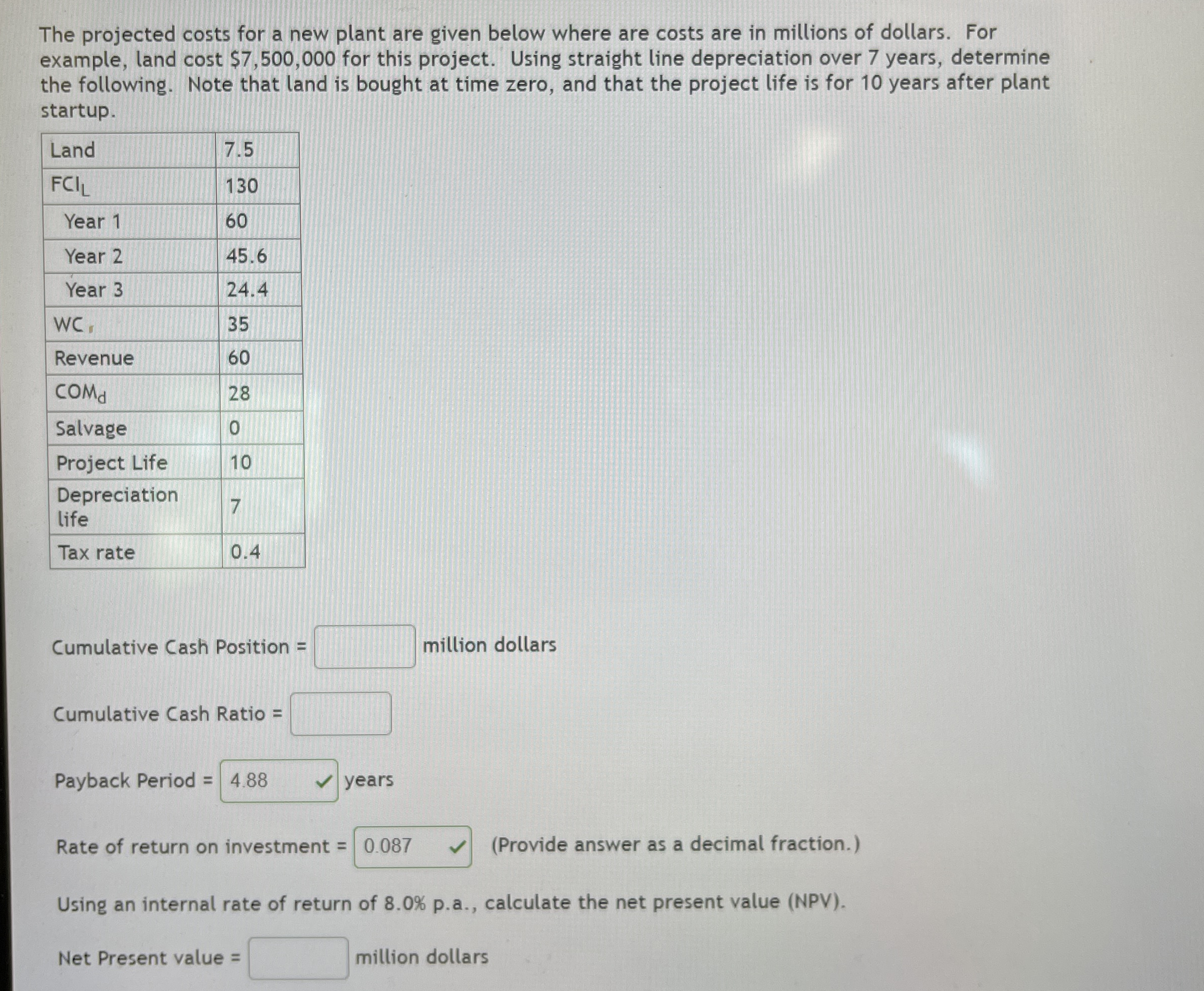

The projected costs for a new plant are given below where are costs are in millions of dollars. For example, land cost $ 7 ,

The projected costs for a new plant are given below where are costs are in millions of dollars. For

example, land cost $ for this project. Using straight line depreciation over years, determine

the following. Note that land is bought at time zero, and that the project life is for years after plant

startup.

Cumulative Cash Position

million dollars

Cumulative Cash Ratio

Payback Period

years

Rate of return on investment

Provide answer as a decimal fraction.

Using an internal rate of return of pa calculate the net present value NPV

Net Present value

million dollars

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started