Answered step by step

Verified Expert Solution

Question

1 Approved Answer

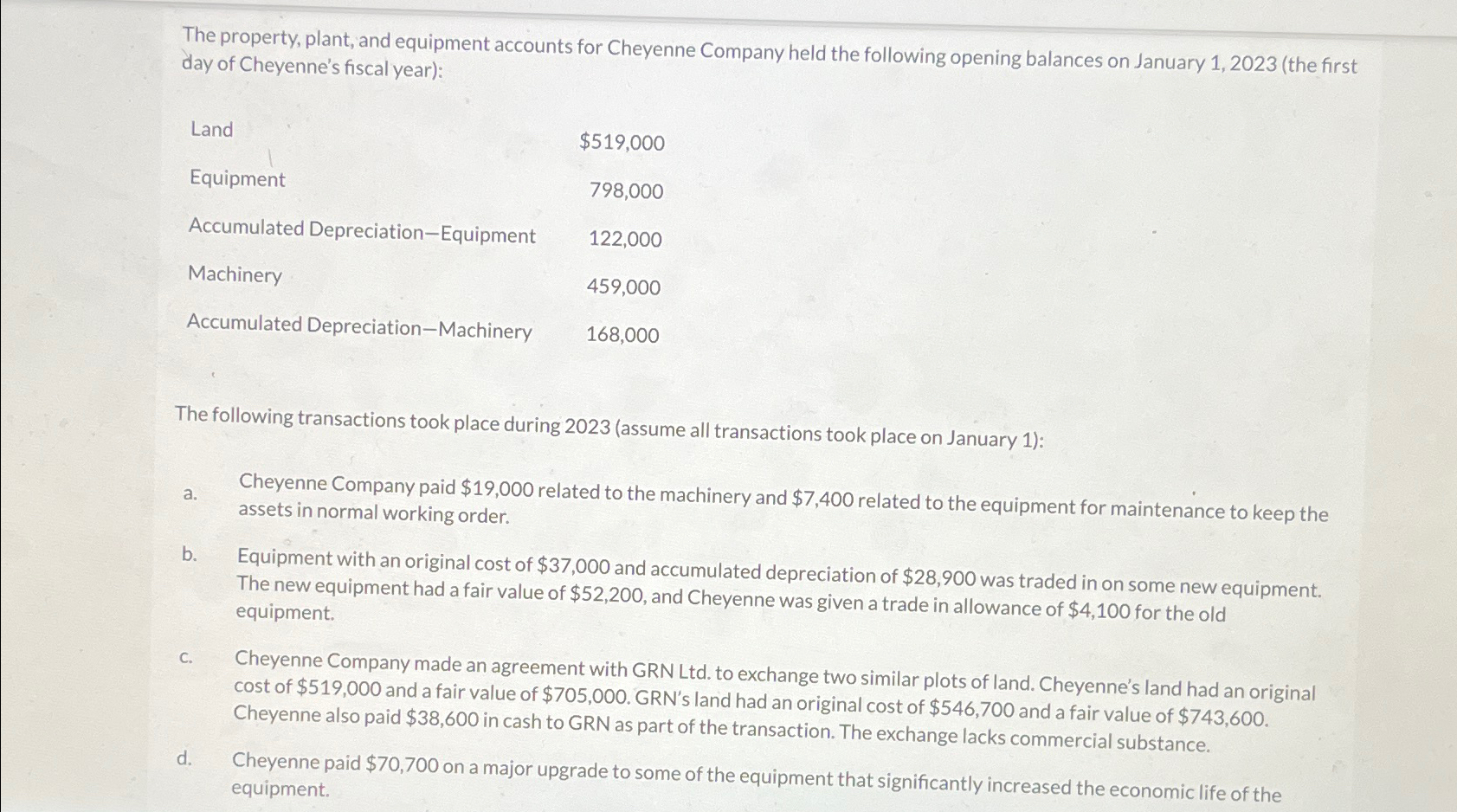

The property, plant, and equipment accounts for Cheyenne Company held the following opening balances on January 1, 2023 (the first day of Cheyenne's fiscal

The property, plant, and equipment accounts for Cheyenne Company held the following opening balances on January 1, 2023 (the first day of Cheyenne's fiscal year): Land $519,000 Equipment 798,000 Accumulated Depreciation-Equipment 122,000 Machinery 459,000 Accumulated Depreciation-Machinery 168,000 The following transactions took place during 2023 (assume all transactions took place on January 1): a. b. C. d. Cheyenne Company paid $19,000 related to the machinery and $7,400 related to the equipment for maintenance to keep the assets in normal working order. Equipment with an original cost of $37,000 and accumulated depreciation of $28,900 was traded in on some new equipment. The new equipment had a fair value of $52,200, and Cheyenne was given a trade in allowance of $4,100 for the old equipment. Cheyenne Company made an agreement with GRN Ltd. to exchange two similar plots of land. Cheyenne's land had an original cost of $519,000 and a fair value of $705,000. GRN's land had an original cost of $546,700 and a fair value of $743,600. Cheyenne also paid $38,600 in cash to GRN as part of the transaction. The exchange lacks commercial substance. Cheyenne paid $70,700 on a major upgrade to some of the equipment that significantly increased the economic life of the equipment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started