Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the proper procedure is to conduct a valuation acturers are reasonably similar to B&C with respect to product mix, asset composition, and sume that the

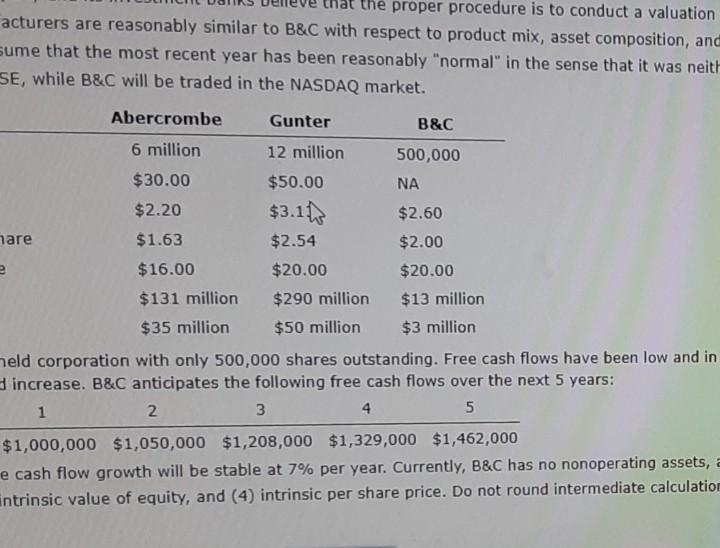

the proper procedure is to conduct a valuation acturers are reasonably similar to B&C with respect to product mix, asset composition, and sume that the most recent year has been reasonably "normal" in the sense that it was neitt SE, while B&C will be traded in the NASDAQ market. Abercrombe Gunter B&C 6 million 12 million 500,000 $30.00 $50.00 NA $2.20 $3.11. $2.60 hare $1.63 $2.54 $2.00 2 $16.00 $20.00 $20.00 $131 million $290 million $13 million $35 million $50 million $3 million meld corporation with only 500,000 shares outstanding. Free cash flows have been low and in increase. B&C anticipates the following free cash flows over the next 5 years: 1 2 3 4 5 $1,000,000 $1,050,000 $1,208,000 $1,329,000 $1,462,000 e cash flow growth will be stable at 7% per year. Currently, B&C has no nonoperating assets, a intrinsic value of equity, and (4) intrinsic per share price. Do not round intermediate calculation S mpare with the price you get using the corporate valuation model ed with the corporate valuation model is Select this range of prices, the proper procedure is to conduct a valuation acturers are reasonably similar to B&C with respect to product mix, asset composition, and sume that the most recent year has been reasonably "normal" in the sense that it was neitt SE, while B&C will be traded in the NASDAQ market. Abercrombe Gunter B&C 6 million 12 million 500,000 $30.00 $50.00 NA $2.20 $3.11. $2.60 hare $1.63 $2.54 $2.00 2 $16.00 $20.00 $20.00 $131 million $290 million $13 million $35 million $50 million $3 million meld corporation with only 500,000 shares outstanding. Free cash flows have been low and in increase. B&C anticipates the following free cash flows over the next 5 years: 1 2 3 4 5 $1,000,000 $1,050,000 $1,208,000 $1,329,000 $1,462,000 e cash flow growth will be stable at 7% per year. Currently, B&C has no nonoperating assets, a intrinsic value of equity, and (4) intrinsic per share price. Do not round intermediate calculation S mpare with the price you get using the corporate valuation model ed with the corporate valuation model is Select this range of prices

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started