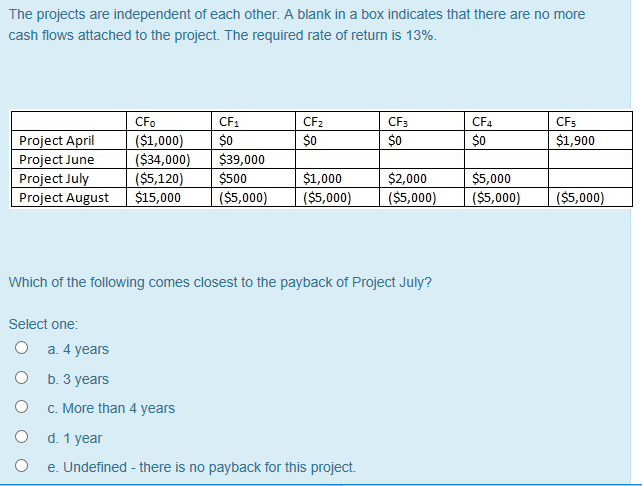

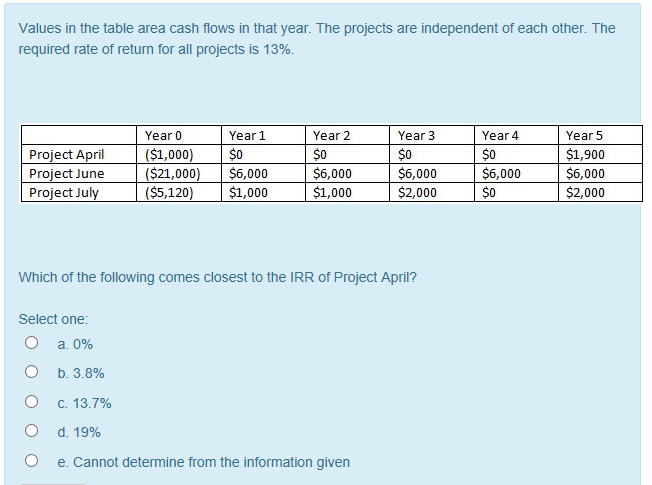

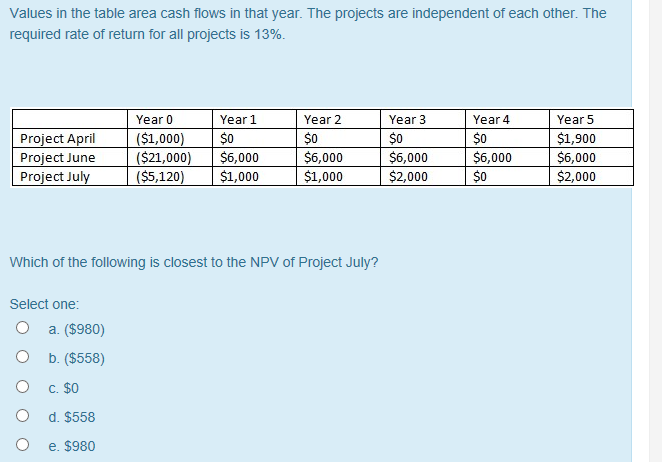

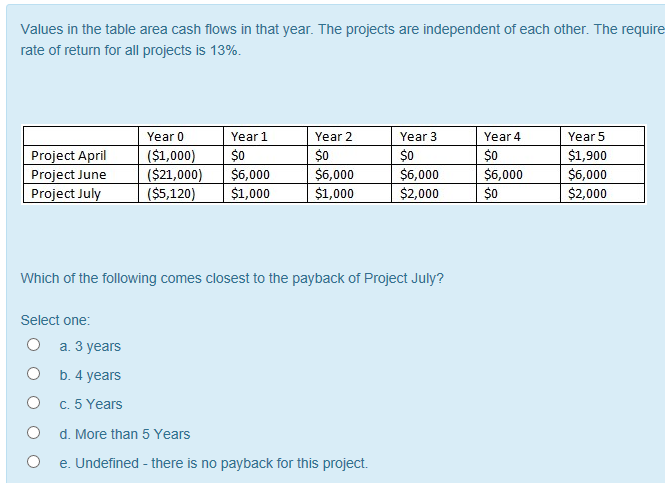

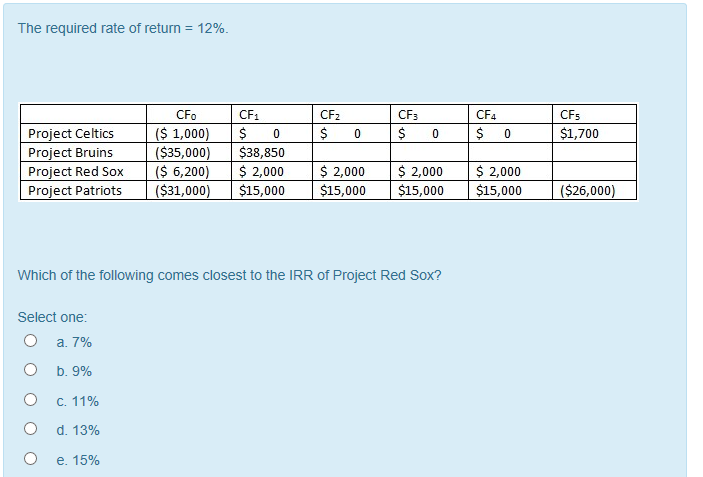

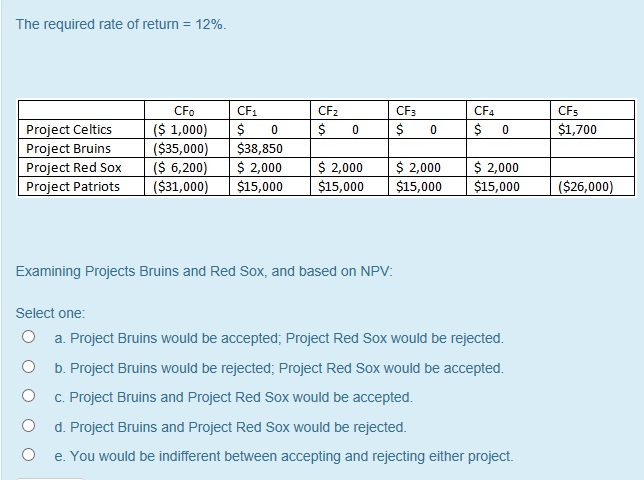

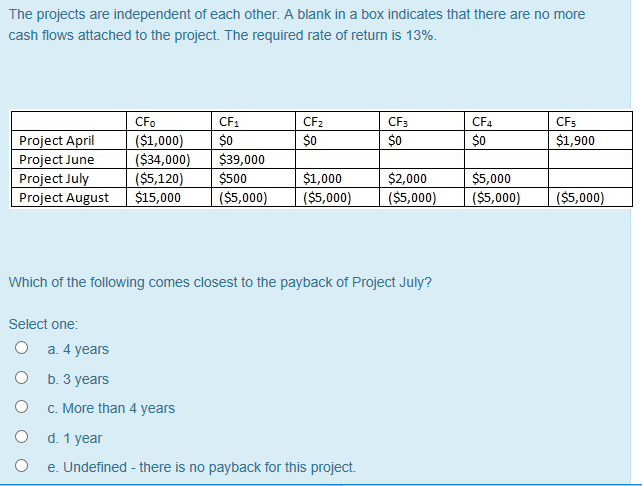

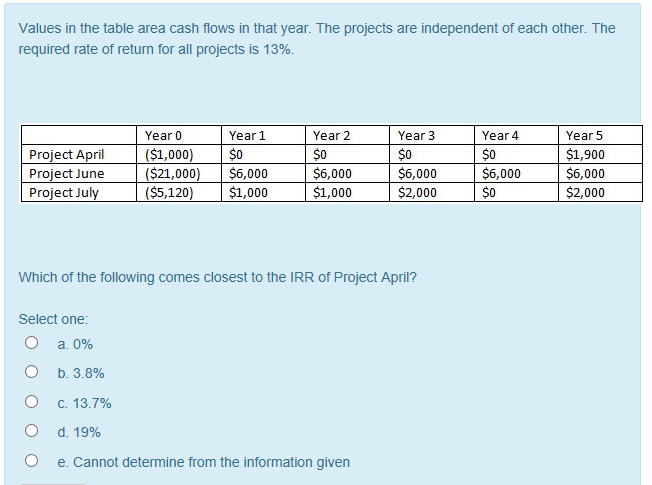

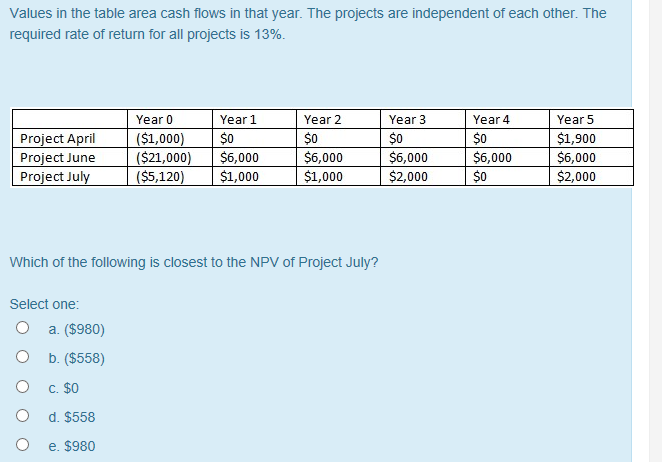

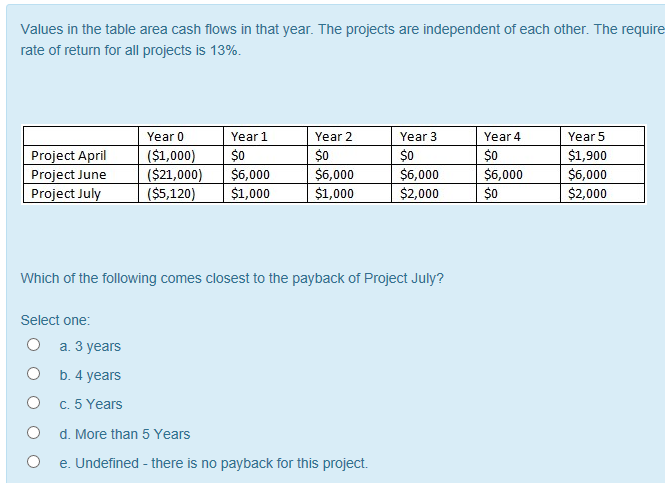

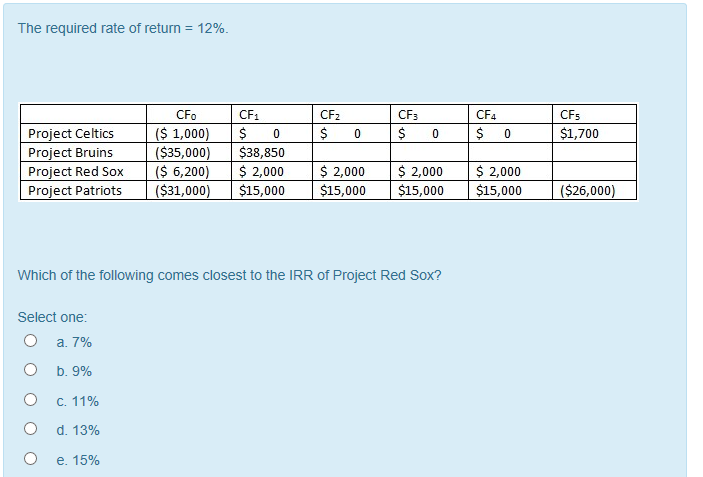

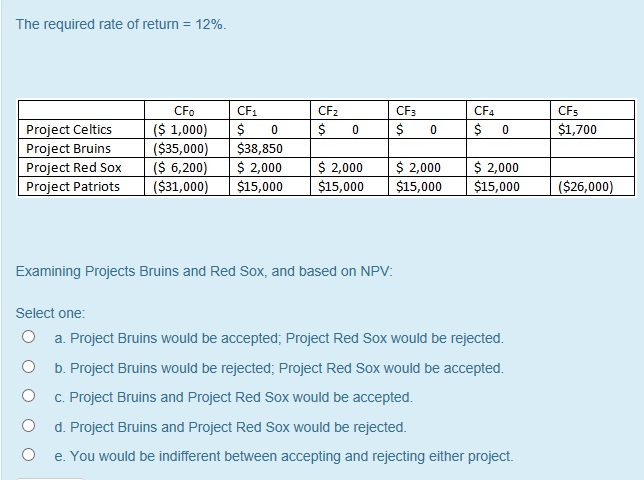

The projects are independent of each other. A blank in a box indicates that there are no more cash flows attached to the project. The required rate of return is 13% CFo ($1,000 ($34,000 $39,000 ($5,120) CF1 $0 CFz $0 CF3 $0 CF4 $0 CFs $1,900 Project April Project June Proiect Ju Project August $1,000 ($5,000) S500 $2,000 ($5,000 $5,000 ($5,000 $15,000 ($5,000 ($5,000 Which of the following comes closest to the payback of Project July? Select one O a. 4 years O b. 3 years O c. More than 4 years O d. 1 year O e. Undefined-there is no payback for this project Values in the table area cash flows in that year. The projects are independent of each other. The required rate of return for all projects is 13% Year 0 ($1,000) ($21,000)$6,000 ($5,120) Year 1 Year 2 $0 $6,000 $1,000 Year 3 $0 $6,000 $2,000 Year 4 $0 $6,000 S0 Year 5 $1,900 $6,000 $2,000 $0 Project April Project June Proiect Ju $1,000 Which of the following comes closest to the IRR of Project April? Select one 0 a. 0% O b. 3.8% C. 13.7% d. 19% e. Cannot determine from the information given O O Values in the table area cash flows in that year. The projects are independent of each other. The require rate of return for all projects is 13% Year 0 Year 1 Year 2 $0 $6,000 $1,000 Year 3 $0 $6,000 $2,000 Year 4 $0 $6,000 $0 Year 5 $1,900 $6,000 $2,000 $0 Proiect April Project June Proiect Ju ($1,000 $21,000 $6,000 $5,120 $1,000 Which of the following comes closest to the payback of Project July? Select one O a. 3 years O b. 4 years O c. 5 Years O d. More than 5 Years O e. Undefined-there is no payback for this project The required rate of return-12% CFo 1,000) is 0 CF1 CF5 $1,700 CFz CF3 CF4 Project Celtics Project Bruins Project Red Sox( 6,200) $ 2,000 2,000$ 2,000 $ 2,000 Project Patriots($31,000) $15,000 $15,000 $15,000 $15,000 ($35,000 $38,850 $26,000) Which of the following comes closest to the IRR of Project Red Sox? Select one a, 7% b. 9% C. 11% d, 13% e. 15% The required rate of return-12% CFo $ 1,0001 S0 ($35,000)$38,850 CFs 1,700 CF1 CFz CF3 CF4 Project Celtics Project Bruins Project Red SoxS 6,200) 2,000 S 2,000 S 2,000 S 2,000 Proiect Patriots |(S31,000) |$15,000 | S15.000 | S15.000 |S15.000 $26,000 Examining Projects Bruins and Red Sox, and based on NPV: Select one 0 a. Project Bruins would be accepted: Project Red Sox would be rejected O b. Project Bruins would be rejected; Project Red Sox would be accepted O c. Project Bruins and Project Red Sox would be accepted O d. Project Bruins and Project Red Sox would be rejected O e. You would be indifferent between accepting and rejecting either project